Question: Marvelous Occasions received $ 1 , 8 2 0 for services to be performed for the next 8 months on March 3 1 and recorded

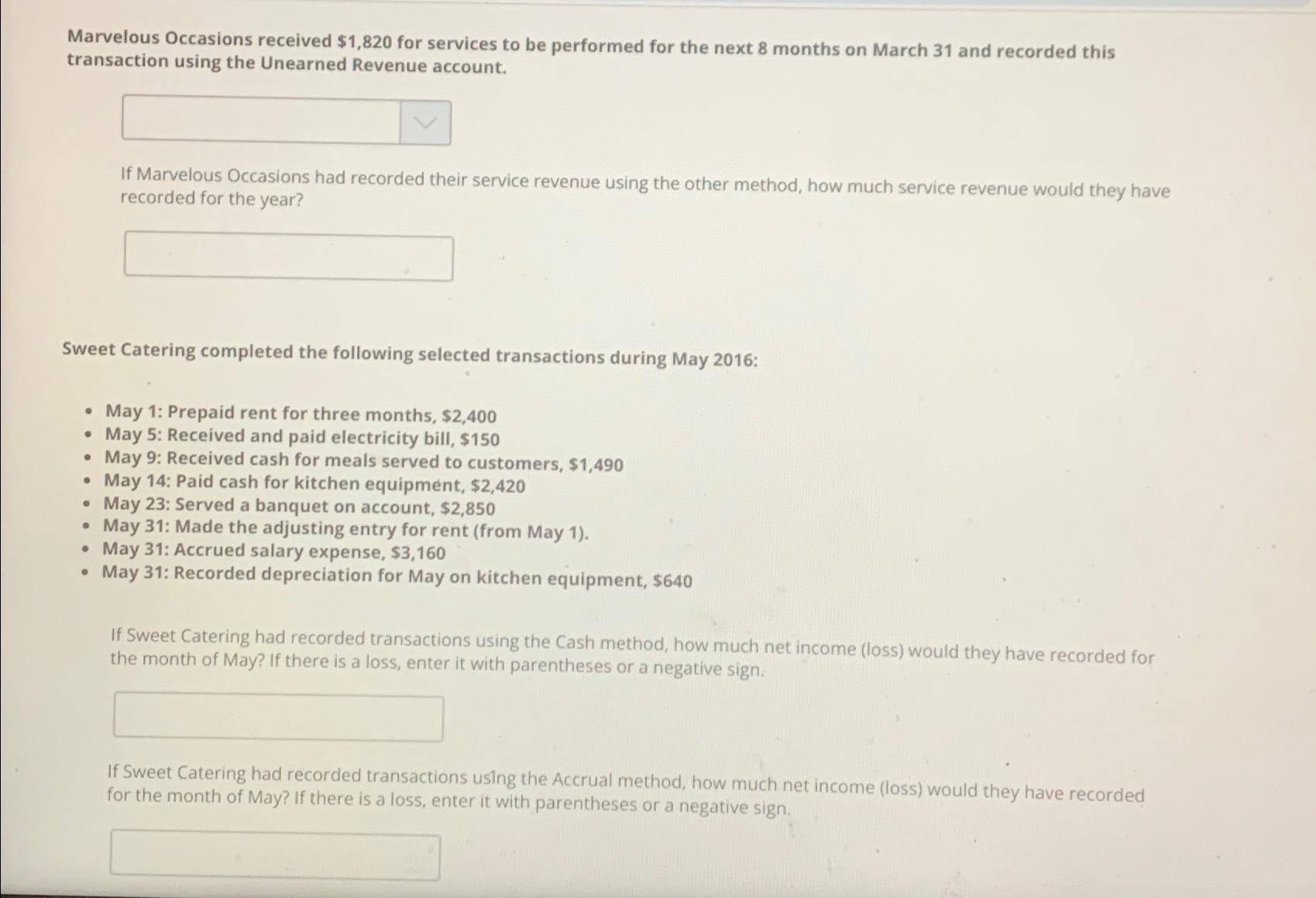

Marvelous Occasions received $ for services to be performed for the next months on March and recorded this transaction using the Unearned Revenue account.

If Marvelous Occasions had recorded their service revenue using the other method, how much service revenue would they have recorded for the year?

Sweet Catering completed the following selected transactions during May :

May : Prepaid rent for three months, $

May : Received and paid electricity bill, $

May : Received cash for meals served to customers, $

May : Paid cash for kitchen equipment, $

May : Served a banquet on account, $

May : Made the adjusting entry for rent from May

May : Accrued salary expense, $

May : Recorded depreciation for May on kitchen equipment, $

If Sweet Catering had recorded transactions using the Cash method, how much net income loss would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign.

If Sweet Catering had recorded transactions using the Accrual method, how much net income loss would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock