Question: Math Questions: Question 1 2 ( 1 0 pts ) . If you note the following yield curve in The Wall Street Journal, what are

Math Questions:

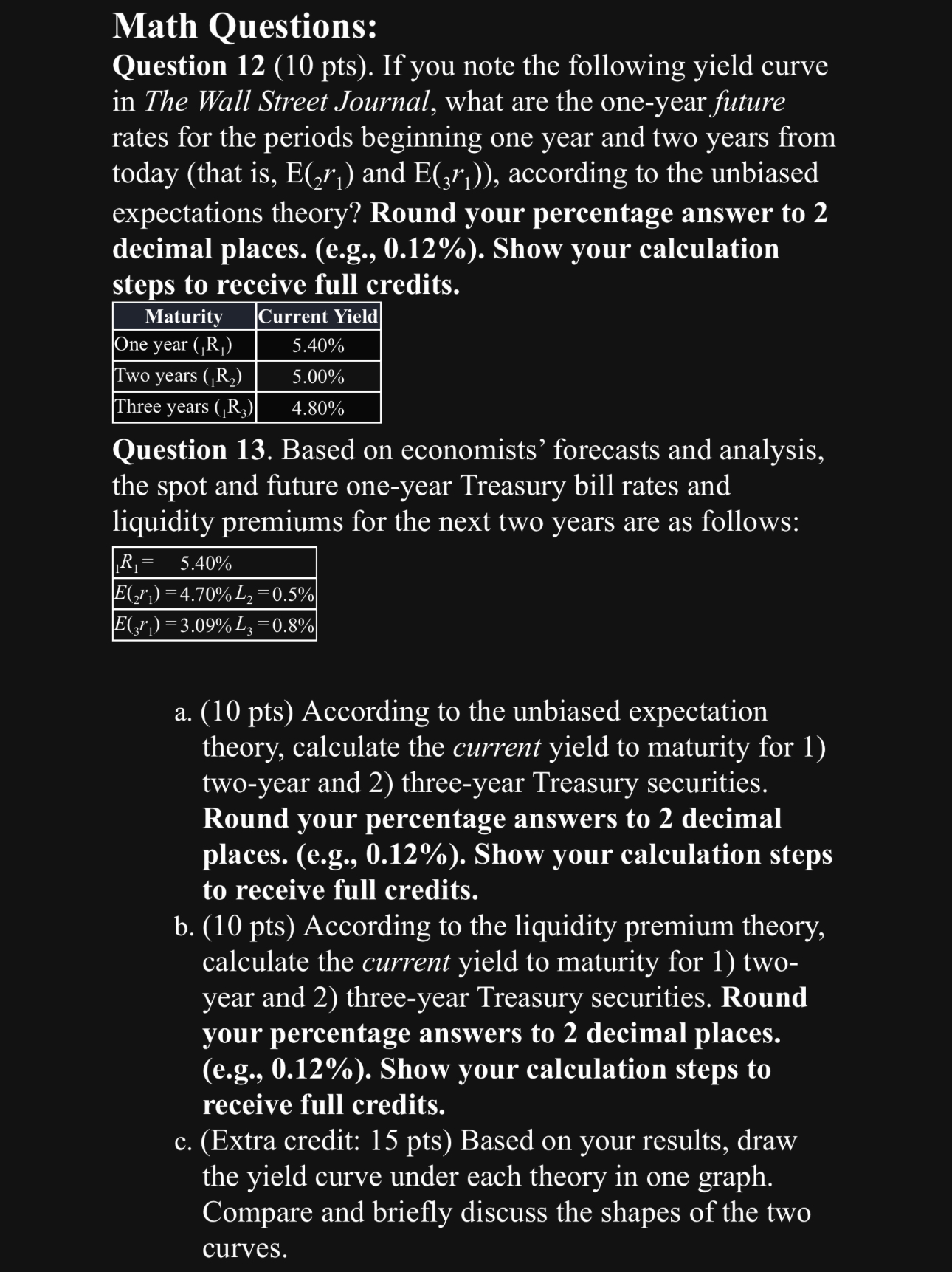

Question pts If you note the following yield curve

in The Wall Street Journal, what are the oneyear future

rates for the periods beginning one year and two years from

today that is and according to the unbiased

expectations theory? Round your percentage answer to

decimal places. eg Show your calculation

steps to receive full credits.

Question Based on economists' forecasts and analysis,

the spot and future oneyear Treasury bill rates and

liquidity premiums for the next two years are as follows:

R

Er

E r

a pts According to the unbiased expectation

theory, calculate the current yield to maturity for

twoyear and threeyear Treasury securities

Round your percentage answers to decimal

places. eg Show your calculation steps

to receive full credits.

b pts According to the liquidity premium theory,

calculate the current yield to maturity for two

year and threeyear Treasury securities Round

your percentage answers to decimal places.

eg Show your calculation steps to

receive full credits.

cExtra credit: pts Based on your results, draw

the yield curve under each theory in one graph.

Compare and briefly discuss the shapes of the two

curves.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock