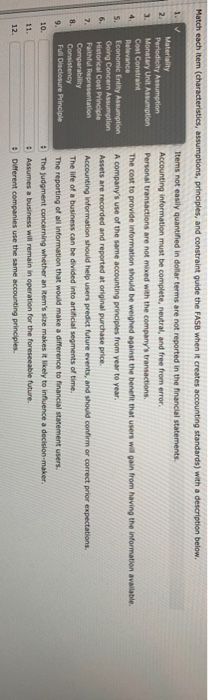

Question: Match each item (characteristics, assumptions, principles, and constraint guide the FASB when it creates accounting standards) with a description below. 1. Items not easily quantified

Match each item (characteristics, assumptions, principles, and constraint guide the FASB when it creates accounting standards) with a description below. 1. Items not easily quantified in dollar terms are not reported in the financial statements 2 Materiality Periodicity Assumption Accounting information must be complete, neutral, and free from error. 3. Monetary Unit Assumption Personal transactions are not mixed with the company's transactions Cost Constrain Relevance The cost to provide information should be weighed against the benefit that users will gain from having the information available. 5. Economic Entity Assumption A company's use of the same accounting principles from year to year. Going Concern Assumption 6. Historical Cost Principle Assets are recorded and reported at original purchase price Falthful Representation Accounting information should help users predict future events, and should confirm or correct prior expectations. Comparability Consistency The life of a business can be divided into artificial segments of time Full Disclosure Principle The reporting of all information that would make a difference to financial statement users. 10. The judgment concerning whether an item's size makes it likely to influence a decision-maker. 11. Assumes a business will remain in operation for the foreseeable future. 12 Different companies use the same accounting principles 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts