Question: Math finance please show all work DO NOT USE EXCEL A bond with a face value of $6,000 and an annual coupon rate of 12%

Math finance please show all work DO NOT USE EXCEL

Math finance please show all work DO NOT USE EXCEL

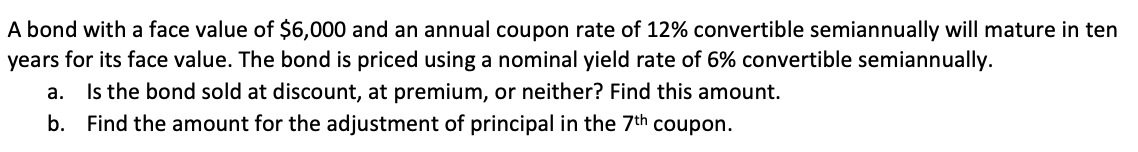

A bond with a face value of $6,000 and an annual coupon rate of 12% convertible semiannually will mature in ten years for its face value. The bond is priced using a nominal yield rate of 6% convertible semiannually. a. Is the bond sold at discount, at premium, or neither? Find this amount. b. Find the amount for the adjustment of principal in the 7th coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts