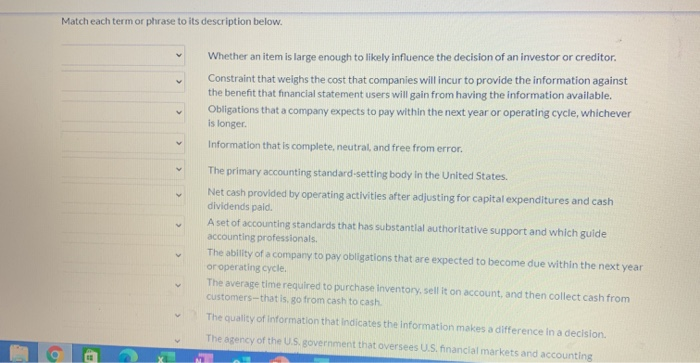

Question: Match each term or phrase to its description below. Whether an item is large enough to likely influence the decision of an investor or creditor.

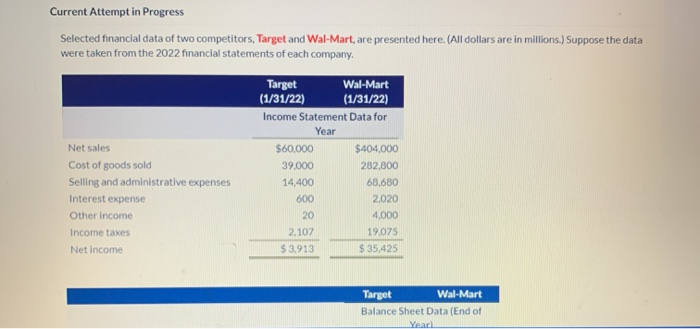

Match each term or phrase to its description below. Whether an item is large enough to likely influence the decision of an investor or creditor. Constraint that weighs the cost that companies will incur to provide the information against the benefit that financial statement users will gain from having the information available. Obligations that a company expects to pay within the next year or operating cycle, whichever is longer Information that is complete, neutral, and free from error. The primary accounting standard setting body in the United States. Net cash provided by operating activities after adjusting for capital expenditures and cash dividends pald. A set of accounting standards that has substantial authoritative support and which guide accounting professionals, The ability of a company to pay obligations that are expected to become due within the next year or operating cycle The average timerequired to purchase inventory Sell it on account, and then collect cash from customers-that is go from cash to cash The quality of information that indicates the information makes a difference in a decision The agency of the U.S. government that oversees U.S.financial markets and accounting Current Attempt in Progress Selected financial data of two competitors, Target and Wal-Mart, are presented here. (All dollars are in millions.) Suppose the data were taken from the 2022 financial statements of each company. Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income Income taxes Net income Target Wal-Mart (1/31/22) (1/31/22) Income Statement Data for Year $60,000 $404,000 39.000 282.800 14,400 68.680 600 2.020 20 4,000 2.107 19.075 $ 3.913 $ 35.425 Target Wal-Mart Balance Sheet Data (End of Yearl Match each term or phrase to its description below. Whether an item is large enough to likely influence the decision of an investor or creditor. Constraint that weighs the cost that companies will incur to provide the information against the benefit that financial statement users will gain from having the information available. Obligations that a company expects to pay within the next year or operating cycle, whichever is longer Information that is complete, neutral, and free from error. The primary accounting standard setting body in the United States. Net cash provided by operating activities after adjusting for capital expenditures and cash dividends pald. A set of accounting standards that has substantial authoritative support and which guide accounting professionals, The ability of a company to pay obligations that are expected to become due within the next year or operating cycle The average timerequired to purchase inventory Sell it on account, and then collect cash from customers-that is go from cash to cash The quality of information that indicates the information makes a difference in a decision The agency of the U.S. government that oversees U.S.financial markets and accounting Current Attempt in Progress Selected financial data of two competitors, Target and Wal-Mart, are presented here. (All dollars are in millions.) Suppose the data were taken from the 2022 financial statements of each company. Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income Income taxes Net income Target Wal-Mart (1/31/22) (1/31/22) Income Statement Data for Year $60,000 $404,000 39.000 282.800 14,400 68.680 600 2.020 20 4,000 2.107 19.075 $ 3.913 $ 35.425 Target Wal-Mart Balance Sheet Data (End of Yearl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts