Question: Math& 107 Hybrid Paklow Names: This activity explofes three different savings options. You may work alone or with a partner. If vou work with a

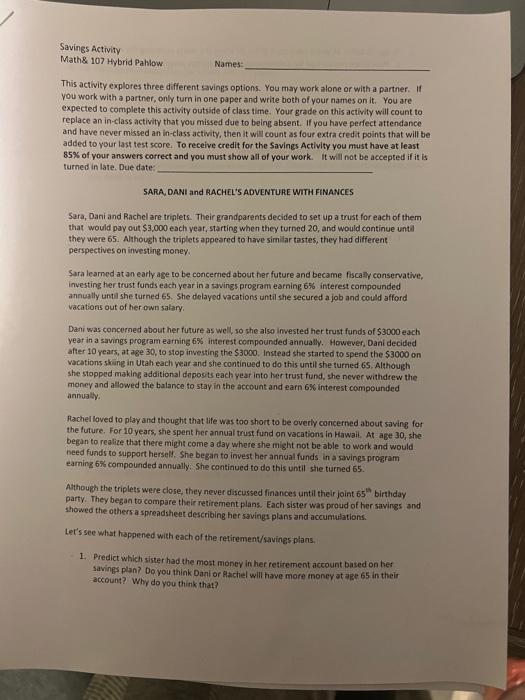

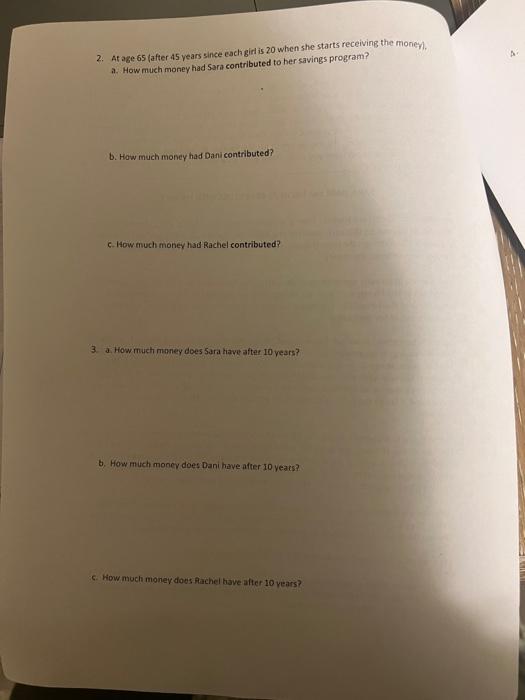

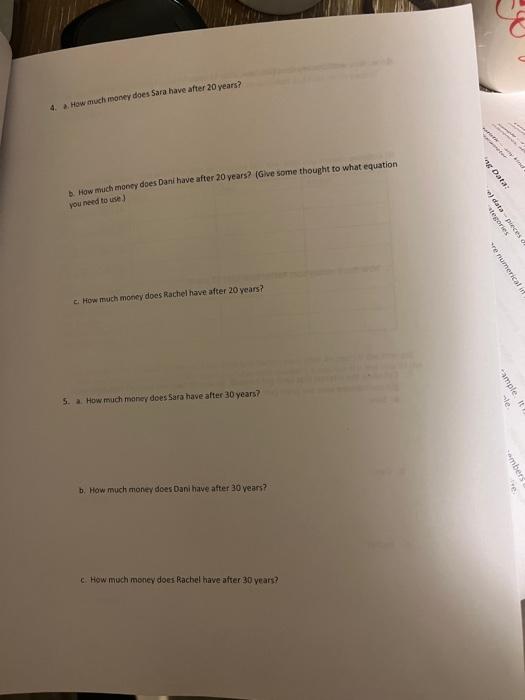

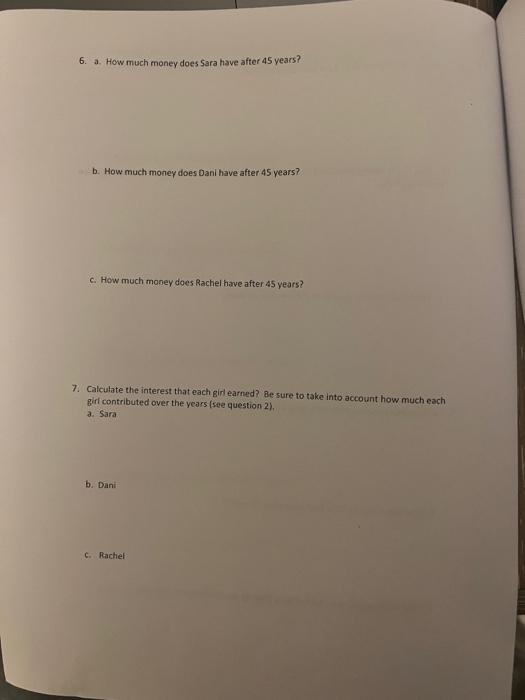

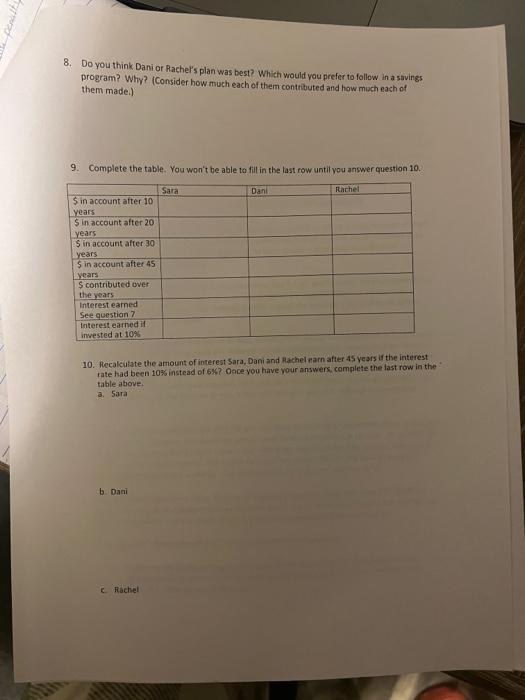

Math\& 107 Hybrid Paklow Names: This activity explofes three different savings options. You may work alone or with a partner. If vou work with a partner, only turn in one paper and write both of your names on it. You are expected to complete this activity outside of class time. Your grade on this activity will count to replace an in-class activity that you missed due to being absent. If you have perfect attendance and have never missed an in-class activity, then it will count as four extra credit polints that will be added to your last test score. To receive credit for the Savings Activity you must have at least 85% of your answers correct and you must show all of your work. It will not be accepted if it is turned in late. Due date SARA, DANI and RACHEL'S ADVENTURE WITH FINANCES Sara, Dani and Rachel are triglets. Their grandparents decided to set up a trust for each of them that would pay out $3,000 each yeat, starting when they turned 20 , and would cantinue unta they were 65. Alhough the triplets appeared to have simllar tastes, they had different perspectives on investing money. Sara leamed at an early age to be concerned about her future and became fiscally conservative, inwesting her trust funds each year in a savings program earning 6% interest compounded annually until she turned 65 . She delayed vacations until she secured a job and could afford vacations out of her own salary. Dani was concerned about her future as well so she also invested her trust funds of $3000 each year in a savings program earning 6% interest compounded annually. However, Dani decided after 10 years, at age 30 , to stop investing the $3000. Instead she started to spend the $3000 on vacations shing in Utah each wear and she continued to do this until she furned 65 . Although she stopped making additional doposits each year into her trust fund, she ncver withdrew the moncy and allowed the balance to stay in the account and earn 6% interest compounded Aachel loved to play and thought that life was too short to be overly concerned about saving for the future. For 10 years, she spent her annual trust fund on vacations in Hawail. At age 30, she. began to realize that there might come a day where she might not be able to work and would need funds to support herself. She began to invest her annual funds in a savings program eaming 6% compounded annually. She contiaued to do this until she turned 65 . Athough the triplets were close, they never discussed finances until their joint 65sh birthday, party. They began to compare their retirement plans. Each sister was proud of her savings and showed the others a spreadsheet descriaing her savings plans and accumulations. Let's see what happened with each of the retirement/savings plans, 1. Predict which sister had the most money in her retirement account based on her savings plan? Do you think Dani or Pachel will have more money at age 65 in their -account? Why do you think that? 2. At age 65 (after 45 years since each girt is 20 when she starts receiving the money, a. How much money had Sara contributed to her savings program? b. How much money had Dani contributed? c. How much money had Rachel contributed? 3. a. How much money does 5ara have after 10 years? b. How much monev does Dani have after 10 years? 6. How moch monev dous pachel have after 10 years? 4. 2. How much moner does 5 safa have after 20 years? b. How much mooer does Dani have after 20 years? (Gwe some thought to what equation younerd to use) c. How much moner does Rachel have after 20 years? 5. a. How mach maner does Sara have after 30 years? b. How much money does Dani have after 30 vears? 6. How moch money does Rachet have atter 30 vears? 6. a. How much money does Sara have after 45 years? b. How much money does Dani have after 45 years? c. How much money does Rachel have after 45 years? 7. Calculate the interest that each ginl earned? Be sure to take into account how much each girl contributed over the years (see question 2), a. Sara b. Dani C. Pachel 8. Do you think Dani or Rachel's plan was best? Which would you prefer to follow in a savings program? Why? (Consider how much each of them contrituted and how moch each of them made.) 9. Complete the table. You won't be able to fill in the last row until vou answer question 10. 10. Recalculate the amount of interest Sara, Dani and Hachel narn after 45 years if the interest rate had been 10% instead of 6% ? Ooce you have vour answers. complete the tast row in the table above. 3. 5ara b. Daai 11. What did you learn about investing from doing this exercise? Math\& 107 Hybrid Paklow Names: This activity explofes three different savings options. You may work alone or with a partner. If vou work with a partner, only turn in one paper and write both of your names on it. You are expected to complete this activity outside of class time. Your grade on this activity will count to replace an in-class activity that you missed due to being absent. If you have perfect attendance and have never missed an in-class activity, then it will count as four extra credit polints that will be added to your last test score. To receive credit for the Savings Activity you must have at least 85% of your answers correct and you must show all of your work. It will not be accepted if it is turned in late. Due date SARA, DANI and RACHEL'S ADVENTURE WITH FINANCES Sara, Dani and Rachel are triglets. Their grandparents decided to set up a trust for each of them that would pay out $3,000 each yeat, starting when they turned 20 , and would cantinue unta they were 65. Alhough the triplets appeared to have simllar tastes, they had different perspectives on investing money. Sara leamed at an early age to be concerned about her future and became fiscally conservative, inwesting her trust funds each year in a savings program earning 6% interest compounded annually until she turned 65 . She delayed vacations until she secured a job and could afford vacations out of her own salary. Dani was concerned about her future as well so she also invested her trust funds of $3000 each year in a savings program earning 6% interest compounded annually. However, Dani decided after 10 years, at age 30 , to stop investing the $3000. Instead she started to spend the $3000 on vacations shing in Utah each wear and she continued to do this until she furned 65 . Although she stopped making additional doposits each year into her trust fund, she ncver withdrew the moncy and allowed the balance to stay in the account and earn 6% interest compounded Aachel loved to play and thought that life was too short to be overly concerned about saving for the future. For 10 years, she spent her annual trust fund on vacations in Hawail. At age 30, she. began to realize that there might come a day where she might not be able to work and would need funds to support herself. She began to invest her annual funds in a savings program eaming 6% compounded annually. She contiaued to do this until she turned 65 . Athough the triplets were close, they never discussed finances until their joint 65sh birthday, party. They began to compare their retirement plans. Each sister was proud of her savings and showed the others a spreadsheet descriaing her savings plans and accumulations. Let's see what happened with each of the retirement/savings plans, 1. Predict which sister had the most money in her retirement account based on her savings plan? Do you think Dani or Pachel will have more money at age 65 in their -account? Why do you think that? 2. At age 65 (after 45 years since each girt is 20 when she starts receiving the money, a. How much money had Sara contributed to her savings program? b. How much money had Dani contributed? c. How much money had Rachel contributed? 3. a. How much money does 5ara have after 10 years? b. How much monev does Dani have after 10 years? 6. How moch monev dous pachel have after 10 years? 4. 2. How much moner does 5 safa have after 20 years? b. How much mooer does Dani have after 20 years? (Gwe some thought to what equation younerd to use) c. How much moner does Rachel have after 20 years? 5. a. How mach maner does Sara have after 30 years? b. How much money does Dani have after 30 vears? 6. How moch money does Rachet have atter 30 vears? 6. a. How much money does Sara have after 45 years? b. How much money does Dani have after 45 years? c. How much money does Rachel have after 45 years? 7. Calculate the interest that each ginl earned? Be sure to take into account how much each girl contributed over the years (see question 2), a. Sara b. Dani C. Pachel 8. Do you think Dani or Rachel's plan was best? Which would you prefer to follow in a savings program? Why? (Consider how much each of them contrituted and how moch each of them made.) 9. Complete the table. You won't be able to fill in the last row until vou answer question 10. 10. Recalculate the amount of interest Sara, Dani and Hachel narn after 45 years if the interest rate had been 10% instead of 6% ? Ooce you have vour answers. complete the tast row in the table above. 3. 5ara b. Daai 11. What did you learn about investing from doing this exercise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts