Question: Match the self - directed retirement program terms on the right with the descriptions of the terms on the left. ( Hint: These are not

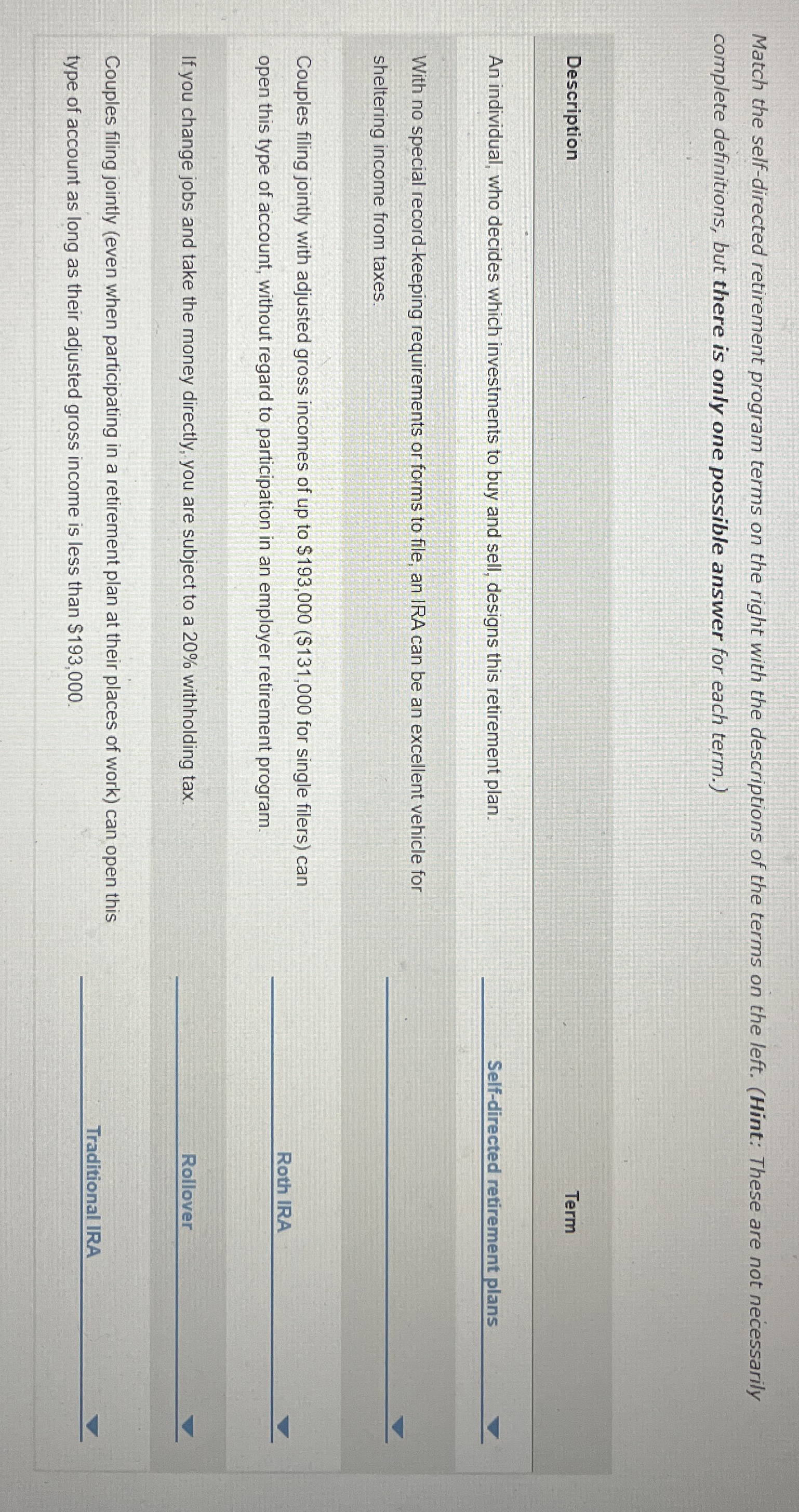

Match the selfdirected retirement program terms on the right with the descriptions of the terms on the left. Hint: These are not necessarily complete definitions, but there is only one possible answer for each term.

Description

Term

An individual, who decides which investments to buy and sell, designs this retirement plan.

Selfdirected retirement plans

With no special recordkeeping requirements or forms to file, an IRA can be an excellent vehicle for sheltering income from taxes.

Couples filing jointly with adjusted gross incomes of up to $ $ for single filers can open this type of account, without regard to participation in an employer retirement program.

Roth IRA

If you change jobs and take the money directly, you are subject to a withholding tax.

Rollover

Couples filing jointly even when participating in a retirement plan at their places of work can open this type of account as long as their adjusted gross income is less than $

Traditional IRA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock