Question: MATHEMATICS GRADE 1 0 2 SEPTEMBER 2 0 2 4 QUESTION 1 1 . 1 . Seven years ago, Mrs Hlongwane decided to invest R

MATHEMATICS

GRADE

SEPTEMBER

QUESTION

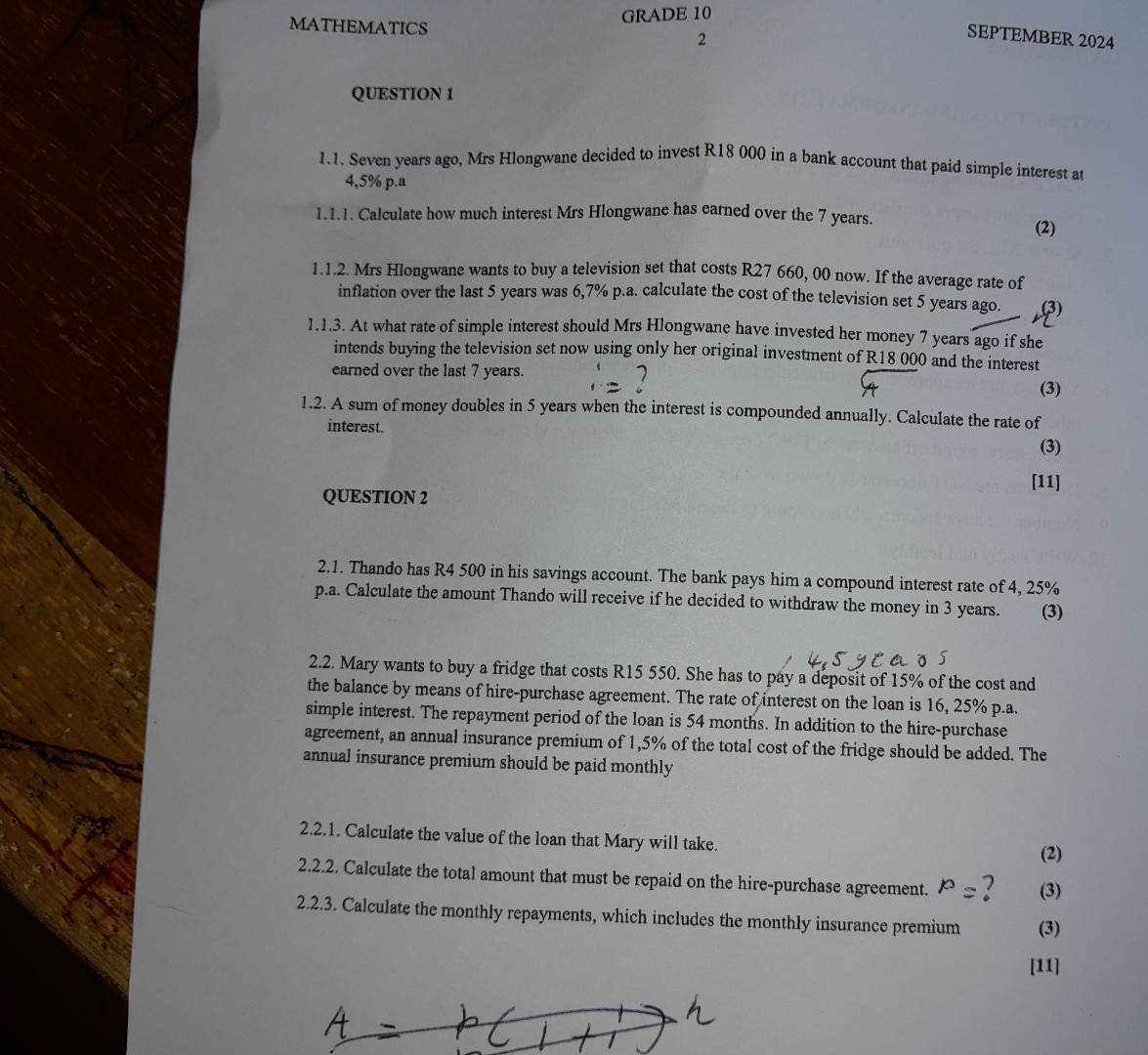

Seven years ago, Mrs Hlongwane decided to invest R in a bank account that paid simple interest at pa

Calculate how much interest Mrs Hlongwane has earned over the years.

Mrs Hlongwane wants to buy a television set that costs R now. If the average rate of inflation over the last years was pa calculate the cost of the television set years ago.

At what rate of simple interest should Mrs Hlongwane have invested her money years ago if she intends buying the television set now using only her original investment of R and the interest earned over the last years.

A sum of money doubles in years when the interest is compounded annually. Calculate the rate of interest.

QUESTION

Thando has R in his savings account. The bank pays him a compound interest rate of

pa Calculate the amount Thando will receive if he decided to withdraw the money in years. the balance by means of hirepurchase agreement. The rate of interest on the loan is pa simple interest. The repayment period of the loan is months. In addition to the hirepurchase agreement, an annual insurance premium of of the total cost of the fridge should be added. The annual insurance premium should be paid monthly

Calculate the value of the loan that Mary will take.

Calculate the total amount that must be repaid on the hirepurchase agreement.

Calculate the monthly repayments, which includes the monthly insurance premium

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock