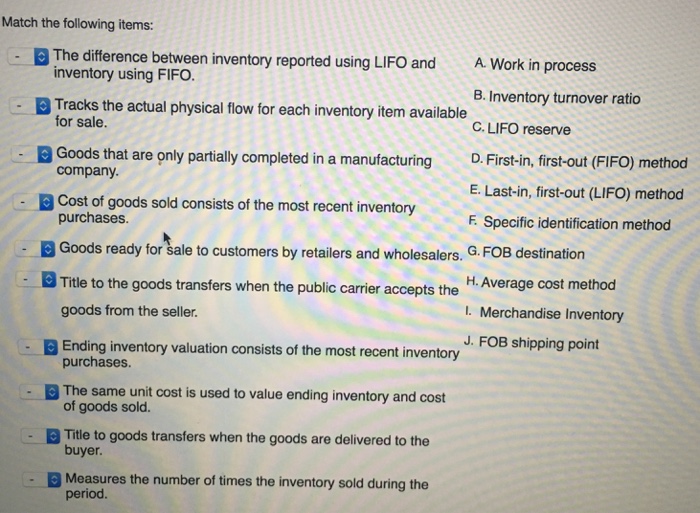

Question: Match the following items: The difference between inventory reported using LIFO and inventory using FIFO. Work in process Tracks the actual physical flow for each

Match the following items: The difference between inventory reported using LIFO and inventory using FIFO. Work in process Tracks the actual physical flow for each inventory item available for sale Inventory turnover ratio Goods that are only partially completed in a manufacturing company. LIFO reserve Cost of goods sold consists of the most recent inventory purchases. First-in, first-out (FIFO) method Goods ready for sale to customers by retailers and wholesalers. Last-in, first-out (LIFO) method Title to the goods transfers when the public carrier accepts the goods from the seller. Specific identification method Ending inventory valuation consists of the most recent inventory purchases. FOB destination The same unit cost is used to value ending inventory and cost of goods sold. Average cost method Title to goods transfers when the goods are delivered to the buyer. Merchandise Inventory Measures the number of times the inventory sold during the period. FOB shipping point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts