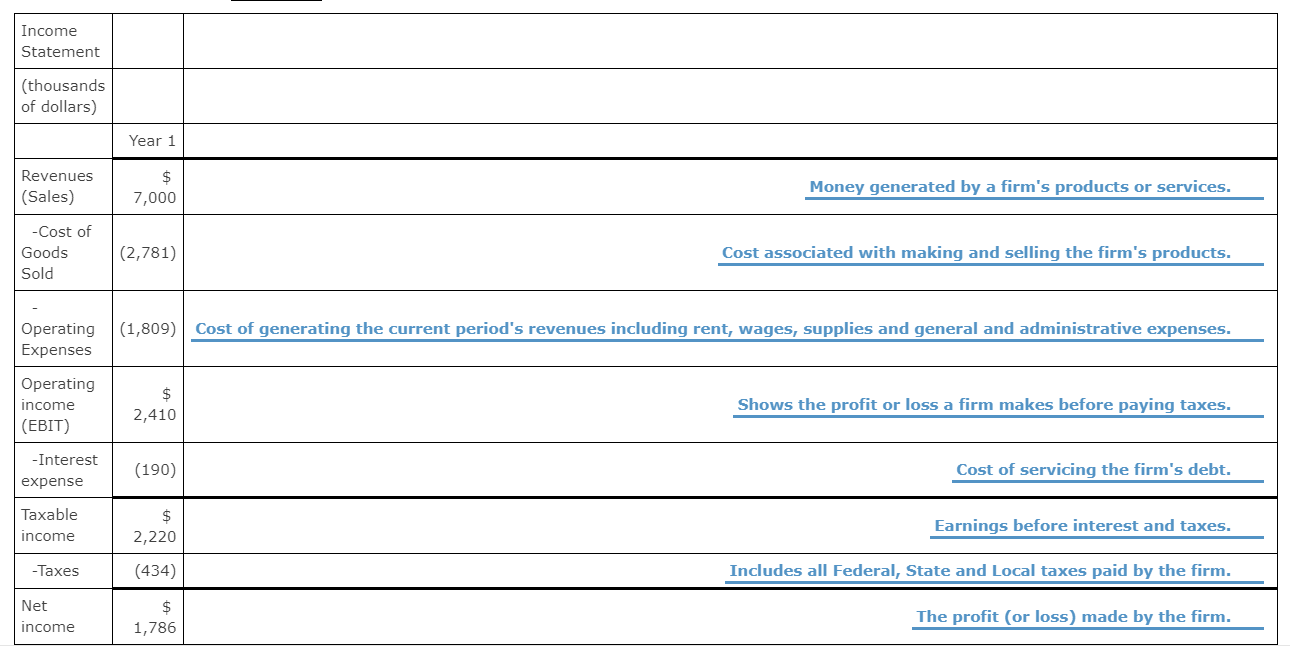

Question: Match each term with its definition from the drop-down list of choices. Please confirm if these are correct. Income Statement (thousands of dollars) Year 1

Match each term with its definition from the drop-down list of choices. Please confirm if these are correct.

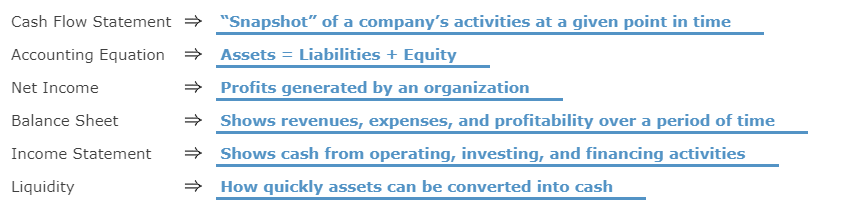

Income Statement (thousands of dollars) Year 1 Revenues (Sales) 7,000 Money generated by a firm's products or services. -Cost of Goods Sold (2,781) Cost associated with making and selling the firm's products. (1,809) Cost of generating the current period's revenues including rent, wages, supplies and general and administrative expenses. Operating Expenses Operating income (EBIT) Shows the profit or loss a firm makes before paying taxes. 2,410 -Interest expense (190) Cost of servicing the firm's debt. Taxable income Earnings before interest and taxes. 2,220 -Taxes (434) Includes all Federal, State and Local taxes paid by the firm. Net income The profit (or loss) made by the firm. 1,786 Cash Flow Statement Accounting Equation * * Net Income Balance Sheet "Snapshot" of a company's activities at a given point in time Assets = Liabilities + Equity Profits generated by an organization Shows revenues, expenses, and profitability over a period of time Shows cash from operating, investing, and financing activities How quickly assets can be converted into cash * Income Statement Liquidity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts