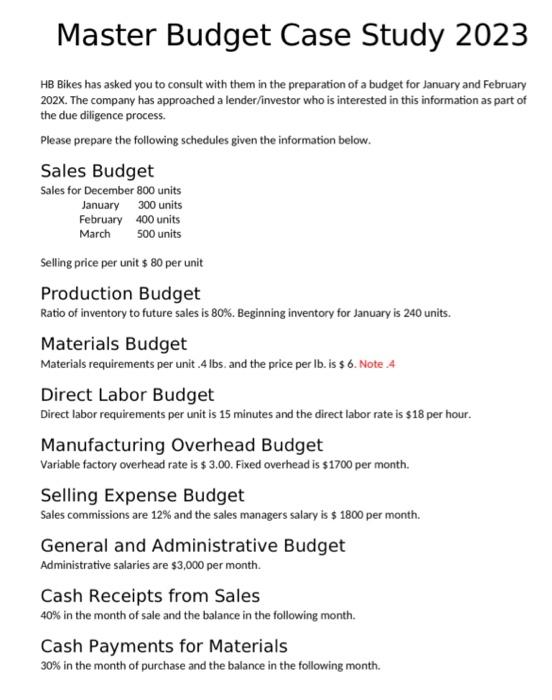

Question: Master Budget Case Study 2023 HB Bikes has asked you to consult with them in the preparation of a budget for January and February 202X.

Master Budget Case Study 2023 HB Bikes has asked you to consult with them in the preparation of a budget for January and February 202X. The company has approached a lender/investor who is interested in this information as part of the due diligence process. Please prepare the following schedules given the information below. Sales Budget Sales for December 800 units January 300 units February 400 units March 500 units Selling price per unit $80 per unit Production Budget Ratio of inventory to future sales is 80%. Beginning inventory for January is 240 units. Materials Budget Materials requirements per unit .4lbs. and the price per lb. is $6. Note .4 Direct Labor Budget Direct labor requirements per unit is 15 minutes and the direct labor rate is $18 per hour. Manufacturing Overhead Budget Variable factory overhead rate is $3.00. Fixed overhead is $1700 per month. Selling Expense Budget Sales commissions are 12% and the sales managers salary is $1800 per month. General and Administrative Budget Administrative salaries are s3,000 per month. Cash Receipts from Sales 40% in the month of sale and the balance in the following month. Cash Payments for Materials 30% in the month of purchase and the balance in the following month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts