Question: (math finance) 7. The following numbers were randomly generated from a standard normal distribution: 0.5 0.75 1.1 i). Given interest rate r=0.01 and volatility parameter

(math finance)

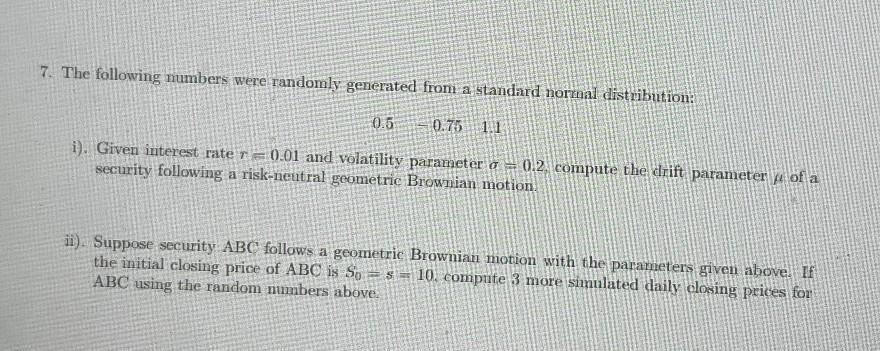

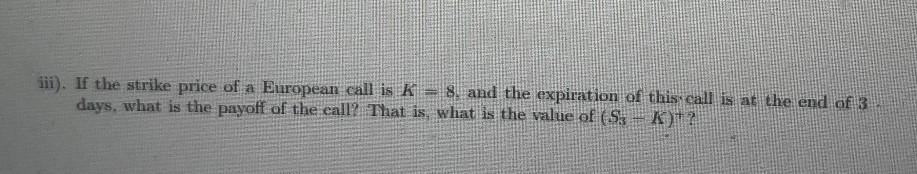

7. The following numbers were randomly generated from a standard normal distribution: 0.5 0.75 1.1 i). Given interest rate r=0.01 and volatility parameter o = 0.2. compute the drift parameter y of a security following a risk-neutral geometric Brownian motion, ii). Suppose security ABC follows a geometric Brownian motion with the parameters given above. If the initial closing price of ABC is so = 3 = 10. compute 3 more simulated daily closing prices for ABC using the random numbers above. iii). If the strike price of a European call is k = 8. and the expiration of this call is at the end of 3 days, what is the payoff of the call? That is what is the value of ($ 312

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts