Question: Math120 Consumer Math project. (50pts) Instruction: You must show all work to get full credits. Do not round any values until the end of a

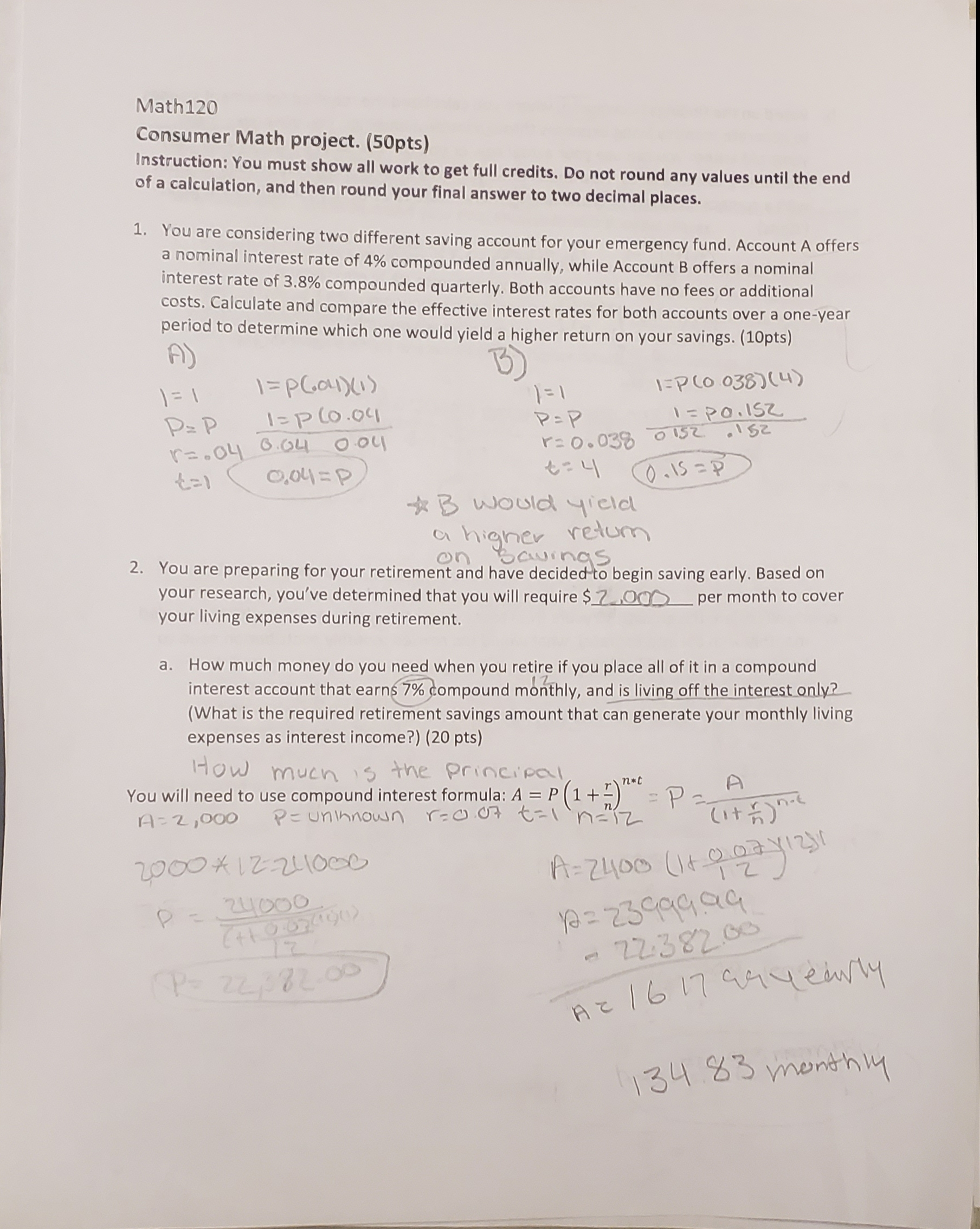

Math120 Consumer Math project. (50pts) Instruction: You must show all work to get full credits. Do not round any values until the end of a calculation, and then round your final answer to two decimal places. 1. You are considering two different saving account for your emergency fund. Account A offers a nominal interest rate of 4% compounded annually, while Account B offers a nominal interest rate of 3.8% compounded quarterly. Both accounts have no fees or additional costs. Calculate and compare the effective interest rates for both accounts over a one-year period to determine which one would yield a higher return on your savings. (10pts) A) B 1 = 1 1 = PGOLD ( I) 1=1 1=P (0 038) (4 ) P = P 1= P 60 . 04 P = P 1 = P0. 152 1=. 04 0.64 0.04 1= 0.038 0152 . 152 0. 04 = P 8 = 4 CO. IS = P * B would yield a higher return on savings 2. You are preparing for your retirement and have decided to begin saving early. Based on your research, you've determined that you will require $ 7_On _per month to cover your living expenses during retirement. a. How much money do you need when you retire if you place all of it in a compound interest account that earns 7% compound monthly, and is living off the interest only? (What is the required retirement savings amount that can generate your monthly living expenses as interest income?) (20 pts) How much is the principal You will need to use compound interest formula: A = P (1+ !)"* = P = A A = 2,000 P= unknown r=0. 07 n=iz (itt ) not 2000 * 12:241006 A = 2400 ( 1 + 0 07 7 12)1 12 P = 24000 (+10 07( 19 (1) 1 = 239 9 9 9q - 22:382.60 P- 22:82.00 A= 16 17 9 9 yearly 134. 83 monthly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts