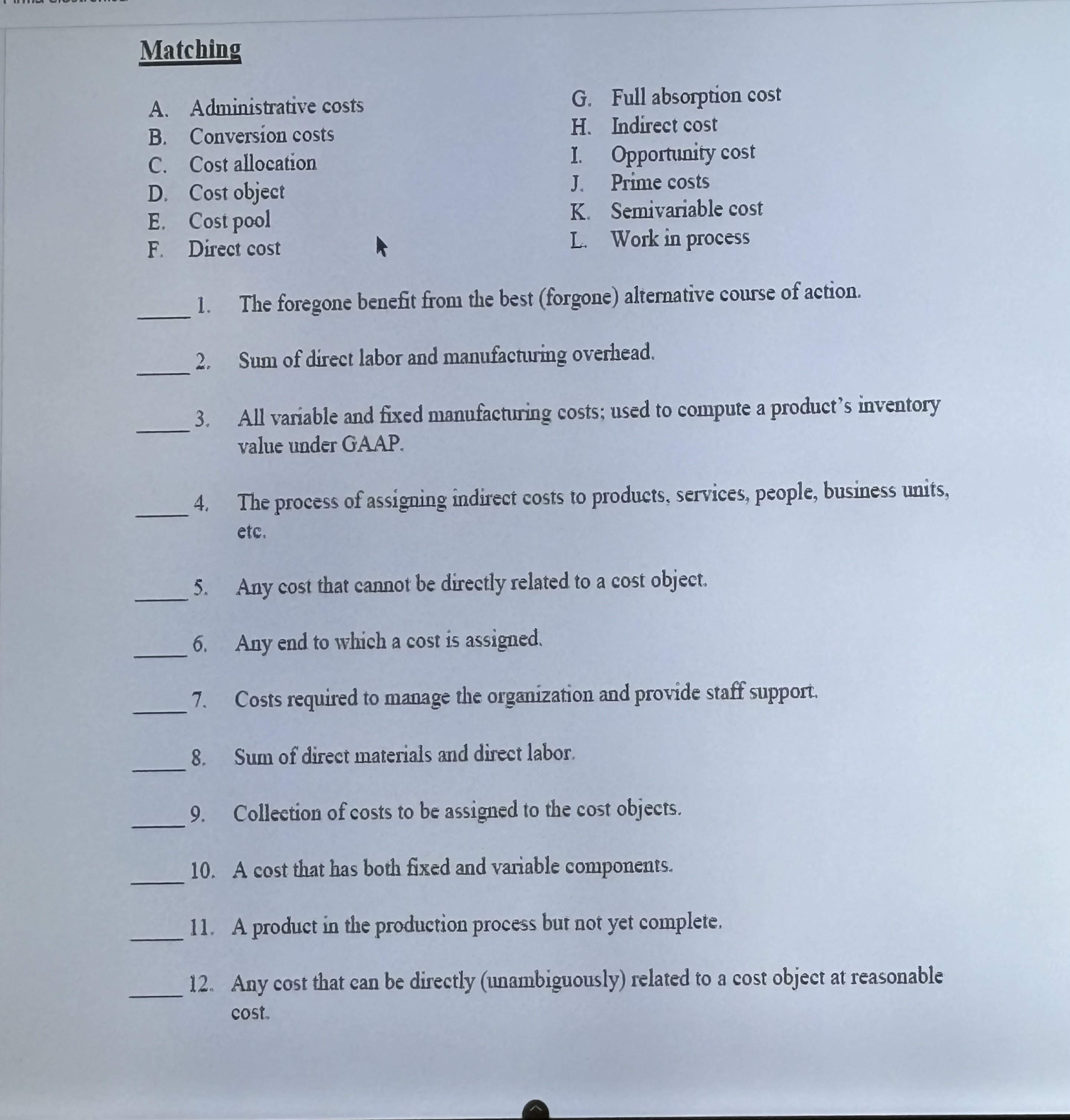

Question: Matching A . Administrative costs G . Full absorption cost B . Conversion costs H . Indirect cost C . Cost allocation I. Opportunity cost

Matching

A Administrative costs

G Full absorption cost

B Conversion costs

H Indirect cost

C Cost allocation

I. Opportunity cost

D Cost object

J Prime costs

E Cost pool

K Semivariable cost

F Direct cost

L Work in process

The foregone benefit from the best forgone alternative course of action.

Sum of direct labor and manufacturing overhead.

All variable and fixed manufacturing costs; used to compute a product's inventory value under GAAP.

The process of assigning indirect costs to products, services, people, business units, ete.

Any cost that cannot be directly related to a cost object.

Any end to which a cost is assigned.

Costs required to manage the organization and provide staff support.

Sum of direct materials and direct labor.

Collection of costs to be assigned to the cost objects.

A cost that has both fixed and variable components.

A product in the production process but not yet complete.

Any cost that can be directly unambiguously related to a cost object at reasonable cost.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock