Question: Martin is working to develop a preliminary cost-benefit analysis for a new client-server system. He has identified a number of cost factors and values for

Martin is working to develop a preliminary cost-benefit analysis for a new client-server system. He has identified a number of cost factors and values for the new system, summarized in the following tables: Development Costs?Personnel 2 ?Systems Analysts 400 ?hours/ea @ $50/hour 4 ?Programmer Analysts 250 ?hours/ea @ $35/hour 1 ?GUI Designer 200 ?hours/ea @ $40/hour 1 ?Telecommunications Specialist 50 ?hours/ea @ $50/hour 1 ?System Architect 100 ?hours/ea @ $50/hour 1 ?Database Specialist 15 ?hours/ea @ $45/hour 1 ?System Librarian 250 ?hours/ea @ $15/hour Development Costs?Training 4 ?Oracle training registration $3500/student Development Costs?New Hardware and Software 1 ?Development server $18,7001 ?Server software (OS, ?misc.) ?$15001 ?DBMS server software $75007 ?DBMS client software $950/client Annual Operating Costs?Personnel 2 ?Programmer Analysts 125 ?hours/ea @ $35/hour 1 ?System Librarian 20 ?hours/ea @ $15/hour Annual Operating Costs?Hardware, ?Software, and Misc. 1 ?Maintenance agreement for server $9951 ?Maintenance agreement for server $525 ?DBMS software Preprinted forms 15,000/year @ $.22/form The benefits of the new system are expected to come from two sources: increased sales and lower inventory levels. Sales are expected to increase by $30,000 ?in the first year of the system's operation and will grow at a rate of 10% ?each year thereafter. Savings from lower inventory levels are expected to be $15,000 ?per year for each year of the project's life. Using a format similar to the spreadsheets in this chapter, develop a spreadsheet that summarizes this project's cash flow, assuming a 4-year useful life after the project is developed. Compute the present value of the cash flows, using an interest rate of 9%. ?What is the NPV for this project? What is the ROI for this project? What is the break-even point? Should this project be accepted by the approval committee?

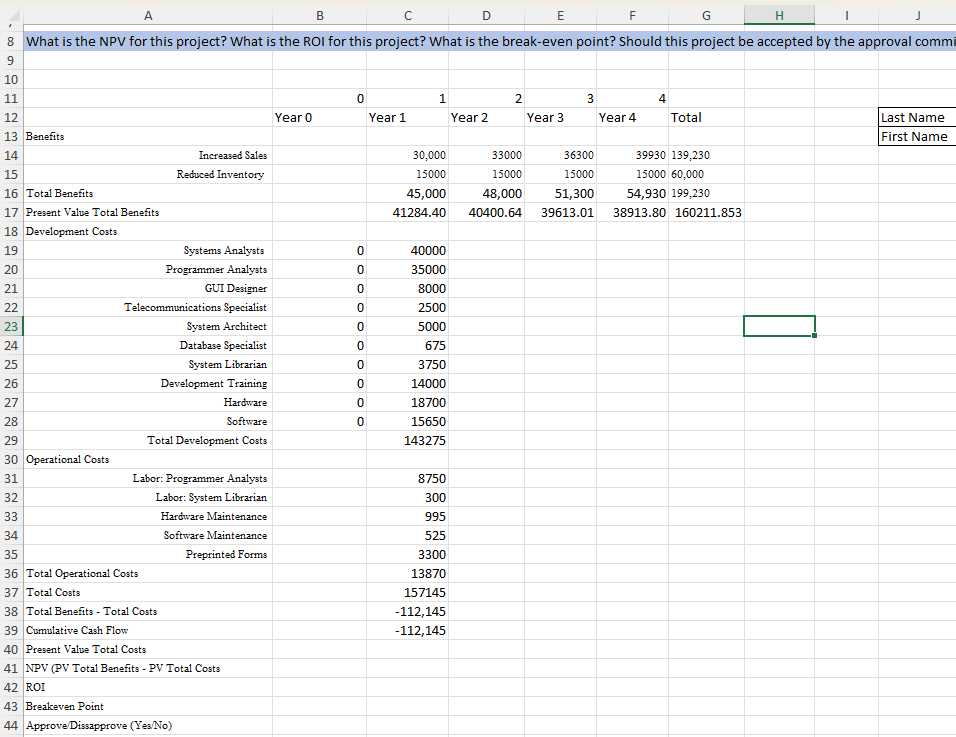

This is what I have figured out in the excel sheets. Please show me if there's any need of corrections or any other additions to fill out.

A B D E F G H What is the NPV for this project? What is the ROI for this project? What is the break-even point? Should this project be accepted by the approval comm 10 11 0 1 2 3 4 12 Year 0 Year 1 Year 2 Year 3 Year 4 Total Last Name 13 Benefits First Name 14 Increased Sales 30,000 33000 36300 39930 139,230 15 Reduced Inventory 15000 15000 15000 15000 60,000 16 Total Benefits 45,000 48,000 51,300 54,930 199,230 17 Present Value Total Benefits 41284.40 40400.64 39613.01 38913.80 160211.853 18 Development Costs 19 Systems Analysts 0 40000 20 Programmer Analysts O 35000 21 GUI Designer 0 8000 22 Telecommunications Specialist 2500 23 System Architect 5000 24 Database Specialist 675 25 System Librarian 3750 26 Development Training 14000 27 Hardware 18700 28 Software 15650 29 Total Development Costs 143275 30 Operational Costs 31 Labor: Programmer Analysts 8750 32 Labor: System Librarian 300 33 Hardware Maintenance 995 34 Software Maintenance 525 35 Preprinted Forms 3300 36 Total Operational Costs 13870 37 Total Costs 157145 38 Total Benefits - Total Costs -112,145 39 Cumulative Cash Flow -112,145 40 Present Value Total Costs 41 NPV (PV Total Benefits - PV Total Costs 42 ROI 43 Breakeven Point 44 Approve Dissapprove (Yes/No)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts