Materials used by Square Yard Products Inc. in producing Division 3's product are currently purchased from...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

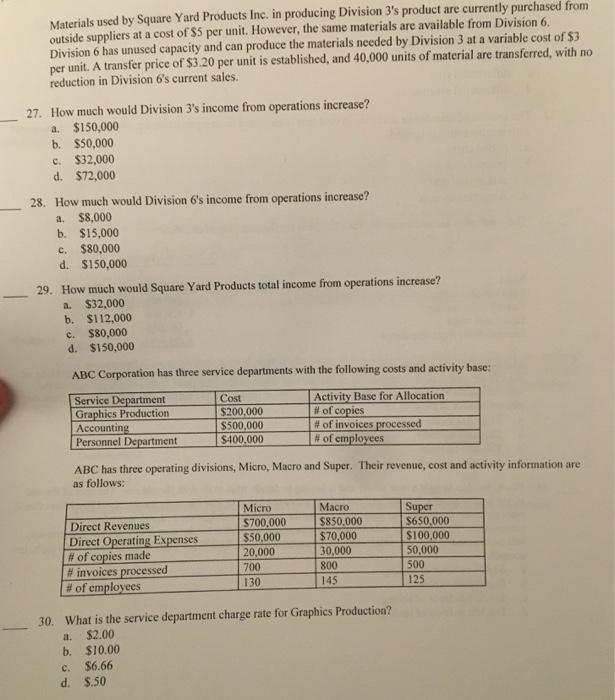

Materials used by Square Yard Products Inc. in producing Division 3's product are currently purchased from outside suppliers at a cost of $5 per unit. However, the same materials are available from Division 6. Division 6 has unused capacity and can produce the materials needed by Division 3 at a variable cost of $3 per unit. A transfer price of $3.20 per unit is established, and 40,000 units of material are transferred, with no reduction in Division 6's current sales. 27. How much would Division 3's income from operations increase? a. $150,000 b. $50,000 c. $32,000 d. $72,000 28. How much would Division 6's income from operations increase? $8,000 b. $15,000 a. c. $80,000 d. $150,000 29. How much would Square Yard Products total income from operations increase? $32,000 b. $112,000 a. c. $80,000 d. $150,000 ABC Corporation has three service departments with the following costs and activity base: Service Department Graphics Production Accounting Personnel Department Activity Base for Allocation of copies # of invoices processed # of employees Cost $200,000 $500,000 $400,000 ABC has three operating divisions, Micro, Macro and Super. Their revenue, cost and activity information are as follows: Micro Масго Direct Revenues Direct Operating Expenses # of copies made # invoices processed #of employees Super $650,000 S100.000 50,000 500 S700,000 $50,000 20,000 $850,000 $70,000 30,000 700 800 130 145 125 30. What is the service department charge rate for Graphics Production? $2.00 b. $10.00 c. $6.66 d. $.50 a. Materials used by Square Yard Products Inc. in producing Division 3's product are currently purchased from outside suppliers at a cost of $5 per unit. However, the same materials are available from Division 6. Division 6 has unused capacity and can produce the materials needed by Division 3 at a variable cost of $3 per unit. A transfer price of $3.20 per unit is established, and 40,000 units of material are transferred, with no reduction in Division 6's current sales. 27. How much would Division 3's income from operations increase? a. $150,000 b. $50,000 c. $32,000 d. $72,000 28. How much would Division 6's income from operations increase? $8,000 b. $15,000 a. c. $80,000 d. $150,000 29. How much would Square Yard Products total income from operations increase? $32,000 b. $112,000 a. c. $80,000 d. $150,000 ABC Corporation has three service departments with the following costs and activity base: Service Department Graphics Production Accounting Personnel Department Activity Base for Allocation of copies # of invoices processed # of employees Cost $200,000 $500,000 $400,000 ABC has three operating divisions, Micro, Macro and Super. Their revenue, cost and activity information are as follows: Micro Масго Direct Revenues Direct Operating Expenses # of copies made # invoices processed #of employees Super $650,000 S100.000 50,000 500 S700,000 $50,000 20,000 $850,000 $70,000 30,000 700 800 130 145 125 30. What is the service department charge rate for Graphics Production? $2.00 b. $10.00 c. $6.66 d. $.50 a.

Expert Answer:

Answer rating: 100% (QA)

Total Cost to be paid to the outside supplier 40000 units x 5 per unit 200000 Transfer Price t... View the full answer

Related Book For

Accounting

ISBN: 978-0324662962

23rd Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

Posted Date:

Students also viewed these accounting questions

-

Cardo, a GSIS employee, died in a car accident. His heirs collected the following procedure of life insurance policies: AXA Life, revocable, designated to his wife Alyana - 500,000 Sunlife,...

-

A robot has just been installed at a cost of $81,000. It will have no salvage value at the end of its useful life. Given the following estimates and probabilities for the yearly savings and useful...

-

Gregory Company purchased equipment on August 1, Year 1, at a cost of $117,900. The asset is expected to have a service life of 5 years, and its working hours estimated at 21,000 hours and a salvage...

-

If the demand during review cycle is equal to 12, the demand during lead time is 11, and the safety stock is equal to 8, what is the order point? What is the EOQ of an item with a project annual...

-

A small electrical motor produces 5 W of mechanical power. What is this power in (a) N, m, and s units; and (b) kg, m, and s units?

-

Let be two globally Lipschitz continuous functions. If \(f\) is bounded, then \(h(x):=f(x) g(x)\) is locally Lipschitz continuous and at most linearly growing. fg: R-R

-

Reconsider Parts (a) through (f) of Problem 2. For each "true" statement, develop a mathematical proof based on the time value of money factor equations from Table 2.6 in Chapter 2. Data from problem...

-

I think we goofed when we hired that new assistant controller,? said Ruth Scarpino, president of Provost Industries. ?Just look at this report that he prepared for last month for the Finishing...

-

b. A fence company is measuring a rectangular area in order to install a fence around its perimeter. If the length of the rectangular area is 130 yards and the width is 75 feet, what is the total...

-

Their 1.5 inch, 90-degree copper elbow (see below) is a very popular item in the plumbing line that comes packaged in 10 elbows per box. The box costs about $65 to Western, and Western sells it at...

-

Your city has decided to address the issue of biased-based policing proactively. With your current assignment in the planning division, your chief has asked you to develop an instru- ment for...

-

Programming and Interface Design (a) Defifine brieflfly, for every one of the accompanying procedures, what its motivation is and how it is led. (I) Regression testing (ii) A/B testing (iii) Unit...

-

Given the equations 2x + y = 1 and y = x + 7. Find the value of x - y.

-

Brantley recently purchased a new video game system on his credit card. Assuming the nominal annual percentage rate (APR) is 14.95% (compounded daily), calculate the effective annual rate (EAR)?

-

At the end of the month, a company is replenishing the petty cash fund with a cheque for $87. Cash receipts for the fund total $87, which all relates to postage purchased. What is the impact of the...

-

A new mill costs $5000 and has an annual maintenance fee of $200. salvage value after 5 years is $1000. if the interest rate is 8% the present worth is nearly?

-

Describe workplace scenarios where different types of listening went wrong and hence affected strategic management negatively.

-

In the current year, the City of Omaha donates land worth $500,000 to Ace Corporation to induce it to locate in Omaha and create an estimated 2,000 jobs for its citizens. a. How much income, if any,...

-

Determine the amount to be paid in full settlement of each of invoices (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid...

-

Carnival Corporation has recently placed into service some of the largest cruise ships in the world. One of these ships, the Carnival Dream, can hold up to 3,600 passengers and cost $750 million to...

-

The prepaid insurance account had a balance of $5,400 at the beginning of the year. The account was debited for $6,000 for premiums on policies purchased during the year. Journalize the adjusting...

-

What is the half-life of uranium-238?

-

Who discovered that energy and mass are two different forms of the same thing?

-

Is it possible for a hydrogen nucleus to emit an alpha particle? Why? (a) yes, because alpha particles are the simplest form of radiation (b) no, because it would require the nuclear fission of...

Study smarter with the SolutionInn App