Question: Mastery Problem: Long Term Assets: Fixed and Intangible Patterson Planning Corp. You have been hired by Patterson Planning Corpu an events planning company that recently

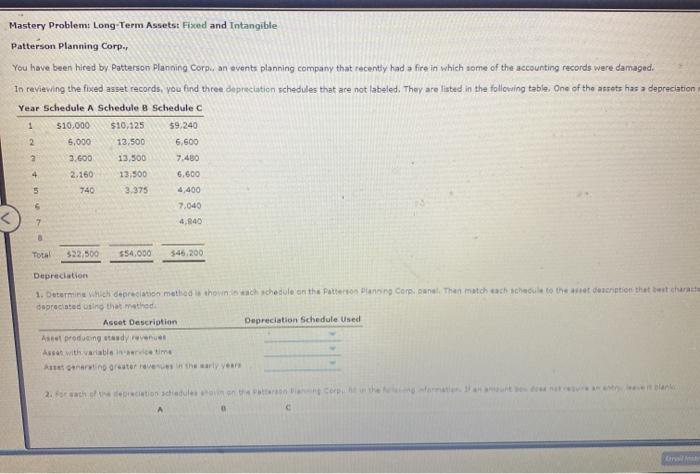

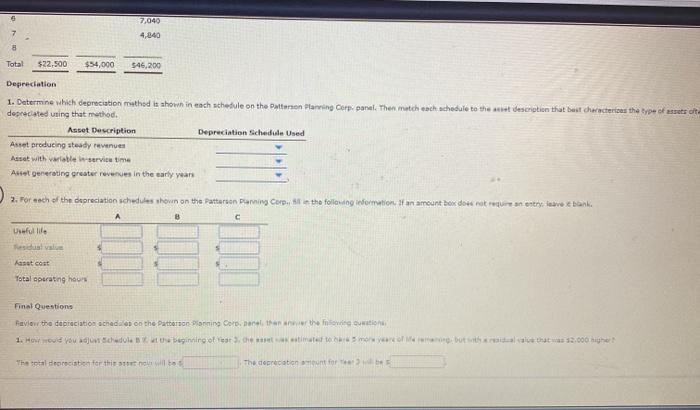

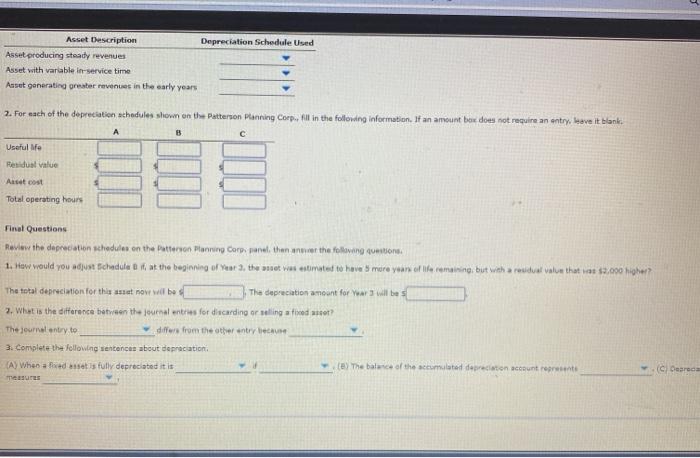

Mastery Problem: Long Term Assets: Fixed and Intangible Patterson Planning Corp. You have been hired by Patterson Planning Corpu an events planning company that recently had a fire in which some of the accounting records were damaged. In reviewing the fixed asset records, you find three dapreciation schedules that are not labeled. They are listed in the following table. One of the assets has a depreciation Year Schedule A Schedule B Schedule C $10,125 1 59,240 2 13,500 2 $10.000 5.000 3.600 2.160 740 6.600 7.480 6.600 4,400 13.500 13,500 3.375 4 5 7.040 4,840 7 Total $32,500 $$4.000 $46.200 Depreciation 1. Determine which depreciation method is showniach schedule on the patient Planng Corp. ant. The match each schedule to the descretion that he characte deprecated in the method Asset Description Depreciation Schedule Used Aste producing study was Asset with variable in time tinate the early year 2.swath to schedule anche C 6 7,040 7 4,040 8 Total $22.500 $54,000 $46,200 Depreciation 1. Determine which depreciation method is shown in each schedule on the Patterson Planning Corp.panel. The match each schedule to the description that best characters the type of assets of deprecated using that method Asset Description Depreciation Schedule Used Asset producing steady revenues Asset with variable service time Asset generating greater revenues in the early years 2. For each of the depreciation schedules shown on the Patterson Planning Corp., in the following inomation, an amount box does not an entry leave bank Useful life 3 Aast cost Total rating hours Final Questions Favlow the depreciation scheda on the Patterson Dorning Corp. nacel tarthens with 1. Hold You schedule to beginning of the time tomorrow, but with all that 12.000 The total rorociation for this The depreciation for Asset Description Depreciation Schedule Used Asset producing steady revenues Asset with variable in-service time Asset generating greater revenues in the early years 2. For each of the depreciation schedules shown on the Patterson Planning Corp., fill in the following information. If an amount box does not require an entry leave it blank B Useful Me Residual value Anse cost Total operating hours Final Questions Review the depreciation schedules on the Patterson Planning Corps panel than ance the following question 1. How would you adjust sichedule of at the beginning of years, the moet vomitimated to have more year of life caningbut with a residual value that was 12,000 higher? The total depreciation for this isset nove will be The depreciation amount for Yar will be 7. What is the difference between the journal entries for discarding or seling a fined 2007 The journal entry to diffure from the other entry 3. Complete the following sentences about depreciation (A) When a red so is fully deprecated it is (e) The balance of the accumulated depreciation count represente eur C Card Mastery Problem: Long Term Assets: Fixed and Intangible Patterson Planning Corp. You have been hired by Patterson Planning Corpu an events planning company that recently had a fire in which some of the accounting records were damaged. In reviewing the fixed asset records, you find three dapreciation schedules that are not labeled. They are listed in the following table. One of the assets has a depreciation Year Schedule A Schedule B Schedule C $10,125 1 59,240 2 13,500 2 $10.000 5.000 3.600 2.160 740 6.600 7.480 6.600 4,400 13.500 13,500 3.375 4 5 7.040 4,840 7 Total $32,500 $$4.000 $46.200 Depreciation 1. Determine which depreciation method is showniach schedule on the patient Planng Corp. ant. The match each schedule to the descretion that he characte deprecated in the method Asset Description Depreciation Schedule Used Aste producing study was Asset with variable in time tinate the early year 2.swath to schedule anche C 6 7,040 7 4,040 8 Total $22.500 $54,000 $46,200 Depreciation 1. Determine which depreciation method is shown in each schedule on the Patterson Planning Corp.panel. The match each schedule to the description that best characters the type of assets of deprecated using that method Asset Description Depreciation Schedule Used Asset producing steady revenues Asset with variable service time Asset generating greater revenues in the early years 2. For each of the depreciation schedules shown on the Patterson Planning Corp., in the following inomation, an amount box does not an entry leave bank Useful life 3 Aast cost Total rating hours Final Questions Favlow the depreciation scheda on the Patterson Dorning Corp. nacel tarthens with 1. Hold You schedule to beginning of the time tomorrow, but with all that 12.000 The total rorociation for this The depreciation for Asset Description Depreciation Schedule Used Asset producing steady revenues Asset with variable in-service time Asset generating greater revenues in the early years 2. For each of the depreciation schedules shown on the Patterson Planning Corp., fill in the following information. If an amount box does not require an entry leave it blank B Useful Me Residual value Anse cost Total operating hours Final Questions Review the depreciation schedules on the Patterson Planning Corps panel than ance the following question 1. How would you adjust sichedule of at the beginning of years, the moet vomitimated to have more year of life caningbut with a residual value that was 12,000 higher? The total depreciation for this isset nove will be The depreciation amount for Yar will be 7. What is the difference between the journal entries for discarding or seling a fined 2007 The journal entry to diffure from the other entry 3. Complete the following sentences about depreciation (A) When a red so is fully deprecated it is (e) The balance of the accumulated depreciation count represente eur C Card

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts