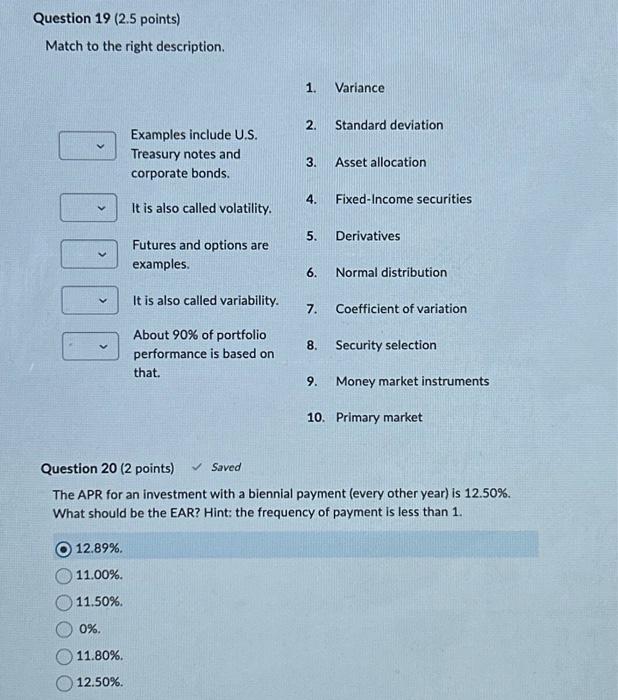

Question: Match to the right description. 1. Variance Examples include U.S. Treasury notes and corporate bonds. It is also called volatility. Futures and options are examples.

Match to the right description. 1. Variance Examples include U.S. Treasury notes and corporate bonds. It is also called volatility. Futures and options are examples. It is also called variability. About 90% of portfolio performance is based on that. 2. Standard deviation 3. Asset allocation 4. Fixed-Income securities 5. Derivatives 6. Normal distribution 7. Coefficient of variation 8. Security selection 9. Money market instruments 10. Primary market Question 20 ( 2 points) Saved The APR for an investment with a biennial payment (every other year) is 12.50%. What should be the EAR? Hint: the frequency of payment is less than 1. 12.89%. 11.00%. 11.50%. 0%. 11.80%. 12.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts