Question: Mason ( single ) is a 5 0 percent shareholder in Angels Corporation ( an S Corporation ) . Mason receives a $ 1 8

Mason single is a percent shareholder in Angels Corporation an S Corporation Mason receives a $ salary working full time for Angels Corporation. Angels Corporation reported $ of taxable business income for the year Before considering his business income allocation from Angels and the selfemployment tax deduction if any Mason's adjusted gross income is $all salary from Angels Corporation Mason claims $ in itemized deductions. Answer the following questions for Mason.Required information

The following information applies to the questions displayed below.

Mason single Is a percent shareholder in Angels Corporation an S Corporation Mason recelves a $ salary

working full time for Angels Corporation. Angels Corporation reported $ of taxable business income for the year

Before considering his business Income allocation from Angels and the selfemployment tax deductlon If any

Mason's adjusted gross income is $all salary from Angels Corporation Mason claims $ in itemized

deductions. Answer the following questions for Mason.

Note: Leave no answer blank. Enter zero if applicable.

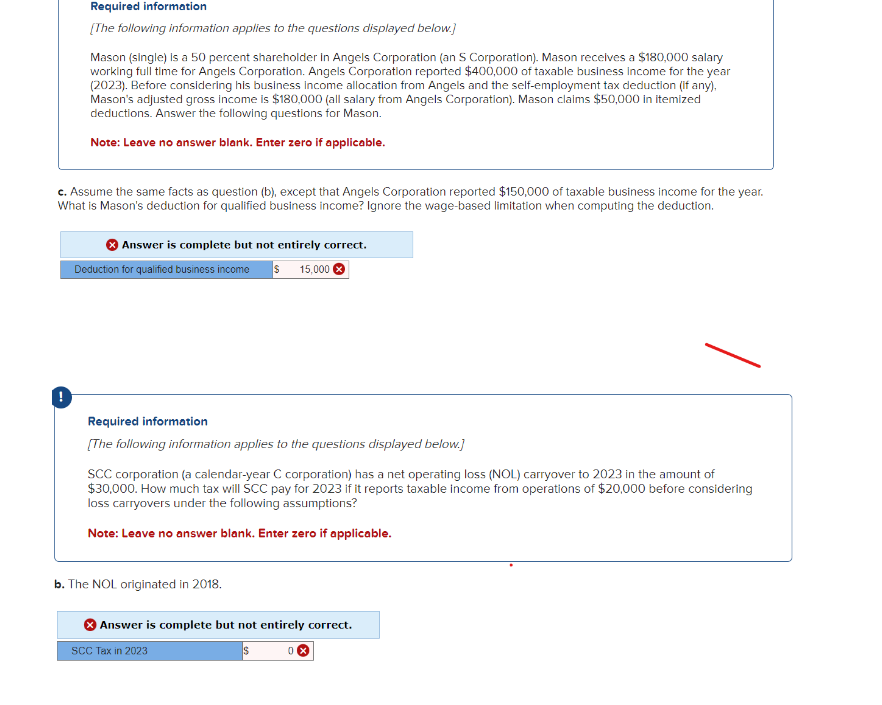

c Assume the same facts as question b except that Angels Corporation reported $ of taxable business income for the year.

What is Mason's deduction for qualified business income? Ignore the wagebased limitation when computing the deduction.

Answer is complete but not entirely correct.

Deduction for qualified business income $

Required information

The following information applies to the questions displayed below.

SCC corporation a calendaryear C corporation has a net operating loss NOL carryover to in the amount of

$ How much tax will SCC pay for if it reports taxable income from operations of $ before considering

loss carryovers under the following assumptions?

Note: Leave no answer blank. Enter zero if applicable.

b The NOL originated in

Answer is complete but not entirely correct.

Note: Leave no answer blank. Enter zero if applicable.

c Assume the same facts as question b except that Angels Corporation reported $ of taxable business income for the year. What is Mason's deduction for qualified business income? Ignore the wagebased limitation when computing the deduction.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock