Question: Matching Concepts A. Defined benefit plan. B. Funded pension plan. C. Corridor approach. D. Projected benefit obligation. E. Defined contribution plan. F. Prior service cost.

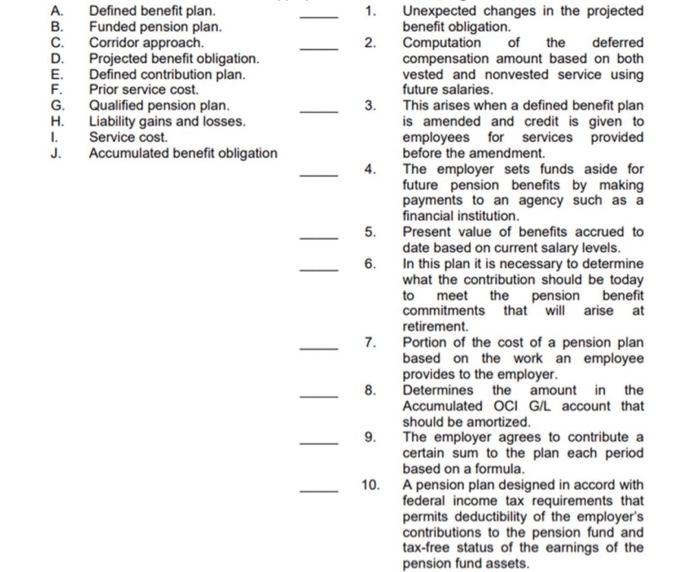

A. Defined benefit plan. B. Funded pension plan. C. Corridor approach. D. Projected benefit obligation. E. Defined contribution plan. F. Prior service cost. G. Qualified pension plan. H. Liability gains and losses. I. Service cost. J. Accumulated benefit obligation 1. Unexpected changes in the projected benefit obligation. 2. Computation of the deferred compensation amount based on both vested and nonvested service using future salaries. 3. This arises when a defined benefit plan is amended and credit is given to employees for services provided before the amendment. 4. The employer sets funds aside for future pension benefits by making payments to an agency such as a financial institution. 5. Present value of benefits accrued to date based on current salary levels. 6. In this plan it is necessary to determine what the contribution should be today to meet the pension benefit commitments that will arise at retirement. 7. Portion of the cost of a pension plan based on the work an employee provides to the employer. 8. Determines the amount in the Accumulated OClG/L account that should be amortized. 9. The employer agrees to contribute a certain sum to the plan each period based on a formula. 10. A pension plan designed in accord with federal income tax requirements that permits deductibility of the employer's contributions to the pension fund and tax-free status of the earnings of the pension fund assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts