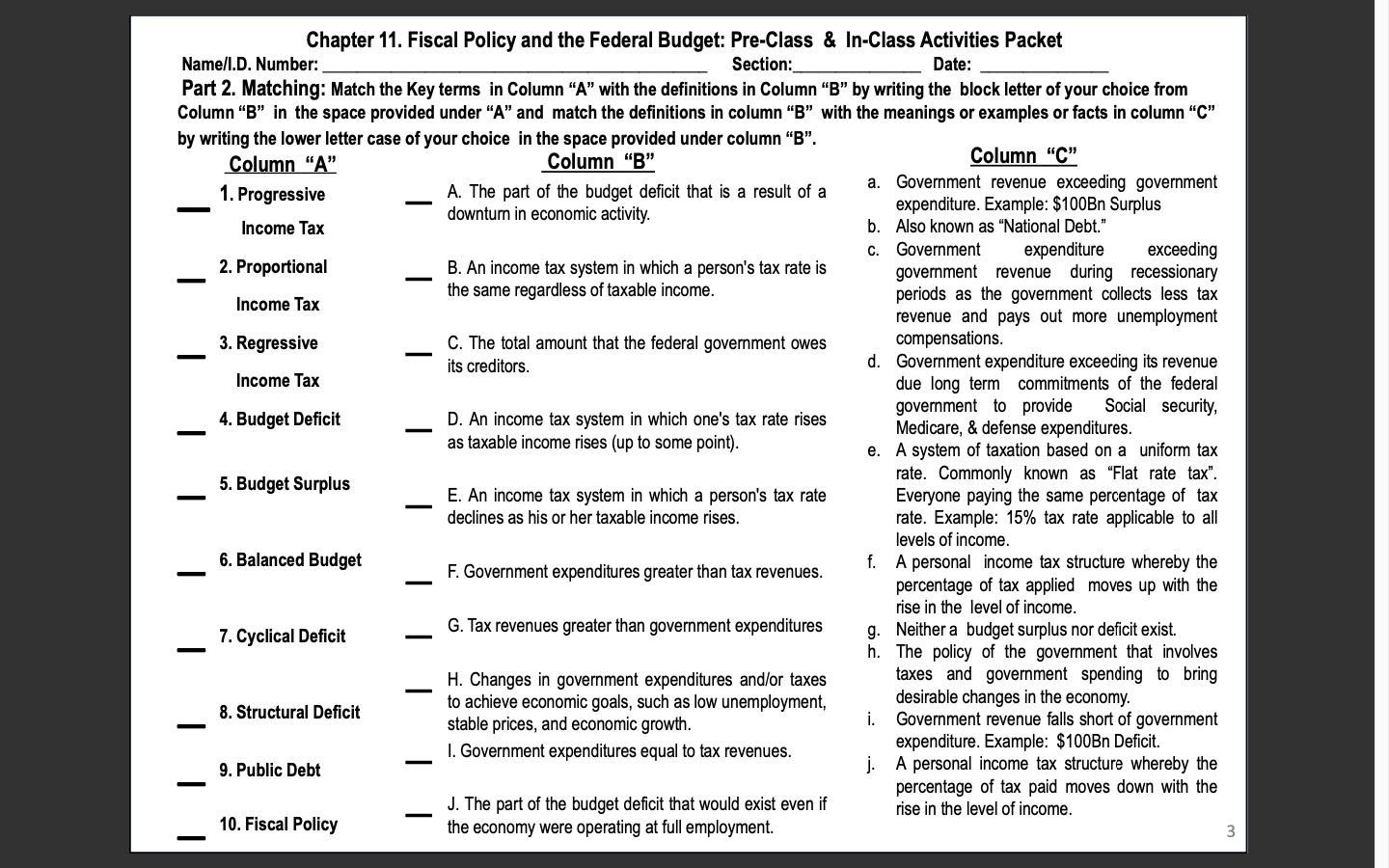

Question: Matching:Match the Key terms in Column A with the definitions in Column B by writing the block letter of your choice from Column B in

Matching:Match the Key terms in Column "A" with the definitions in Column "B" by writing the block letter of your choice from

Column "B" in the space provided under "A" and match the definitions in column "B" with the meanings or examples or factsincolumn "C"

by writing the lower letter case of your choice in the space provided under column "B".

I need only questions #1, 3, 5, 7 & 9. Thanks!

Chapter 11. Fiscal Policy and the Federal Budget: Pre-Class & In-Class Activities Packet Name/I.D. Number: Section: Date: Part 2. Matching: Match the Key terms in Column "A" with the definitions in Column "B" by writing the block letter of your choice from Column "B" in the space provided under "A" and match the definitions in column "B" with the meanings or examples or facts in column "C" by writing the lower letter case of your choice in the space provided under column "B". Column "A" Column "B" Column "C" 1. Progressive A. The part of the budget deficit that is a result of a a. Government revenue exceeding government downturn in economic activity. expenditure. Example: $100Bn Surplus Income Tax b. Also known as "National Debt." 2. Proportional B. An income tax system in which a person's tax rate is C. Government expenditure exceeding the same regardless of taxable income. government revenue during recessionary Income Tax periods as the government collects less tax revenue and pays out more unemployment 3. Regressive C. The total amount that the federal government owes compensations. Income Tax its creditors. d. Government expenditure exceeding its revenue due long term commitments of the federal 4. Budget Deficit D. An income tax system in which one's tax rate rises government to provide Social security, as taxable income rises (up to some point). Medicare, & defense expenditures e. A system of taxation based on a uniform tax 5. Budget Surplus rate. Commonly known as "Flat rate tax". E. An income tax system in which a person's tax rate Everyone paying the same percentage of tax declines as his or her taxable income rises. rate. Example: 15% tax rate applicable to all 6. Balanced Budget levels of income. F. Government expenditures greater than tax revenues. f. A personal income tax structure whereby the percentage of tax applied moves up with the G. Tax revenues greater than government expenditures rise in the level of income. 7. Cyclical Deficit - g. Neither a budget surplus nor deficit exist. h . The policy of the government that involves H. Changes in government expenditures and/or taxes taxes and government spending to bring 8. Structural Deficit to achieve economic goals, such as low unemployment, desirable changes in the economy. stable prices, and economic growth. i. Government revenue falls short of government 9. Public Debt I. Government expenditures equal to tax revenues. expenditure. Example: $100Bn Deficit. j. A personal income tax structure whereby the percentage of tax paid moves down with the 10. Fiscal Policy J. The part of the budget deficit that would exist even if the economy were operating at full employment. rise in the level of income. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts