Question: Match the term with the correct defintion. Internal Control Systems Cost-benefit principle Liquidity v Cash Cash Equivalents Cash Over and Short Petty Cash v Bank

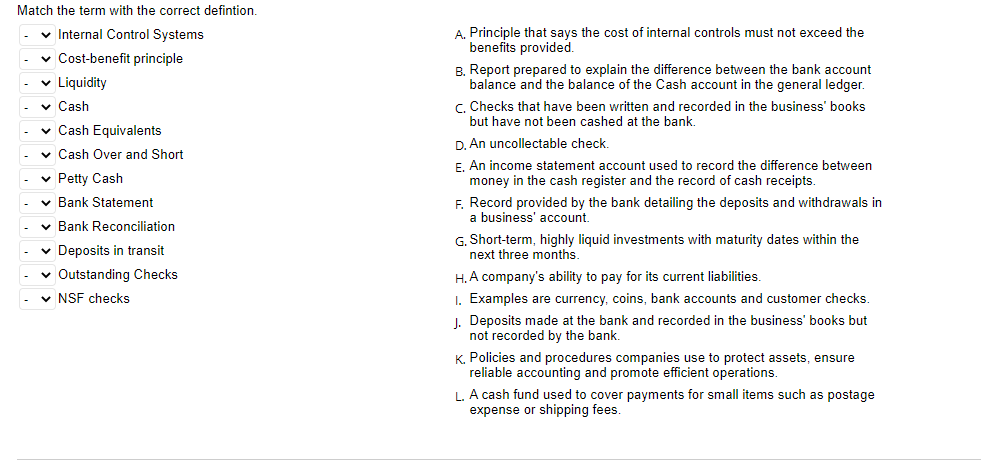

Match the term with the correct defintion. Internal Control Systems Cost-benefit principle Liquidity v Cash Cash Equivalents Cash Over and Short Petty Cash v Bank Statement Bank Reconciliation Deposits in transit - Outstanding Checks v NSF checks A. Principle that says the cost of internal controls must not exceed the benefits provided B. Report prepared to explain the difference between the bank account balance and the balance of the Cash account in the general ledger. c. Checks that have been written and recorded in the business' books but have not been cashed at the bank. D. An uncollectable check. E. An income statement account used to record the difference between money in the cash register and the record of cash receipts. F. Record provided by the bank detailing the deposits and withdrawals in a business' account G. Short-term, highly liquid investments with maturity dates within the next three months. H. A company's ability to pay for its current liabilities. 1. Examples are currency, coins, bank accounts and customer checks. J. Deposits made at the bank and recorded in the business' books but not recorded by the bank. K. Policies and procedures companies use to protect assets, ensure reliable accounting and promote efficient operations. L. A cash fund used to cover payments for small items such as postage expense or shipping fees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts