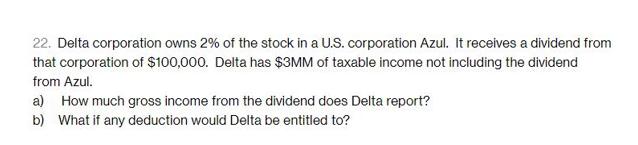

Question: 22. Delta corporation owns 2% of the stock in a U.S. corporation Azul. It receives a dividend from that corporation of $100,000. Delta has

22. Delta corporation owns 2% of the stock in a U.S. corporation Azul. It receives a dividend from that corporation of $100,000. Delta has $3MM of taxable income not including the dividend from Azul. a) How much gross income from the dividend does Delta report? b) What if any deduction would Delta be entitled to?

Step by Step Solution

★★★★★

3.52 Rating (142 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

a Delta corporation owns 2 of the stock in a US corporation Azul and ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock