Question: mastery 24. please help chpt. 24 mastery. this is as clear as these photos will get Mastery Problemt Evahuating Decentralized Operations BOR CPAs, Inc. BOR

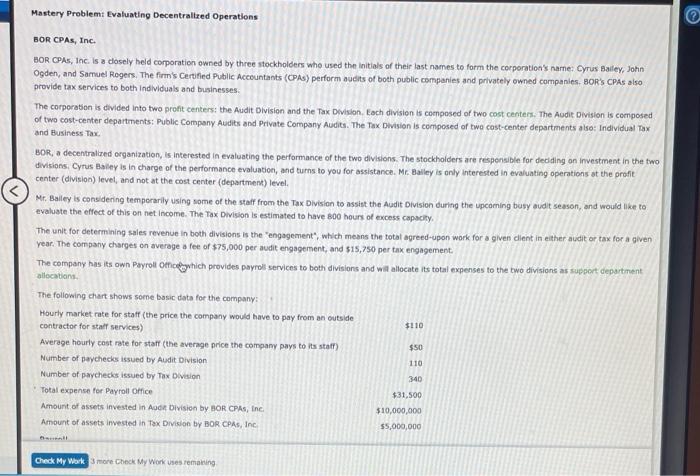

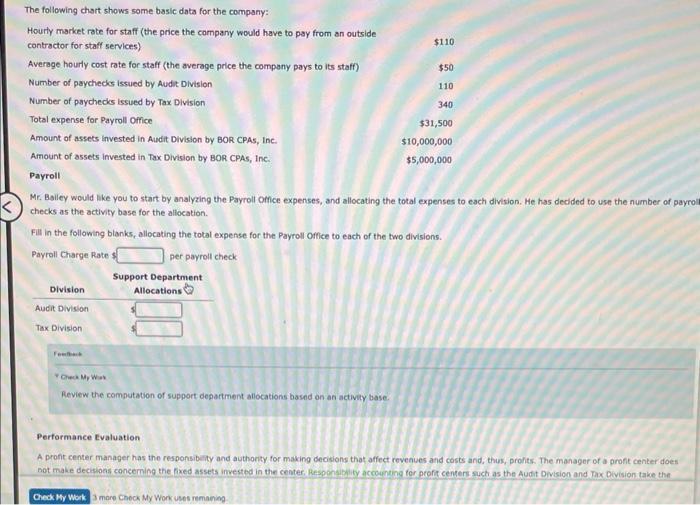

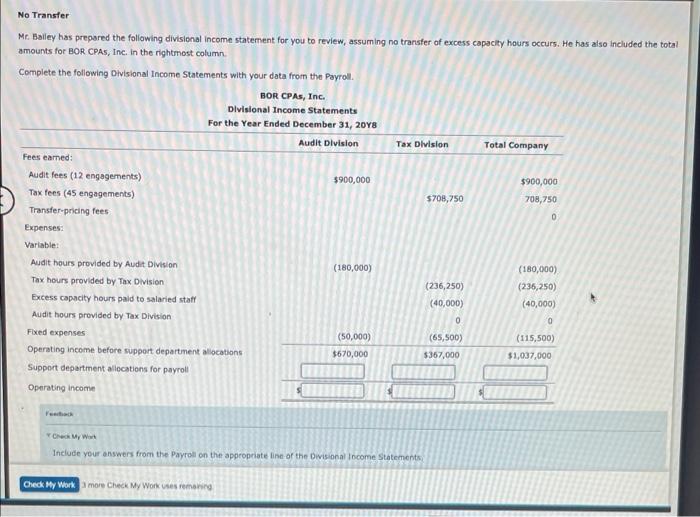

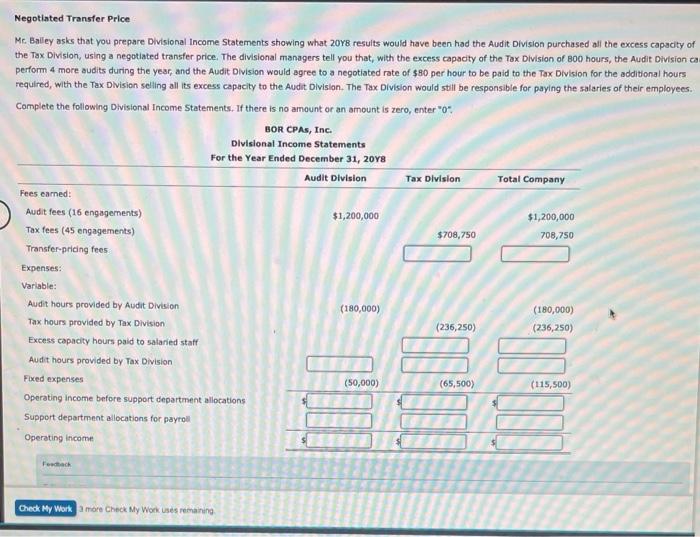

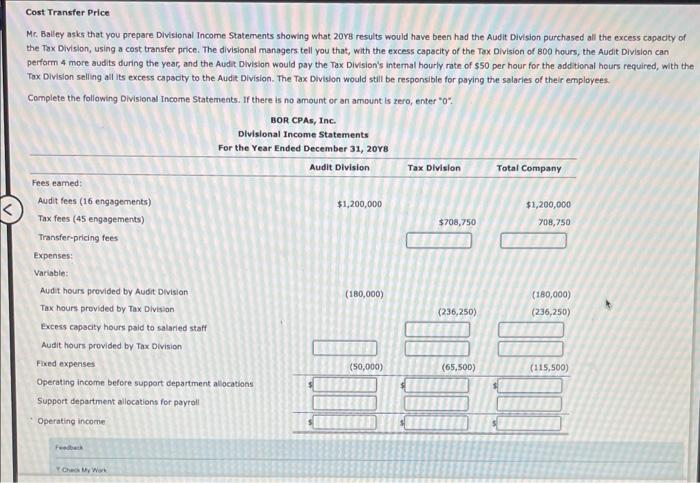

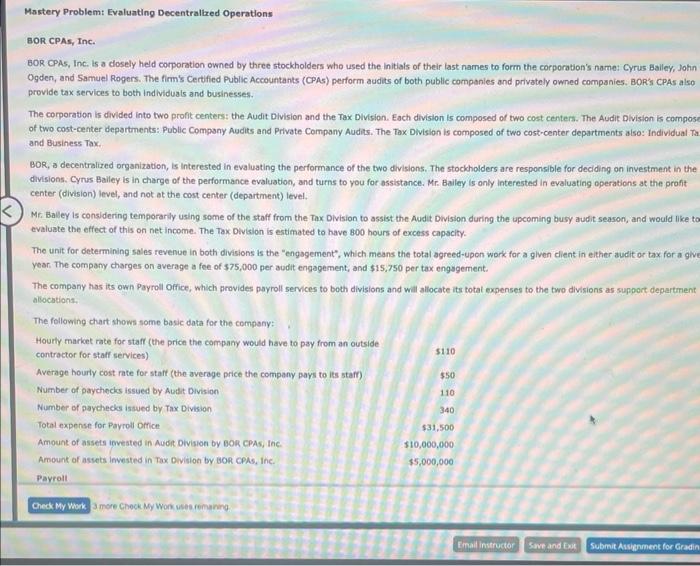

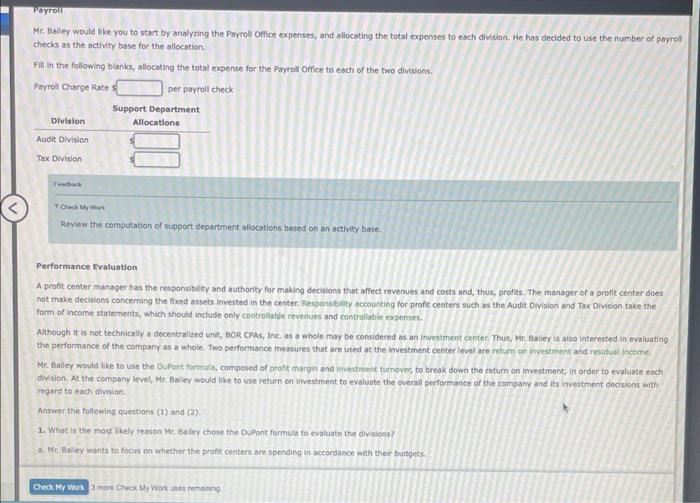

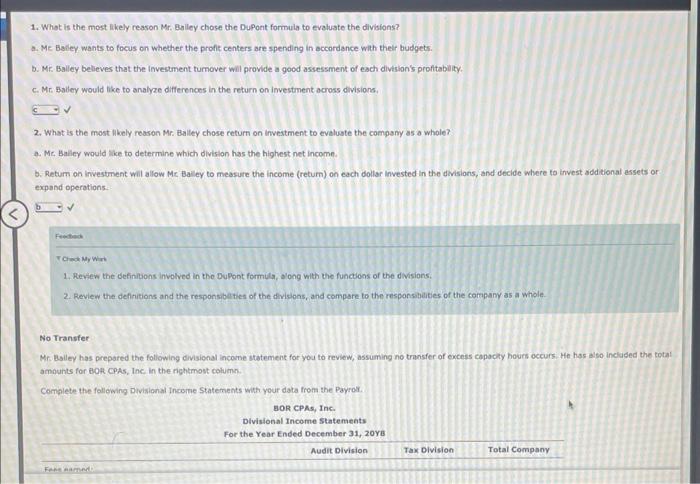

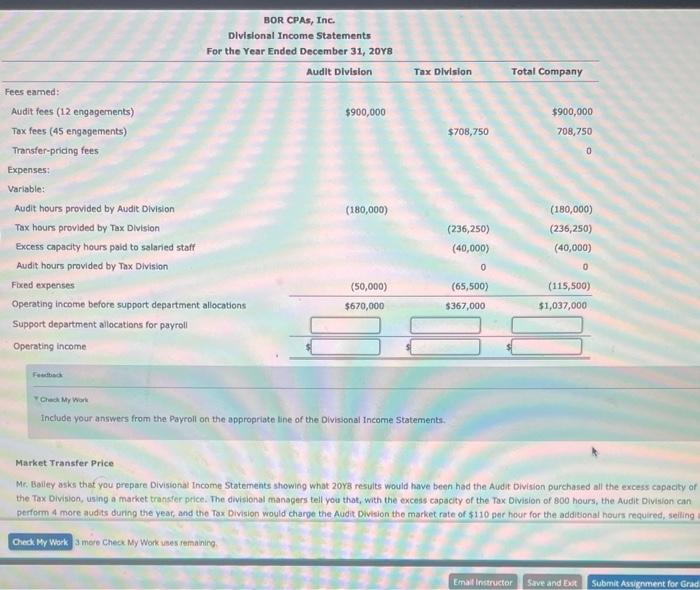

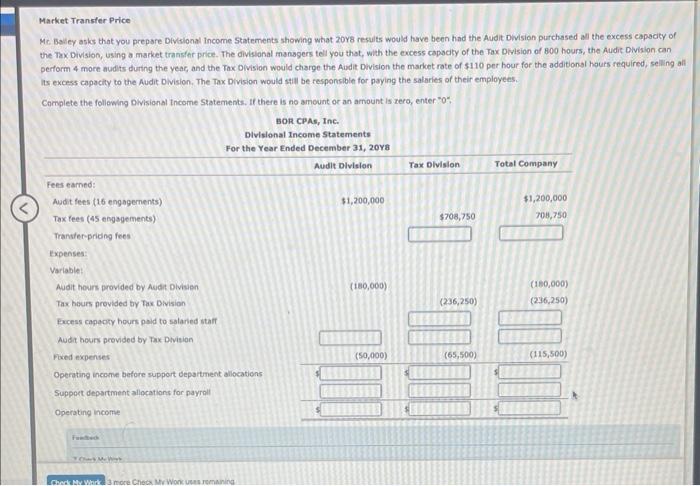

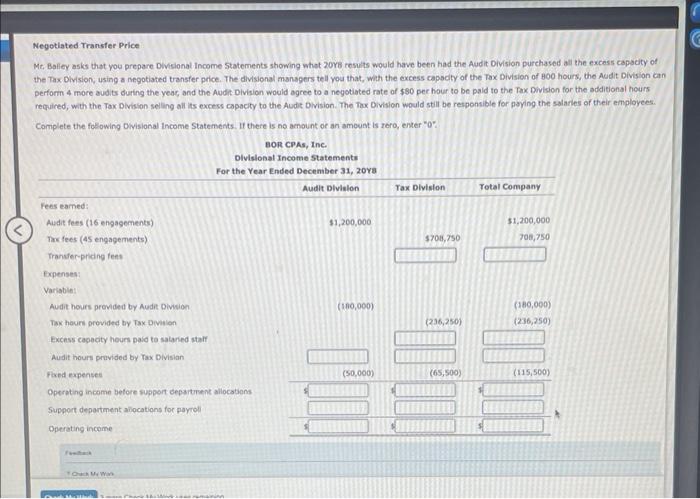

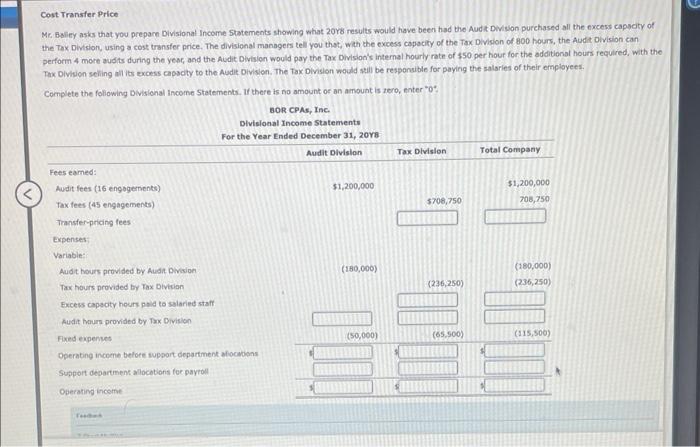

Mastery Problemt Evahuating Decentralized Operations BOR CPAs, Inc. BOR CPAF, lnc. is a dosely held corporation owned by three stockholders who used the initials of their last names to form the corporatioa's name: Cyrus Baifey, John Ogden, and Samuel Rogers. The firm's Certified Public Accountants (CPAS) perform aucits of both public companies and privately owned companies. BOR'5 CPA's also provide tax services to both individuals and businesses. The corporabon is divided into two profit centers: the Audit Division and the Tax Division. Foch division is composed of two cost centers. The Audic Division is composed of two cost-center departments: Public Company Audits and Private Company Audits. The Tax Bivision is composed of two cost-center departments also: Individual Tax and Business Tax. BOR, a decentraltzed organization, is interested in evaluating the performance of the two divisions. The stockholders are respensible for dedding on investment in the two divisions, Cyrus Baiey is in charge of the performance evaluation, and turns to you for assistance. Mr. Balley is only interested in evaluating operations at the profit. center (division) level, and not at the cost center (department) level, Mr. Bailey is considering temperarily using some of the shaff from the Tax Division to assist the Audit Division during the upcaming busy aud season, and would like to. evaluate the effect of this on net income. The Tax Division is estimated to have 800 hours of excess capschy. The unit for determining sales revenue in both divisions is the "engogement", which means the total agreed-upon work for a given dient in either audit or tax for a given year. The company charges on average a fee of $75,000 per audit engagement, and $15,750 per tax engagement. The company has its own Payroll Oencegawhich provides payrols services to both divisions and will allocate its total expenses to the two divisions as suppert department allecatans. Mr. Bailey would lke you to start by analyzing the Payroll Omice expenses, and allocating the total expenses to each division. He has decided to use the number of payro checks as the activity base for the allocation. Fill in the following blaniks, allocating the total expense for the Payroll Office to each of the two divisions. Payroll Charge Rate $ per payroll check f eennest T Greik My Wav Review the computation of support department aliocations based on an activity base. Performance Evaluation A pront center manager has the responsibaty and authonty for making decisions that affect revenues and costs and, thus, profits. The manager of a pront center does not make decieions conceming the fixed assets invested in the center. Respansibality accounting for profit centers such as the Audit Division and Tax Division take the Me. Ealley has prepared the following divisional income statement for you to review, assuming no transfer of excess capacity hours occurs. He has also included the total amounts for BOR CPA5, Inc. in the rightmost column. Complete the following Divisional Income Statements with vour data from the Pavrnil. 7 Clesia My Wont Inclue your answers from the Payroll on the approprate line of the Dwisonal I ncome Statementsi I more Check My Work wes remaning Mr. Baliey asks that you prepare Divisional Income Statements showing what 20 r results would have been had the Aud it Division purchased all the excess capacty of the Tax Division, using a market transfer price. The divisional managers tell you that, with the excess capacity of the Tax Division of 800 hours, the Audit Division can perform 4 more audits during the year, and the Tax Division would charge the Audit Division the market rate of $110 per hour for the additional hours required, selling all its excess capaciy to the Audit Division. The Tax Division would still be responsible for paying the salarles of their employees. Complete the following Divisional income Statements. If there is no amount of an amount is zero, enter " 0. vichecky Wus 3 mise Check My Wonc uses remaining Negotiated Transfer Price Mc. Bailey asks that you prepare Divisional income Statements showing what 20 r results would have been had the Audit Division purchased all the excess capacity of the Tax Division, using a negotiated transfer price. The divisional managers tell you that, with the excess capacity of the Tax Division of Boo hours, the Audit Division ca perform 4 more audits during the year, and the Audit Division would agree to a negotiated rate of $80 per hour to be paid to the Tax Division for the additional hours requlred, with the Tax Division seling all its excess capacity to the Audit Division. The Tax Division would still be responsible for paying the salaries of their employees. Complete the following Divisional Income Statements. If there is no amount or an amount is zero, enter "0". Mr. Balley asks that you prepare Divisional Income Statements showing what 20 s results would have been had the Audit Division purchased all the excess capacity of the Tax Division, using a cost transfer price. The divisional managers tell you that, with the excess capacity of the Tax Division of 800 hours, the Audit Division can perform 4 more audits during the year, and the Audit Division would pay the Tax Division's internal hourly rate of $50 per hour for the additional hours required, with the Tox Division selling all its excess capscty to the Audit Division. The Tax Division would still be responsible for paying the salaries of their employees. Complete the foliowing Divisional Income Statements. If there is no amount or an amount is zero, enter " 0 ". BOR CPAs, Inc. BOR CPAS, Inc. is a closely held corporation owned by three stockholders who used the initials of their last names to form the corporation's name: Cyrus Balley, John Ogden, and Samuel Rogers. The firm's Certified Public Accountants (CPAs) perform audits of both public companies and privately owned companies. BOR's CPAs also provide tax services to both individuats and businesses. The corporation is divided into two profit centers: the Audit Division and the Tax Division. Each division is composed of two cost centers. The Audit Division is compos of two cost-center departments: Public Company Audits and Private Company Audits. The Tax Division is composed of two cost-center departments also: Individual Ta and Business Tax. BOR, a decentralized organization, is interested in evaluating the performance of the two divisions. The stockholders are responsible for deciding on investment in the divisions. Cyrus Bailey is in charge of the performance evaluation, and turns to you for assistance. Mr. Bailey is only interested in evaluating operations at the profit center (division) level, and not at the cost center (department) level, Mr. Balley is considering temporarly using seme of the staff from the Tax Division to assist the Audit Division during the upcoming busy audit season, and would like to evaluate the effect of this on net income. The Tax Division is estimated to have 800 hours of excess capscity. The unit for determining sales revenue in both divisions is the "engogement", which means the total agreed-upen work for a given dient in either audit or tax for a giv year: The company charges on average a fee of $75,000 per audit engagement, and $15,750 per tax engagement. The company has its own Payroll office, which provides payroll services to both divisions and will allocate its total expenses to the two divisions as support department allocations. Mr. Bailey would fike you to start by analyzing the Payrol Office expenses, and allocating the total expenses to each division. He has decided to use the number of payrol checks as the activity base for the allocation. Fill in the following blanks, allocating the total expense for the Payroll office to each of the two divisions. Payroll Charge Rate is per payroll check fenten veres sty Wos Review the computation of sypport department allocations based on an activity base. Performance Evaluation A profit center manager has the responsibility and authority for making decisions that affect revenues and costs and, thus, profits. The manager of a profic center does not make decisions concerning the fixed assets irverted in the center. Respensibaty accounting for profit centers such as the Audit Division and Tax Division take the form of income statements, which should include only coetroltable revenues and controliatile expenses. Athough it is not technicaly a decentralized unit, GOR CPAs, Inc, as a whole may be considered as an investment center, Thus, Mr. Balley is also interested in evaluatiog the performance of the company as a whole. Two performance measures that are used at the investment center level are return on investment and residusl income. Me: Balizy would we to use the Durfont fonmule, composed of oroht margin and investment furnover, to break dowa the return on investment, in order to evaluate each division, At the company level, Mr. Ealiey would like to use return on anvestment to evaluate the overall performance of the compary and its investment decisions with regard to each division. Answer the following quections (1) and (2). 1. What is the most ikely reason Mr, Baley chose the Dupont formba to evaluate the divisions? 3. Mr. Bsiey wants to focus on whether the profit centers are spending in accordance with their budgets. 1. What is the most likely reason Mr. Balley chose the DuPont formula to evaluate the divisions? a. Me Balley wants to focus on whether the profic centers are spending in accordance with their budgets. b. Mr. Balley believes that the investment tumover will provide a good assessment of each division's profitability. c. Mr. ailey would hike to analyze differences in the return on investment across divisions, 2. What is the most ilkely reason Mr. Balley chose ceturn on investment to evaluste the company as a whole? a. Mr. Balley would hike to determine which division has the highest net income. b. Return on investment wil allow Me Balley to measure the income (return) on each dollar invested in the divisions, and decide where to invest additional assets or: expand operations. Fientack Foroth My Wirt 1. Review the definitions involved in the DuPont formila, along with the functoas of the divisions: 2. Review the definitions and the responsibetties of the divisions, and compare to the responsablities of the company as a whole. No Transfer Mr. Ugiley has prepared the foliowing divisional income statement for you to review, assuming no transfer of excess capachy hours occurs. He has aleo included the totat amaunts for BOF CPAs, Inc, in the rightmost colvimen. Complete the fallowing Divisional incorne Statements with your data from the Payror. Market Transfer Price Mr. Bailey asks that you prepare Divisional Income Statements ahowing what 20 YB results would have been had the Audit Division purchased all the excess capacity of the Tax Division, using a market transfer price. The divisional managers tell you that, with the excess capacity of the Tox Division of 800 hours, the Audit Division can perform 4 more audits during the vear, and the Tax Division would charpe the fudit Division the market rate of $110 per hour for the addibonal hours required, seiling Market Transfer Price Mr. Baifey asks that you prepare Divesional income Statements showing what 20 ro results would have been had the Audit Division purchased all the excess capacty of the Tax Division, using a market tranisfer price. The divisional managers tell you that, with the excess capacity of the Tax Division of 800 hours, the Audic Division can perform 4 more audits during the yeac, and the Tax D.vision would charge the Audit Division the market rate of $110 per hour for the additional haurs required, selling all its excess capacity to the Audit Division. The Tax Division would still be responsible for paying the salaries of their employees. Camplete the following Divisional income Statements. If there is no amount or an arnount is zero, enter " 0 :" Negotiated Transfer Price Mc, Balley asks that you prepare Divisional Income Statements showing whot 20 re resuits would have been had the Audit Division purchased all the excess capscity of the Tax. Division, using a negotiated transfer price. The divisional mansgers tell you that, whth the excess capocty of the Tax Division of Boo hours, the Acidit Division can perform 4 more audits during the yeac, and the Audit Division would agree to a negotiated rate of $80 per hour to be pald to the Tax Division for the additional hours reguired, with the Tax Division seling all its excess capacity to the Audit Oivision. The Tax Division would still be responsible for poring the salaries of their employees. Complete the folowing OWisional Income Statements. H there is no amount of an ameust is rero, enter " 0. Cost Transfer Price Mr. Esliey asks that you preparn Divisional Income Statements showing what 20 fi results would have been had the Aud to Dison purchased all the excess capscty of the Tax Divtion, using a cost transfer price. The divisional managers tell you that, with the excess capacity of the Tax Division of 800 hours, the Audt Division can perform 4 more audits during the yese, and the Audic Division would pay the Tax Division's internal hourly rate of $50 per hour for the additional hours required, with the Tax Divirion seling ailits excess capsoty to the Audit Divisan. The Tax Divislon would sill be responsible for paying the salories of their employees. Complete the foliowing Divisional income Statements. If there is no amount of an amount is zero, enter 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts