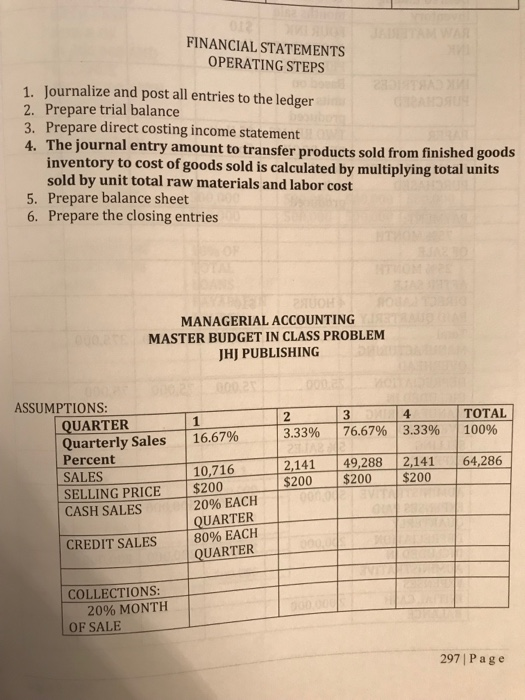

Question: master budget problem FINANCIAL STATEMENTS OPERATING STEPS 1. Journalize and post all entries to the ledger 2. Prepare trial balance 3. Prepare direct costing income

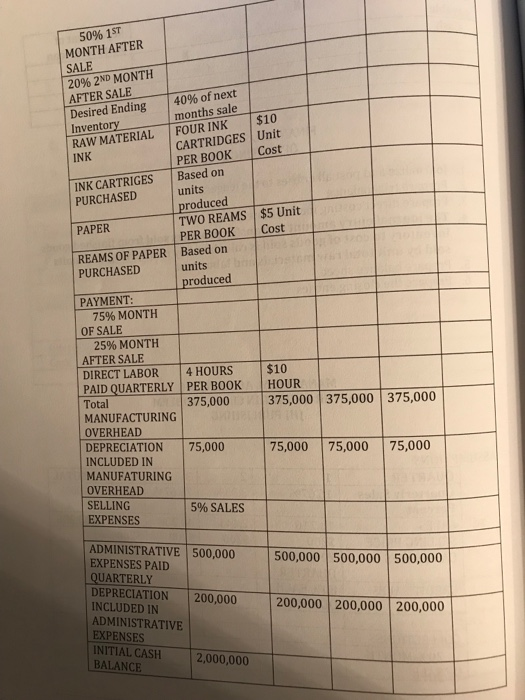

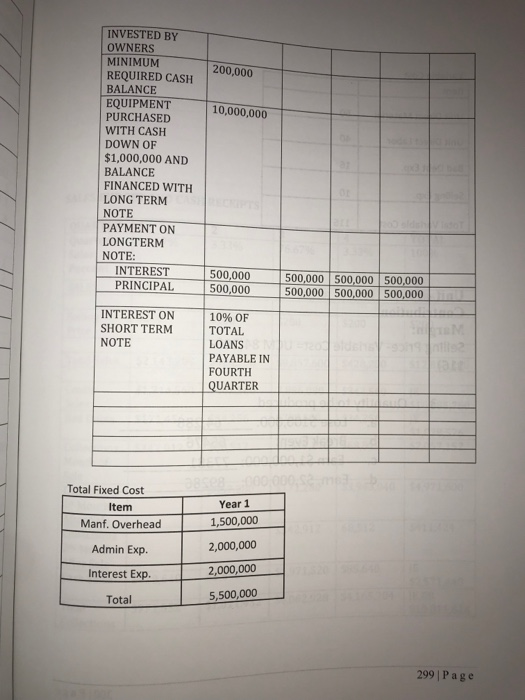

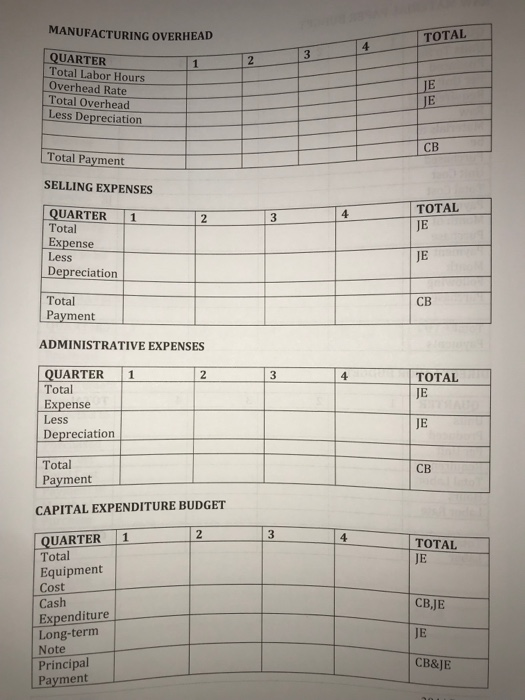

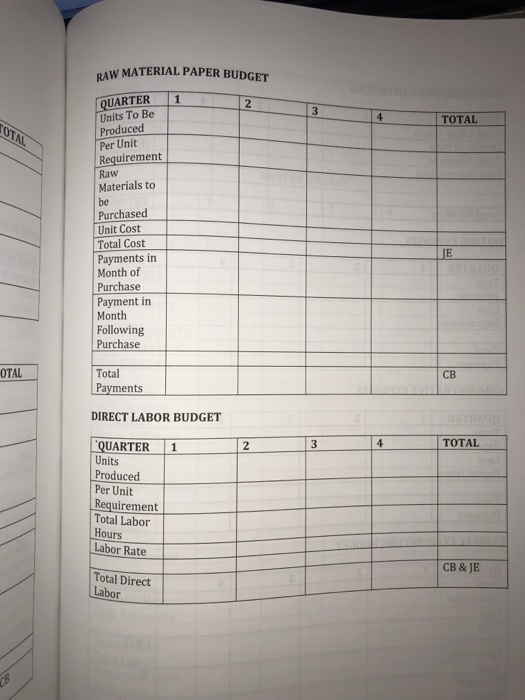

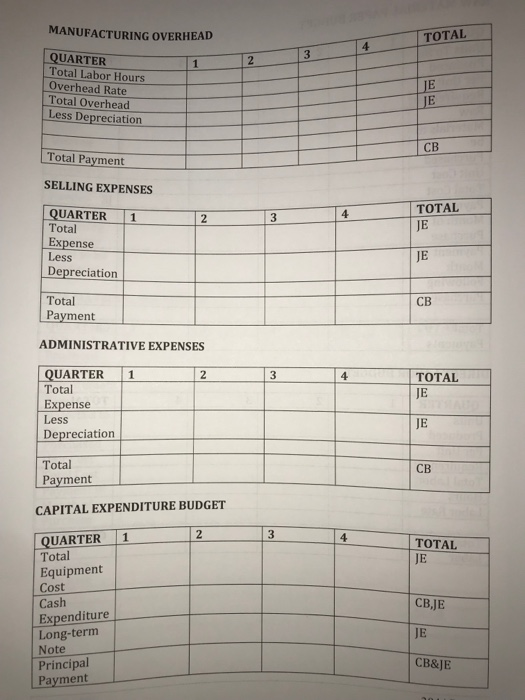

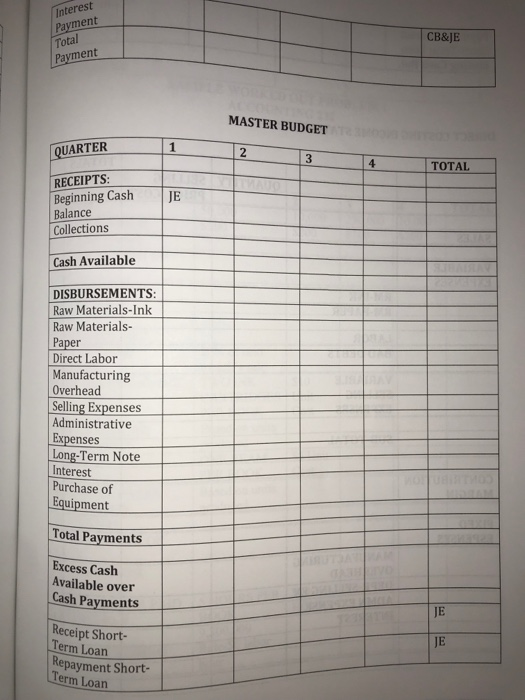

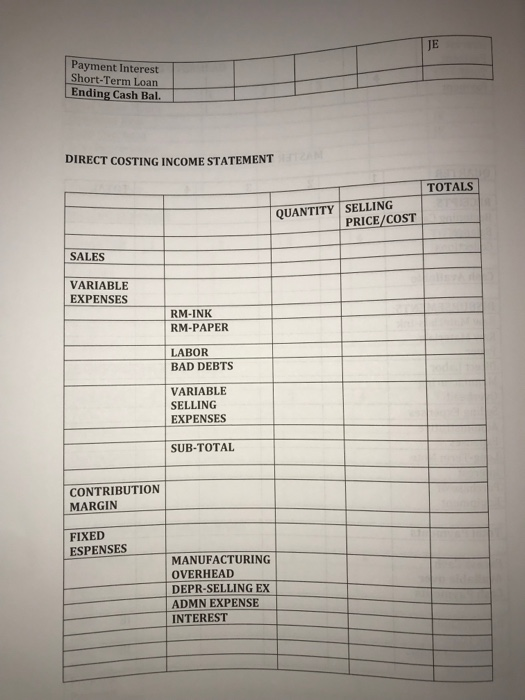

FINANCIAL STATEMENTS OPERATING STEPS 1. Journalize and post all entries to the ledger 2. Prepare trial balance 3. Prepare direct costing income statement 4. The journal entry amount to transfer products sold from finished goods inventory to cost of goods sold is calculated by multiplying total units sold by unit total raw materials and labor cost Prepare balance sheet Prepare the closing entries 5. 6. MANAGERIAL ACCOUNTING MASTER BUDGET IN CLASS PROBLEM JHJ PUBLISHING ASSUMPTIONS 4 TOTAL | 100% 3 1 QUARTER | 76.67% | 3.33% 3.33% 116.67% Quarterly Sales SALES SELLING PRICE Percent10.7 10,716 2,141 49288 2,141 64,286 200 $200 $200 $200 20% EACH QUARTER | 80% EACH QUARTER CASH SALES CREDIT SALES COLLECTIONS: 20% MONTH OF SALE 297 Pa g e 50% 1ST MONTH AFTER SALE 2096 2ND MONTH AFTER SALE Desired Ending 140% of next months sale Inventory RAW MATERIAL FOUR INK $10 CARTRIDGES Unit PER BOOK Cost INK INK CARTRIGES Based on PURCHASED units produced TWO REAMS $5 Unit PER BOOK Cost PAPER REAMS OF PAPER Based on PURCHASED units produced PAYMENT: 75% MONTH OF SALE 25% MONTH AFTER SALE DIRECT LABOR 4 HOURS $10 PAID QUARTERLY PER BOOK HOUR Total MANUFACTURING 375,000 375,000 375,000 375,000 OVERHEAD DEPRECIATION 75,000 75 NCLUDED IN MANUFATURING OVERHEAD SELLING EXPENSES 75,000 75,000 75,000 5% SALES ADMINISTRATIVE 500,000500,000 500,000 500,000 EXPENSES PAID QUARTERLY DEPRECIATION -00,000 200,000|200,000|200,000 INCLUDED IN ADMINISTRATIVE EXPENSES INITIAL CASH BALANCE 2,000,000 INVESTED BY OWNERS MINIMUM REQUIRED CASH BALANCE EQUIPMENT PURCHASED WITH CASH DOWN OF $1,000,000 AND BALANCE FINANCED WITH LONG TERM NOTE PAYMENT ON LONGTERM NOTE: 200,000 10,000,000 INTEREST 500,000 500,000 500,000 500,000 INTEREST ON SHORT TERM NOTE | 10% OF TOTAL LOANS PAYABLE IN FOURTH QUARTER Total Fixed Cost Year 1 1,500,000 2,000,000 2,000,000 5,500,000 tem Manf. Overhead Admin Exp. Interest Exp Total 299 Page MANUFACTURING OVERHEAD TOTAL QUARTER Total Labor Hours Overhead Rate Total Overhead Less Depreciation CB Total Payment SELLING EXPENSES TOTAL JE QUARTER 1 Total Expense Less Depreciation 3 JE Total CB Payment ADMINISTRATIVE EXPENSES QUARTER 1 Total Expense Less 3 TOTAL JE JE Depreciation Total Payment CAPITAL EXPENDITURE BUDGET CB QUARTER 1 Total Equipment Cost Cash TOTAL JE CB,JE JE CB&JE Expenditure Long-term Note Principal Payment RAW MATERIAL PAPER BUDGET QUARTER 1 Units To Be Produced Per Unit Requirement Raw Materials to be Purchased Unit Cost Total Cost Payments in Month of Purchase 2 TOTAL Payment in Month Following Purchase Total OTAL CB Payments DIRECT LABOR BUDGET TOTAL 3 2 Units Produced Per Unit Requirement Total Labor Hours LaborRate CB & JE Total Direct Labor MANUFACTURING OVERHEAD TOTAL QUARTER Total Labor Hours Overhead Rate Total Overhead Less Depreciation CB Total Payment SELLING EXPENSES TOTAL JE QUARTER 1 Total Expense Less Depreciation 3 JE Total CB Payment ADMINISTRATIVE EXPENSES QUARTER 1 Total Expense Less 3 TOTAL JE JE Depreciation Total Payment CAPITAL EXPENDITURE BUDGET CB QUARTER 1 Total Equipment Cost Cash TOTAL JE CB,JE JE CB&JE Expenditure Long-term Note Principal Payment Interest Payment Total Payment CB&JE MASTER BUDGET QUARTER 3 TOTAL RECEIPTS Beginning Cash JE Balance Collections Cash Available DISBURSEMENTS Raw Materials-Ink Raw Materials- Paper Direct Labor Manufacturing Overhead Selling Expenses Administrative Expenses Long-Term Note Interest Purchase of Equipment Total Payments Excess Cash Available over Cash Payments JE Receipt Short- Term Loan JE Repayment Short- Term Loan JE Payment Interest Short-Term Loan Ending Cash Bal DIRECT COSTING INCOME STATEMENT TOTALS QUANTITY SELLING PRICE/COST SALES VARIABLE EXPENSES RM-INK RM-PAPER LABOR BAD DEBTS VARIABLE SELLING EXPENSES SUB-TOTAL CONTRIBUTION MARGIN FIXED ESPENSES MANUFACTURING OVERHEAD DEPR-SELLING EX | ADMIN EXPENSE INTEREST FINANCIAL STATEMENTS OPERATING STEPS 1. Journalize and post all entries to the ledger 2. Prepare trial balance 3. Prepare direct costing income statement 4. The journal entry amount to transfer products sold from finished goods inventory to cost of goods sold is calculated by multiplying total units sold by unit total raw materials and labor cost Prepare balance sheet Prepare the closing entries 5. 6. MANAGERIAL ACCOUNTING MASTER BUDGET IN CLASS PROBLEM JHJ PUBLISHING ASSUMPTIONS 4 TOTAL | 100% 3 1 QUARTER | 76.67% | 3.33% 3.33% 116.67% Quarterly Sales SALES SELLING PRICE Percent10.7 10,716 2,141 49288 2,141 64,286 200 $200 $200 $200 20% EACH QUARTER | 80% EACH QUARTER CASH SALES CREDIT SALES COLLECTIONS: 20% MONTH OF SALE 297 Pa g e 50% 1ST MONTH AFTER SALE 2096 2ND MONTH AFTER SALE Desired Ending 140% of next months sale Inventory RAW MATERIAL FOUR INK $10 CARTRIDGES Unit PER BOOK Cost INK INK CARTRIGES Based on PURCHASED units produced TWO REAMS $5 Unit PER BOOK Cost PAPER REAMS OF PAPER Based on PURCHASED units produced PAYMENT: 75% MONTH OF SALE 25% MONTH AFTER SALE DIRECT LABOR 4 HOURS $10 PAID QUARTERLY PER BOOK HOUR Total MANUFACTURING 375,000 375,000 375,000 375,000 OVERHEAD DEPRECIATION 75,000 75 NCLUDED IN MANUFATURING OVERHEAD SELLING EXPENSES 75,000 75,000 75,000 5% SALES ADMINISTRATIVE 500,000500,000 500,000 500,000 EXPENSES PAID QUARTERLY DEPRECIATION -00,000 200,000|200,000|200,000 INCLUDED IN ADMINISTRATIVE EXPENSES INITIAL CASH BALANCE 2,000,000 INVESTED BY OWNERS MINIMUM REQUIRED CASH BALANCE EQUIPMENT PURCHASED WITH CASH DOWN OF $1,000,000 AND BALANCE FINANCED WITH LONG TERM NOTE PAYMENT ON LONGTERM NOTE: 200,000 10,000,000 INTEREST 500,000 500,000 500,000 500,000 INTEREST ON SHORT TERM NOTE | 10% OF TOTAL LOANS PAYABLE IN FOURTH QUARTER Total Fixed Cost Year 1 1,500,000 2,000,000 2,000,000 5,500,000 tem Manf. Overhead Admin Exp. Interest Exp Total 299 Page MANUFACTURING OVERHEAD TOTAL QUARTER Total Labor Hours Overhead Rate Total Overhead Less Depreciation CB Total Payment SELLING EXPENSES TOTAL JE QUARTER 1 Total Expense Less Depreciation 3 JE Total CB Payment ADMINISTRATIVE EXPENSES QUARTER 1 Total Expense Less 3 TOTAL JE JE Depreciation Total Payment CAPITAL EXPENDITURE BUDGET CB QUARTER 1 Total Equipment Cost Cash TOTAL JE CB,JE JE CB&JE Expenditure Long-term Note Principal Payment RAW MATERIAL PAPER BUDGET QUARTER 1 Units To Be Produced Per Unit Requirement Raw Materials to be Purchased Unit Cost Total Cost Payments in Month of Purchase 2 TOTAL Payment in Month Following Purchase Total OTAL CB Payments DIRECT LABOR BUDGET TOTAL 3 2 Units Produced Per Unit Requirement Total Labor Hours LaborRate CB & JE Total Direct Labor MANUFACTURING OVERHEAD TOTAL QUARTER Total Labor Hours Overhead Rate Total Overhead Less Depreciation CB Total Payment SELLING EXPENSES TOTAL JE QUARTER 1 Total Expense Less Depreciation 3 JE Total CB Payment ADMINISTRATIVE EXPENSES QUARTER 1 Total Expense Less 3 TOTAL JE JE Depreciation Total Payment CAPITAL EXPENDITURE BUDGET CB QUARTER 1 Total Equipment Cost Cash TOTAL JE CB,JE JE CB&JE Expenditure Long-term Note Principal Payment Interest Payment Total Payment CB&JE MASTER BUDGET QUARTER 3 TOTAL RECEIPTS Beginning Cash JE Balance Collections Cash Available DISBURSEMENTS Raw Materials-Ink Raw Materials- Paper Direct Labor Manufacturing Overhead Selling Expenses Administrative Expenses Long-Term Note Interest Purchase of Equipment Total Payments Excess Cash Available over Cash Payments JE Receipt Short- Term Loan JE Repayment Short- Term Loan JE Payment Interest Short-Term Loan Ending Cash Bal DIRECT COSTING INCOME STATEMENT TOTALS QUANTITY SELLING PRICE/COST SALES VARIABLE EXPENSES RM-INK RM-PAPER LABOR BAD DEBTS VARIABLE SELLING EXPENSES SUB-TOTAL CONTRIBUTION MARGIN FIXED ESPENSES MANUFACTURING OVERHEAD DEPR-SELLING EX | ADMIN EXPENSE INTEREST

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts