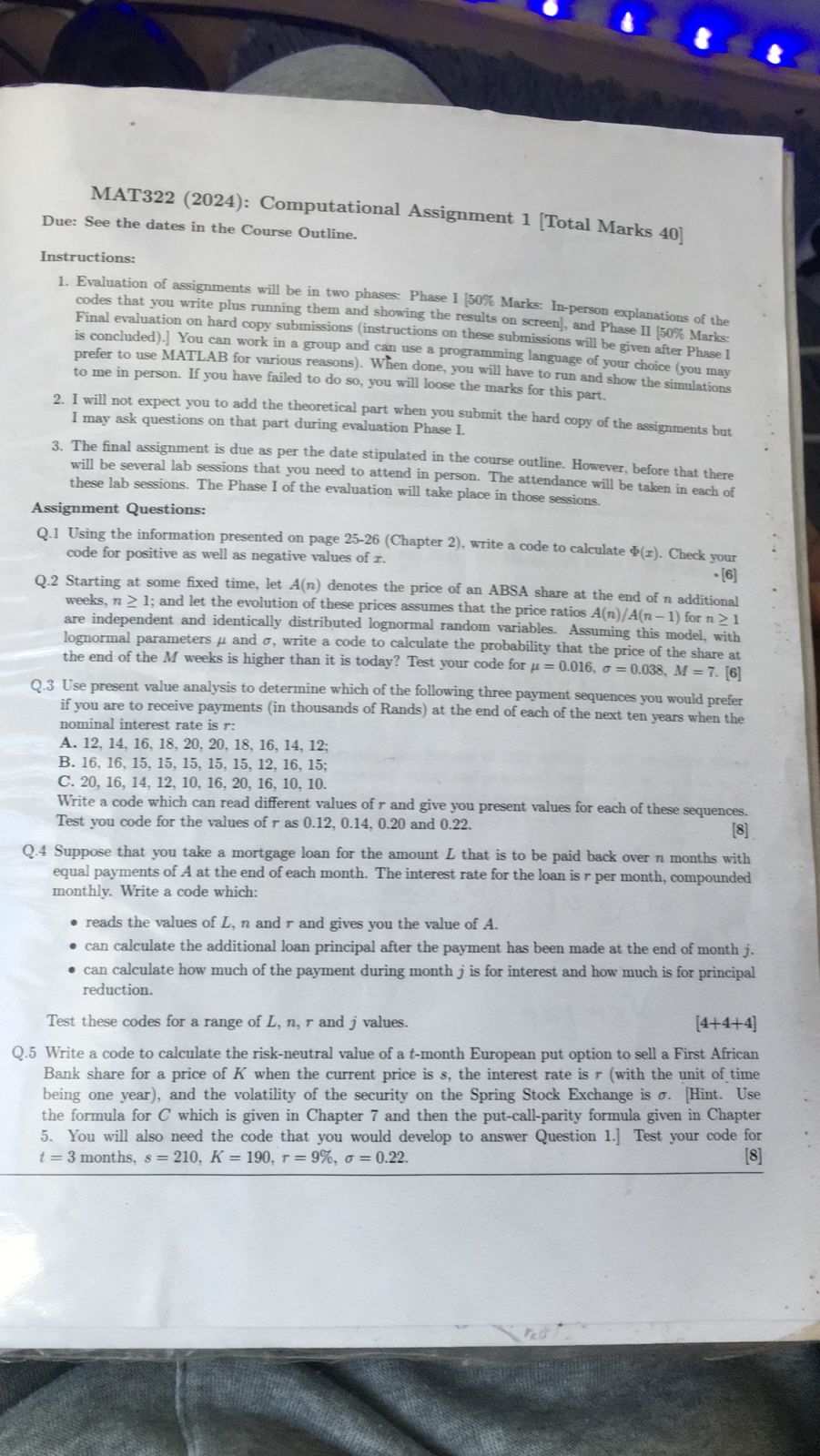

Question: MAT 3 2 2 ( 2 0 2 4 ) : Computational Assignment 1 [ Total Marks 4 0 ] Due: See the dates in

MAT: Computational Assignment Total Marks

Due: See the dates in the Course Outline.

Instructions:

Evaluation of assignments will be in two phases: Phase Marks: Inperson explanations of the

codes that you write plus running them and showing the results on screen and Phase II Marks:

Final evaluation on hard copy submissions instructions on these submissions will be given after Phase I

is concluded You can work in a group and can use a programming language of your choice you may

prefer to use MATLAB for various reasons When done, you will have to run and show the simulations

to me in person. If you have failed to do so you will loose the marks for this part.

I will not expect you to add the theoretical part when you submit the hard copy of the assignments but

I may ask questions on that part during evaluation Phase I.

The final assignment is due as per the date stipulated in the course outline. However, before that there

will be several lab sessions that you need to attend in person. The attendance will be taken in each of

these lab sessions. The Phase I of the evaluation will take place in those sessions.

Assignment Questions:

Q Using the information presented on page Chapter write a code to calculate Check your

code for positive as well as negative values of

Q Starting at some fixed time, let denotes the price of an ABSA share at the end of additional

weeks, ; and let the evolution of these prices assumes that the price ratios for

are independent and identically distributed lognormal random variables. Assuming this model, with

lognormal parameters and write a code to calculate the probability that the price of the share at

the end of the weeks is higher than it is today? Test your code for

Q Use present value analysis to determine which of the following three payment sequences you would prefer

if you are to receive payments in thousands of Rands at the end of each of the next ten years when the

nominal interest rate is :

A;

B;

C

Write a code which can read different values of and give you present values for each of these sequences.

Test you code for the values of as and

Q Suppose that you take a mortgage loan for the amount that is to be paid back over months with

equal payments of at the end of each month. The interest rate for the loan is per month, compounded

monthly. Write a code which:

reads the values of and and gives you the value of

can calculate the additional loan principal after the payment has been made at the end of month

can calculate how much of the payment during month is for interest and how much is for principal

reduction.

Test these codes for a range of and values.

Q Write a code to calculate the riskneutral value of a month European put option to sell a First African

Bank share for a price of when the current price is the interest rate is with the unit of time

being one year and the volatility of the security on the Spring Stock Exchange is Hint Use

the formula for which is given in Chapter and then the putcallparity formula given in Chapter

You will also need the code that you would develop to answer Question Test your code for

months,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock