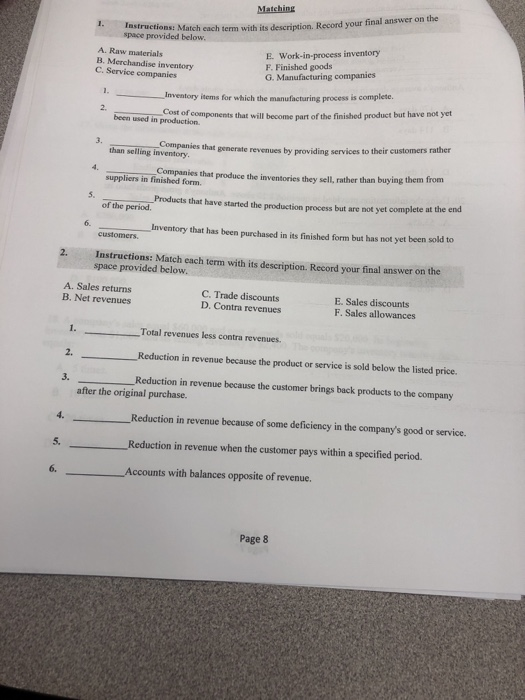

Question: Matching astructions: Match each term with its description Record your final answer on the space provided below. A. Raw materials B. Merchandise inventory C. Service

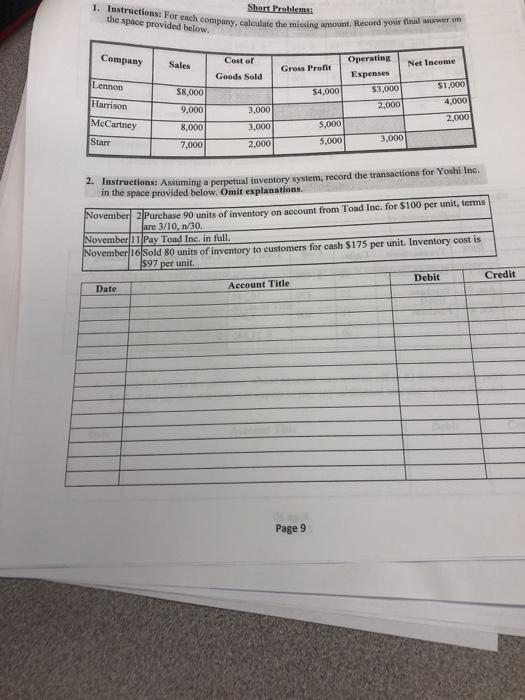

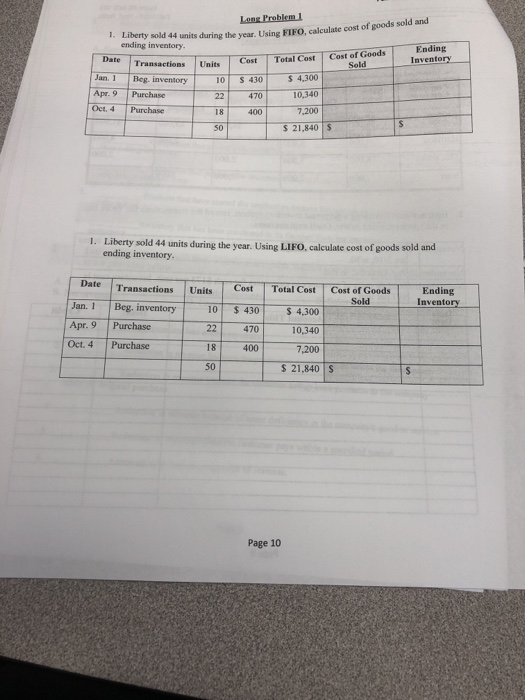

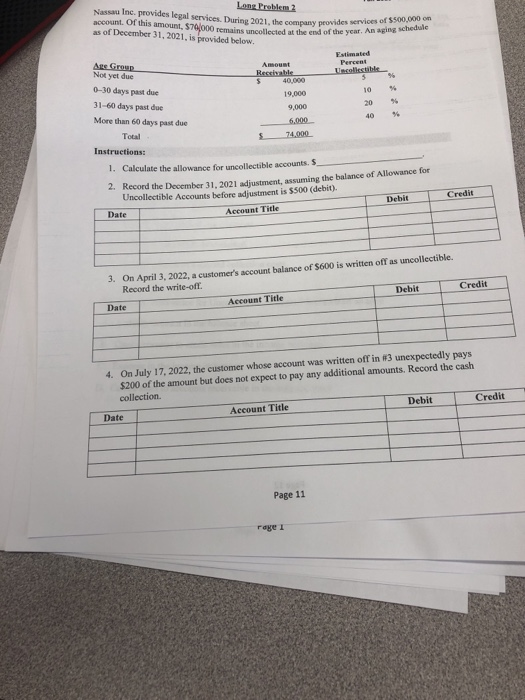

Matching astructions: Match each term with its description Record your final answer on the space provided below. A. Raw materials B. Merchandise inventory C. Service companies E. Work-in-process inventory F. Finished goods G. Manufacturing companies Inventory items for which the manufacturing process is complete. been used in production cost of components that will become part of the finished product but have not yet than selling inventory. Companies that generate revenues by providing services to their customers rather Companies that produce the inventories they sell rather than buying them from suppliers in finished form Products that have started the production process but are not yet complete at the end of the period Inventory that has been purchased in its finished form but has not yet been sold to customers. Instructions: Match each term with its description. Record your final answer on the space provided below. A. Sales returns B. Net revenues C. Trade discounts D. Contra revenues E. Sales discounts F. Sales allowances Total revenues less contra revenues. Reduction in revenue because the product or service is sold below the listed price. Reduction in revenue because the customer brings back products to the company after the original purchase. Reduction in revenue because of some deficiency in the company's good or service. Reduction in revenue when the customer pays within a specified period. Accounts with balances opposite of revenue. Page 8 1. Instructions: For each company, calculate the the space provided below. Short Problems company, calculate the missing amount. Record your finanswer on Company Sales Cost of Operating Gross Profit Net Income Goods Sold Expenses Lennon $8.000 $4,000 $3.000 $1.000 Harrison 4.000 McCartney 9,000 8.000 7,000 3,000 3,000 2,000 Starr 5,000 5,000 3,000 4. Instructions: Assuming a perpetual inventory system, record the transactions for Yoshi Inc. in the space provided below. Omit explanations. povember 2Purchase 90 units of inventory on account from Toad Ine, for $100 per unit, terms are 3/10, /30. November 11 Pay Toad Inc. in full. November 16 Sold 80 units of inventory to customers for cash $175 per unit. Inventory cost is 597 per unit. Date Account Title Debit Credit Page 9 Long Problem 1 Liberty sold 44 units during the year. Using FIFO, calculate cost of goods sold and ending inventory. Date Transactions Ending Inventory Units Cost Cost of Goods Sold Total Cost Jan. 1 Beg. inventory 10 S 430 470 Apr. 9 Oct.4 Purchase Purchase $ 4,300 10,340 7,200 $ 21,840 400 1. Liberty sold 44 units during the year. Using LIFO, calculate cost of goods sold and ending inventory. Date Transactions Units Cost Total Cost Cost of Goods Ending Inventory Sold Jan. 1 Apr. 9 Oct.4 Beg. inventory Purchase Purchase 10 22 $ 430 470 400 $ 4,300 10,340 7,200 $ 21,840 S - Page 10 Long. Problem 2 Nassau Inc provides legal services count of this amount, $70,000 Services. During 2021. the as of December 31, 2021. is provided below. 000 remains collected w ides vices of $500,000 of the year as a schedule Estimated Percent Lincollectible A Group Amount Noryetdur Rechable 40.000 0-30 days past due 31-60 days pas de More than 60 days pas due 6.000 Total 5 74.000 Instructions: 1. Calculate the allowance for uncollectible accounts. S. 19.000 9.000 2. Record the December 31, 2021 adiustment, assuming the balance of Allowance for Uncollectible Accounts before aiustment is $500 (debit) Date Account Title Debit Credit 3. On April 3, 2022, a customer's account balance of $600 is written off as uncollectible. Record the write-ofl. Date Debit Credit Account Title 4. On July 17, 2022, the customer whose account was written off in 3 unexpectedly pays $200 of the amount but does not expect to pay any additional amounts. Record the cash collection Date Account Title Debit Credit Page 11 rage 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts