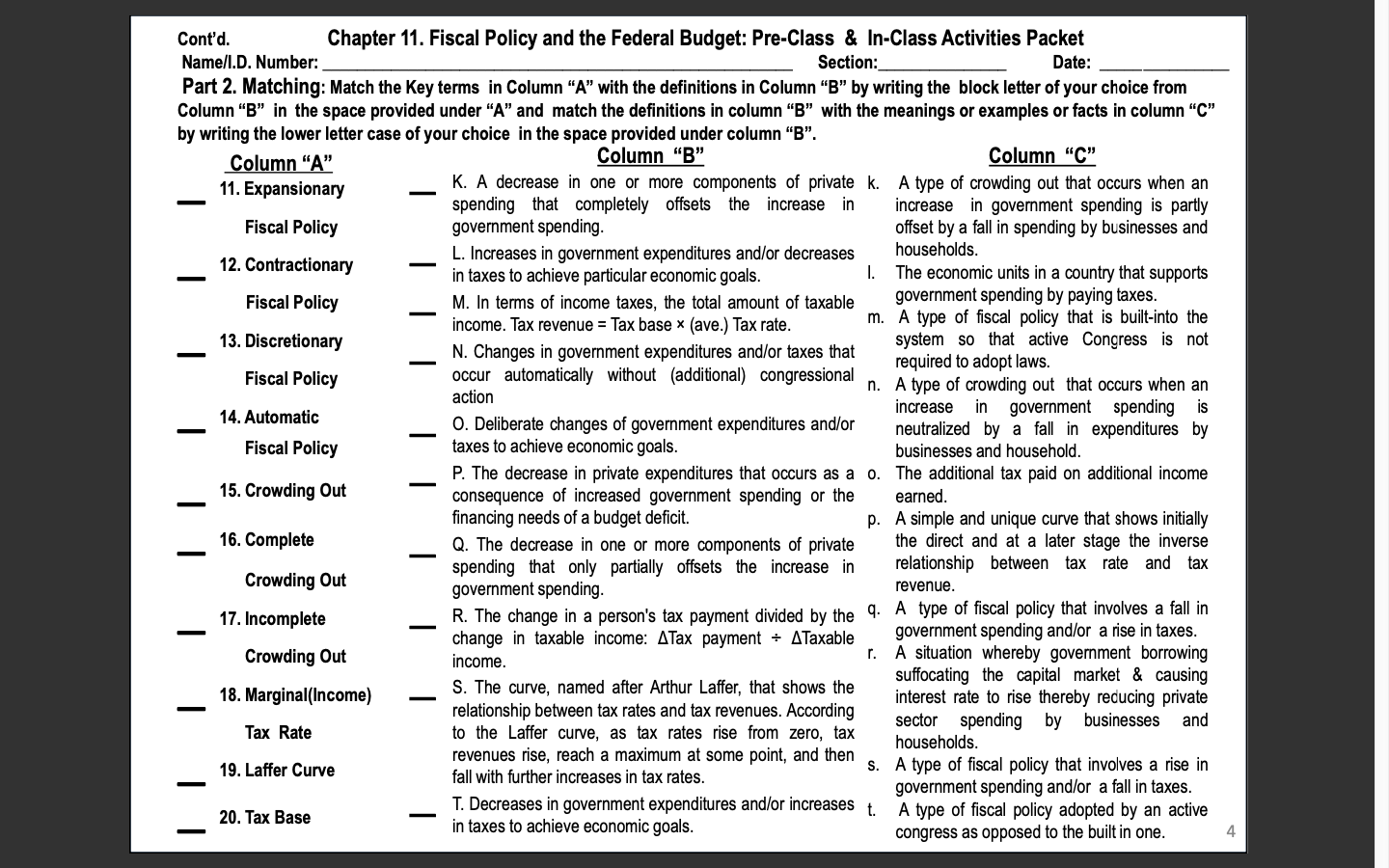

Question: Matching: Match the Key terms in Column A with the definitions in Column B by writing the block letter of your choice from Column B

Matching: Match the Key terms in Column "A" with the definitions in Column "B" by writing the block letter of your choice from

Column "B" in the space provided under "A" and match the definitions in column "B" with the meanings or examples or factsincolumn "C"

by writing the lower letter case of your choice in the space provided under column "B".

I need only question #11, 13, 15, 17 and 19. Thanks

Cont'd. Chapter 11. Fiscal Policy and the Federal Budget: Pre-Class & In-Class Activities Packet Name/I.D. Number: Section: Date: Part 2. Matching: Match the Key terms in Column "A" with the definitions in Column "B" by writing the block letter of your choice from Column "B" in the space provided under "A" and match the definitions in column "B" with the meanings or examples or facts in column "C" by writing the lower letter case of your choice in the space provided under column "B". Column "A" Column "B" Column "C" 11. Expansionary K. A decrease in one or more components of private k. A type of crowding out that occurs when an spending that completely offsets the increase in increase in government spending is partly Fiscal Policy government spending. offset by a fall in spending by businesses and 12. Contractionary L. Increases in government expenditures and/or decreases households. in taxes to achieve particular economic goals. 1. The economic units in a country that supports Fiscal Policy government spending by paying taxes. - M. In terms of income taxes, the total amount of taxable income. Tax revenue = Tax base x (ave.) Tax rate. m. A type of fiscal policy that is built-into the 13. Discretionary N. Changes in government expenditures and/or taxes that system so that active Congress is not Fiscal Policy occur automatically without (additional) congressional required to adopt laws. action n. A type of crowding out that occurs when an 14. Automatic O. Deliberate changes of government expenditures and/or increase in government spending is Fiscal Policy taxes to achieve economic goals neutralized by a fall in expenditures by businesses and household. 15. Crowding Out - P. The decrease in private expenditures that occurs as a o. The additional tax paid on additional income consequence of increased government spending or the earned. financing needs of a budget deficit P. A simple and unique curve that shows initially 16. Complete Q. The decrease in one or more components of private the direct and at a later stage the inverse Crowding Out spending that only partially offsets the increase in relationship between tax rate and tax government spending. revenue. 17. Incomplete - R. The change in a person's tax payment divided by the q. A type of fiscal policy that involves a fall in Crowding Out change in taxable income: ATax payment + ATaxable government spending and/or a rise in taxes. income. r. A situation whereby government borrowing 18. Marginal(Income) S. The curve, named after Arthur Laffer, that shows the suffocating the capital market & causing relationship between tax rates and tax revenues. According interest rate to rise thereby reducing private Tax Rate to the Laffer curve, as tax rates rise from zero, tax sector spending by businesses and revenues rise, reach a maximum at some point, and then households. 19. Laffer Curve fall with further increases in tax rates. s. A type of fiscal policy that involves a rise in government spending and/or a fall in taxes. 20. Tax Base T. Decreases in government expenditures and/or increases t. in taxes to achieve economic goals. A type of fiscal policy adopted by an active congress as opposed to the built in one. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts