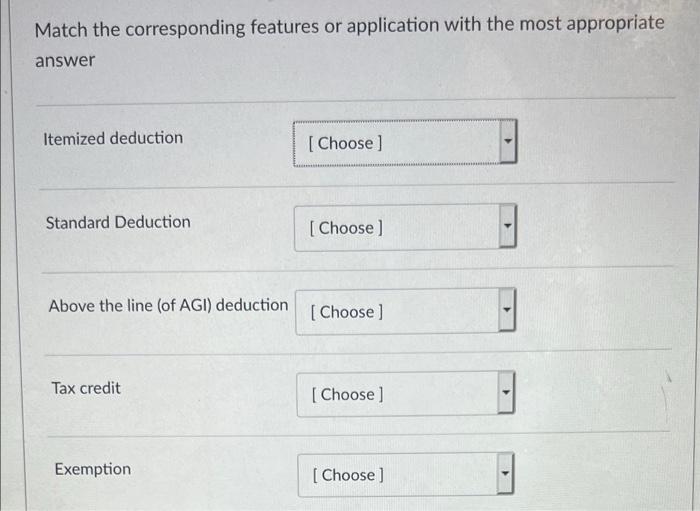

Question: Match the corresponding features or application with the most appropriate answer Itemized deduction [Choose ] - Standard Deduction [Choose ) Above the line (of AGI)

![Itemized deduction [Choose ] - Standard Deduction [Choose ) Above the line](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe413f657c9_87966fe413f14e07.jpg)

Match the corresponding features or application with the most appropriate answer Itemized deduction [Choose ] - Standard Deduction [Choose ) Above the line (of AGI) deduction [Choose) - Tax credit [Choose) - Exemption [Choose ] - - [Choose ] Real Estate Property taxes applied to tax filing For tax years prior to 2018, a deduction from adjusted gross income for yourself, your spouse, and qualified dependents a set amount of income on which no taxes are paid an amount subtracted directly from the amount of taxes owed IRA contributions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts