Question: MAT 1460- Homework Section 5.2 Support your answer by showing your work Jennifer has a balance of $1500 on her credit card that she is

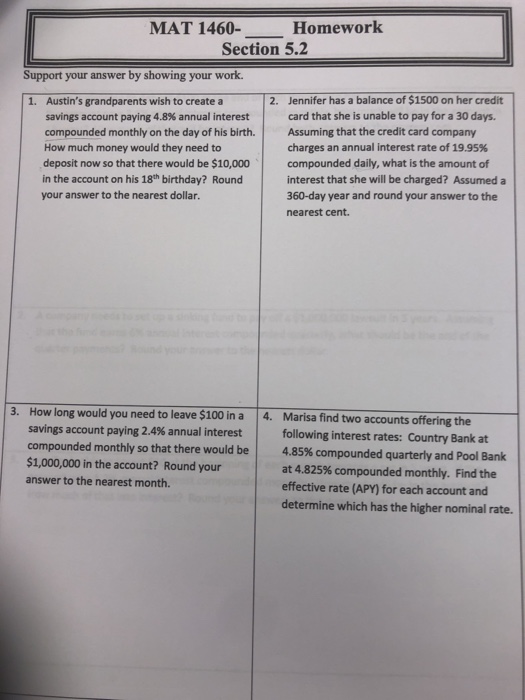

MAT 1460- Homework Section 5.2 Support your answer by showing your work Jennifer has a balance of $1500 on her credit card that she is unable to pay for a 30 days. 2. Austin's grandparents wish to createa savings account paying 4.8% annual interest compounded monthly on the day of his birth. How much money would they need to deposit now so that there would be $10,000 in the account on his 18th birthday? Round your answer to the nearest dollar. 1. Assuming that the credit card company charges an annual interest rate of 19.95% compounded daily, what is the amount of interest that she will be charged? Assumed a 360-day year and round your answer to the nearest cent. 3. How long would you need to leave $100 in a 4. Marisa find two accounts the savings account paying 2.4% annual interest compounded monthly so that there would be $1,000,000 in the account? Round your answer to the nearest month. following interest rates: Country Bank at 4.85% compounded quarterly and Pool Bank at 4.825% compounded monthly. Find the effective rate (APY) for each account and determine which has the higher nominal rate. |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts