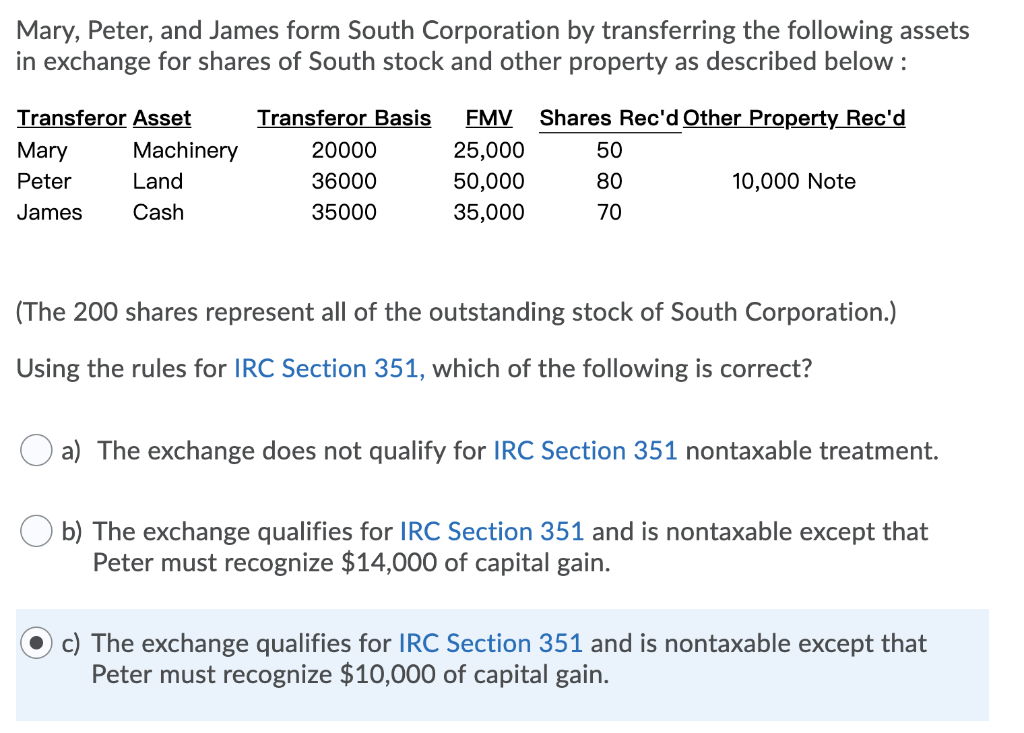

Question: Mary, Peter, and James form South Corporation by transferring the following assets in exchange for shares of South stock and other property as described below:

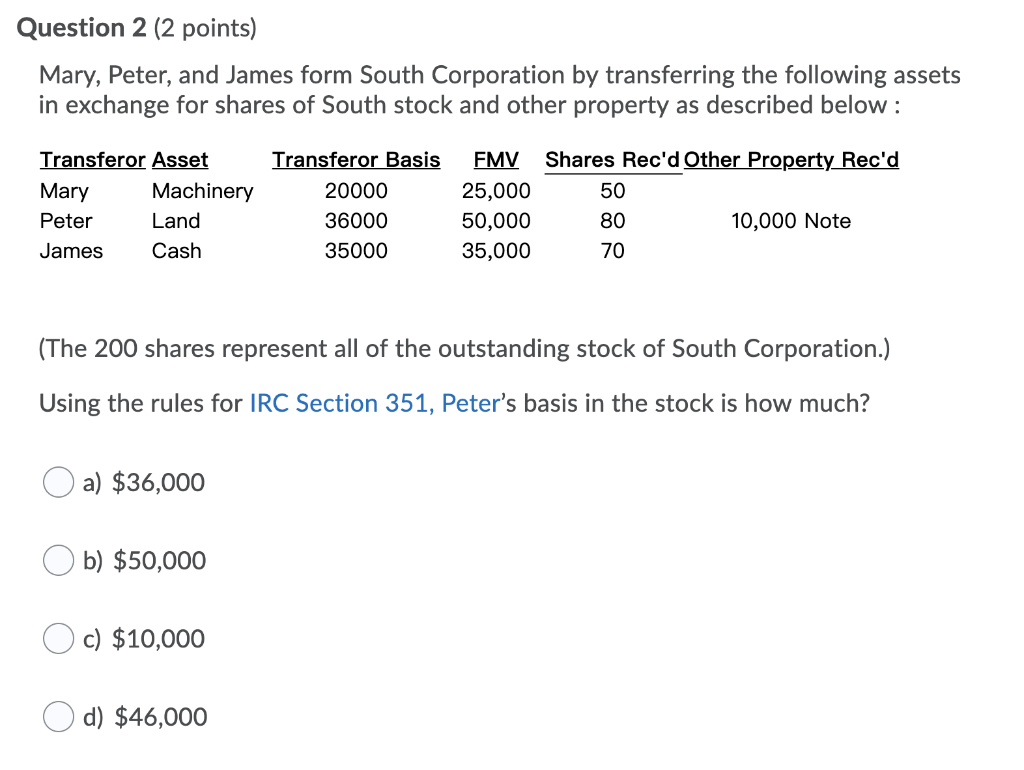

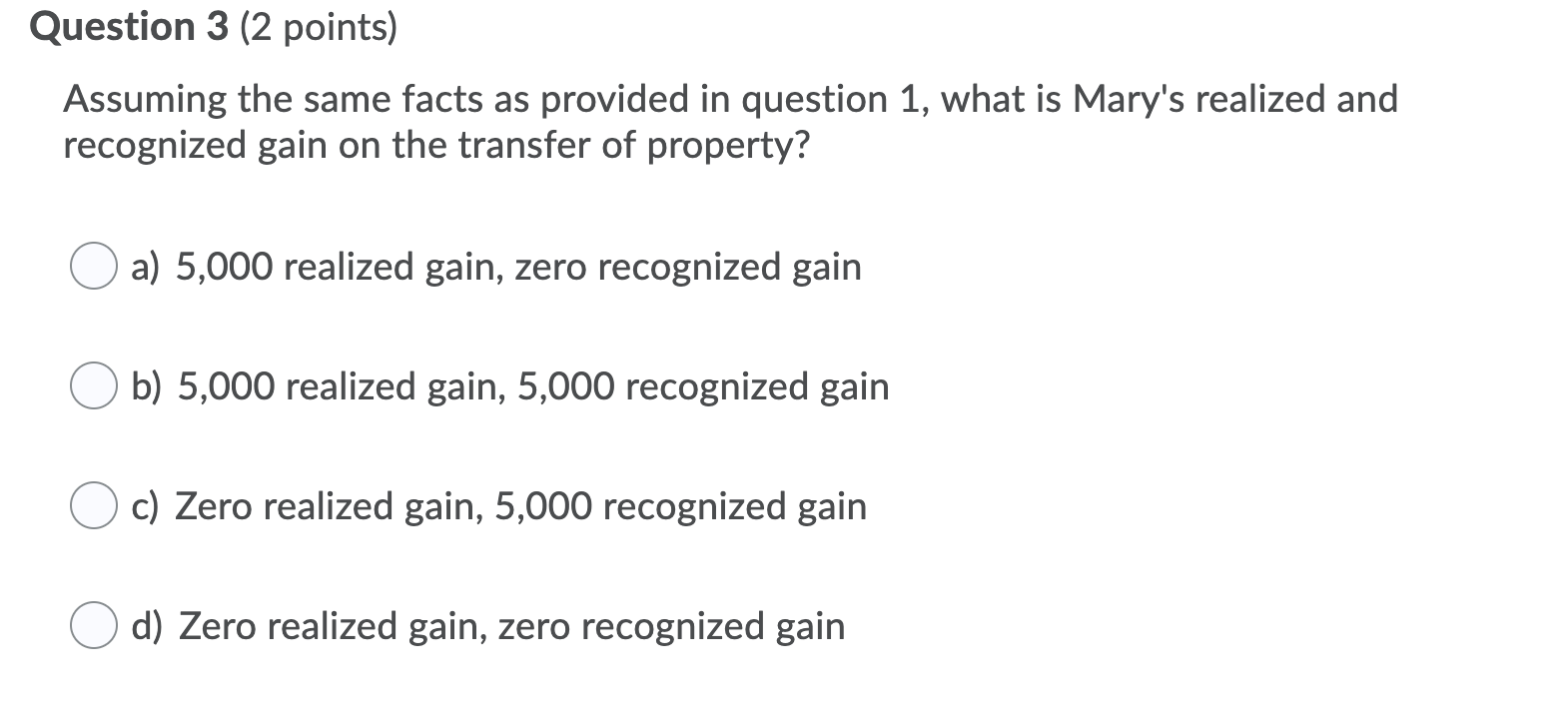

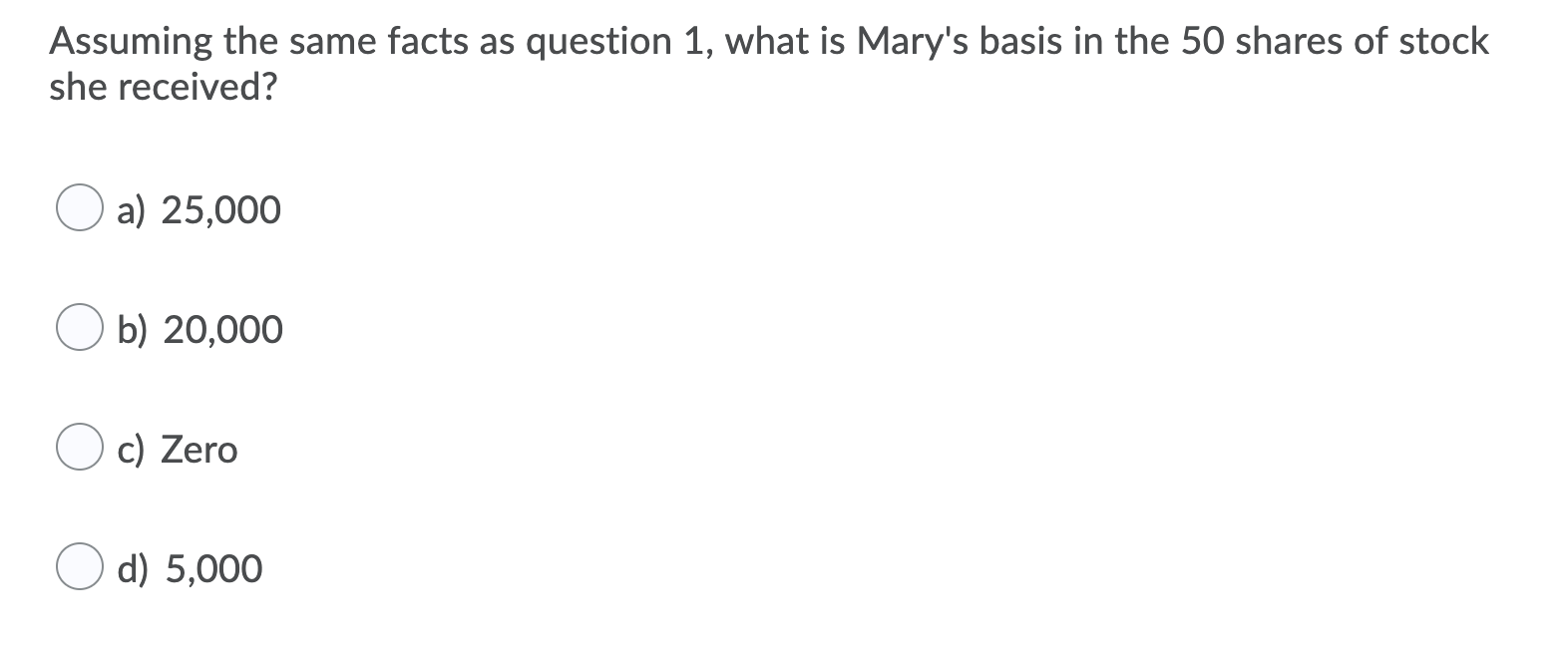

Mary, Peter, and James form South Corporation by transferring the following assets in exchange for shares of South stock and other property as described below: Transferor Asset Mary Machinery Peter Land James Cash Transferor Basis 20000 36000 35000 FMV Shares Rec'd Other Property Rec'd 25,000 50 50,000 80 10,000 Note 35,000 70 (The 200 shares represent all of the outstanding stock of South Corporation.) Using the rules for IRC Section 351, which of the following is correct? O a) The exchange does not qualify for IRC Section 351 nontaxable treatment. Ob) The exchange qualifies for IRC Section 351 and is nontaxable except that Peter must recognize $14,000 of capital gain. O c) The exchange qualifies for IRC Section 351 and is nontaxable except that Peter must recognize $10,000 of capital gain. Question 2 (2 points) Mary, Peter, and James form South Corporation by transferring the following assets in exchange for shares of South stock and other property as described below: Transferor Asset Mary Machinery Peter Land James Cash Transferor Basis 20000 36000 35000 FMV Shares Rec'd Other Property Rec'd 25,000 50 50,000 80 10,000 Note 35,000 70 Using the rules for IRC Section 351, Peter's basis in the stock is how much? O a) $36,000 Ob) $50,000 O c) $10,000 O d) $46,000 Question 3 (2 points) Assuming the same facts as provided in question 1, what is Mary's realized and recognized gain on the transfer of property? O a) 5,000 realized gain, zero recognized gain Ob) 5,000 realized gain, 5,000 recognized gain O c) Zero realized gain, 5,000 recognized gain O d) Zero realized gain, zero recognized gain Assuming the same facts as question 1, what is Mary's basis in the 50 shares of stock she received? O a) 25,000 O b) 20,000 O c) Zero O d) 5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts