Question: Masters Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $385,000 is estimated to result in

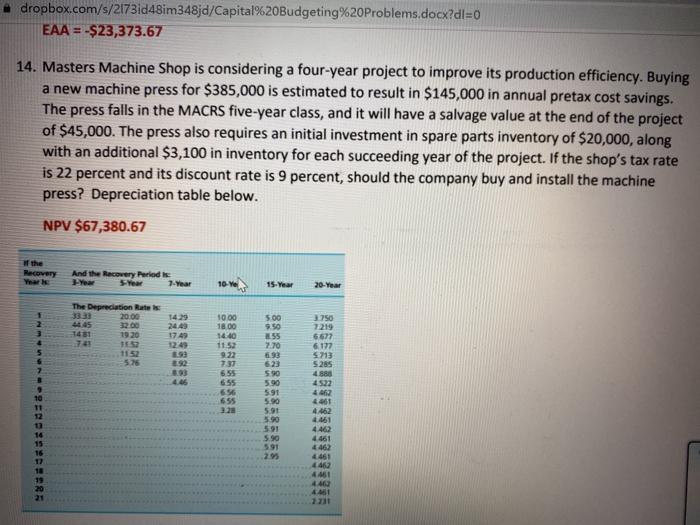

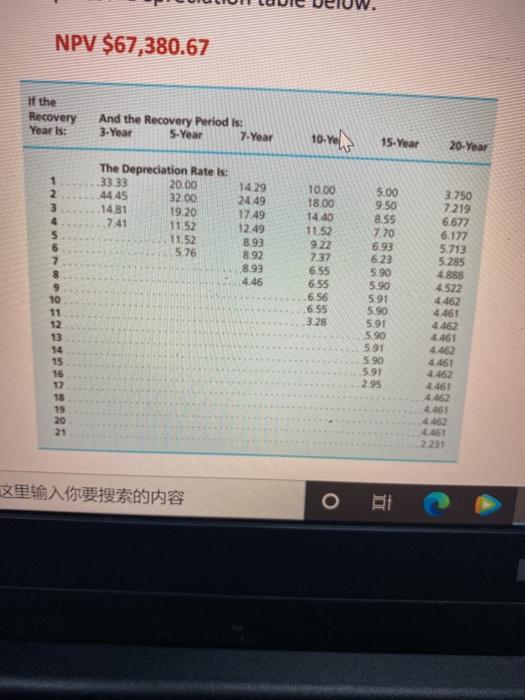

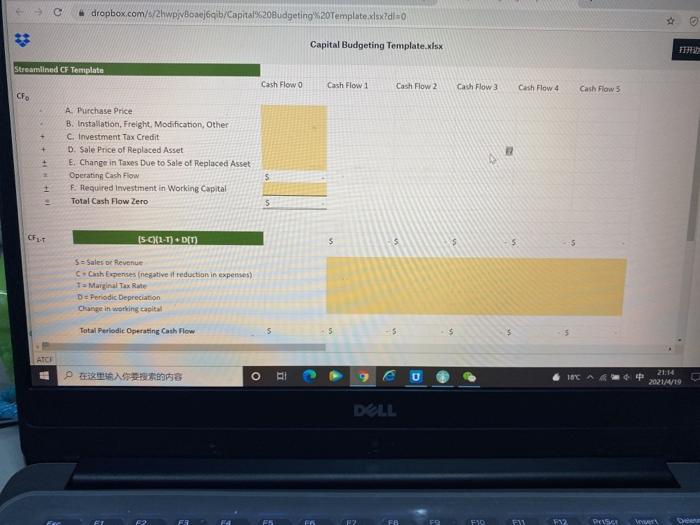

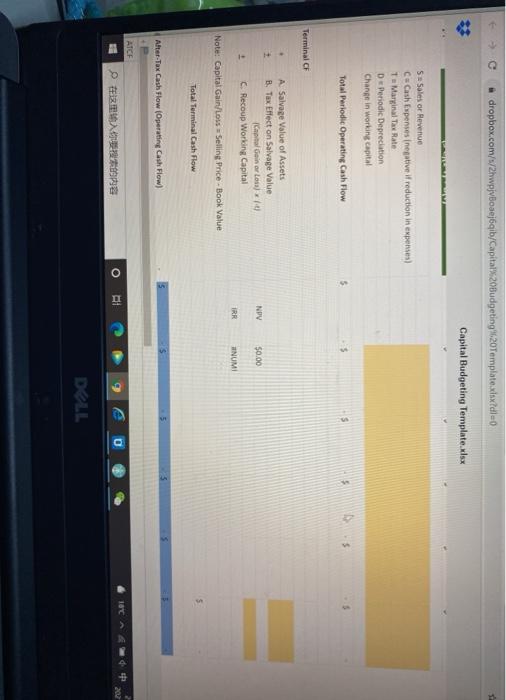

dropbox.com/s/21731d48im348jd/Capital%20Budgeting%20Problems.docx?dl=0 EAA = -$23,373.67 14. Masters Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $385,000 is estimated to result in $145,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage value at the end of the project of $45,000. The press also requires an initial investment in spare parts inventory of $20,000, along with an additional $3,100 in inventory for each succeeding year of the project. If the shop's tax rate is 22 percent and its discount rate is 9 percent, should the company buy and install the machine press? Depreciation table below. NPV $67,380.67 Recovery And the Recovery Periodic Her 7-Year 10-Ve The Depreciation Rates 20.00 1 750 24.49 3 19 20 10.00 18.00 14:40 11.5 922 12:49 5 1152 5.76 655 655 656 655 9 10 Hanasannonpn=bEDn 500 9.50 2.53 7.70 6.93 623 5.90 5.90 591 5.90 591 590 591 5.90 591 2.95 6677 6177 5213 5285 4.888 4522 4462 4461 4462 4.461 4.461 14 15 16 19 20 21 4462 4451 4462 4.41 NPV $67,380.67 If the Recovery Year is: And the Recovery Period is: 3-Year 5-Year 7-Year 10-ye 15-Year 20-Year 1 2 3 4 The Depreciation Rates: 33 33 20.00 44.45 32.00 14.81 19.20 7.41 11.52 11.52 5.76 14.29 24.49 17:49 12.49 8.93 8.92 8.93 4.46 10.00 18.00 14.40 11.52 9.22 737 6.55 6.55 .6 56 6.55 3.28 7 8 9 10 11 12 13 14 15 16 17 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 590 5.91 2.95 3.750 7219 6.677 6.177 5.713 5.285 4888 4522 4.462 4.461 4.461 4.462 4.461 4461 4461 19 20 21 4.462 C dropbox.com/s/2wpivBoarjoqib/Capital%20Budgeting%20Template.xlsx?dio Capital Budgeting Template.xlsx Streamlined CF Template Cash Flow o Cash Flow 1 Cash Flow 2 Cash Flow Cash Flow 4 Cash Flow 5 Cro A Purchase Price B. Installation, Freight. Modification, Other C. Investment Tax Credit D. Sale Price of Replaced Asset E. Change in Taxes Due to Sale of Replaced Asset Operating Cash Flow F. Required Investment in Working Capital Total Cash Flow Zero + 5 1 5 CERT 15-01-10 5 S = Sales De Revenue C.Cash Expenses (negative it reduction in expenses) Ta Marginal Tax Rate De Periodic Depreciation Change in working capital Total Periodic Operating Cash Flow AICI 9 150 21:14 2021/4/19 DOLL FO FU DETSEE VES dropbox.com/s/2hvwpjvBoeij6qib/Capital 2-Budgeting 6.20Tr plate.XIN clle Capital Budgeting Template.xlsx 5. Sale or Revenue C=Cash Expenses negative if reduction in expenses Ta Marginal Tax Rate De Periodic Depreciation Change in working capital Total Periodic Operating Cash Flow Terminal CF 1 A Salvage Value of Assets B. Tax Effect on Salvage Value Catalin or los C. Recoup Working Capital NPV $0.00 IRR UNUMI Note: Capital Gain/Loss Selling Price - Book Value Total Terminal Cash Flow Alter-Tax Cash Flow (Operating Cash Flow) |ATCF 9 e 0 DOLL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts