Question: Matrix.com has designed a virtual -reality program that is indistinguishable from real life to those experiencing it. Matrix .com's weighted average cost of capital is

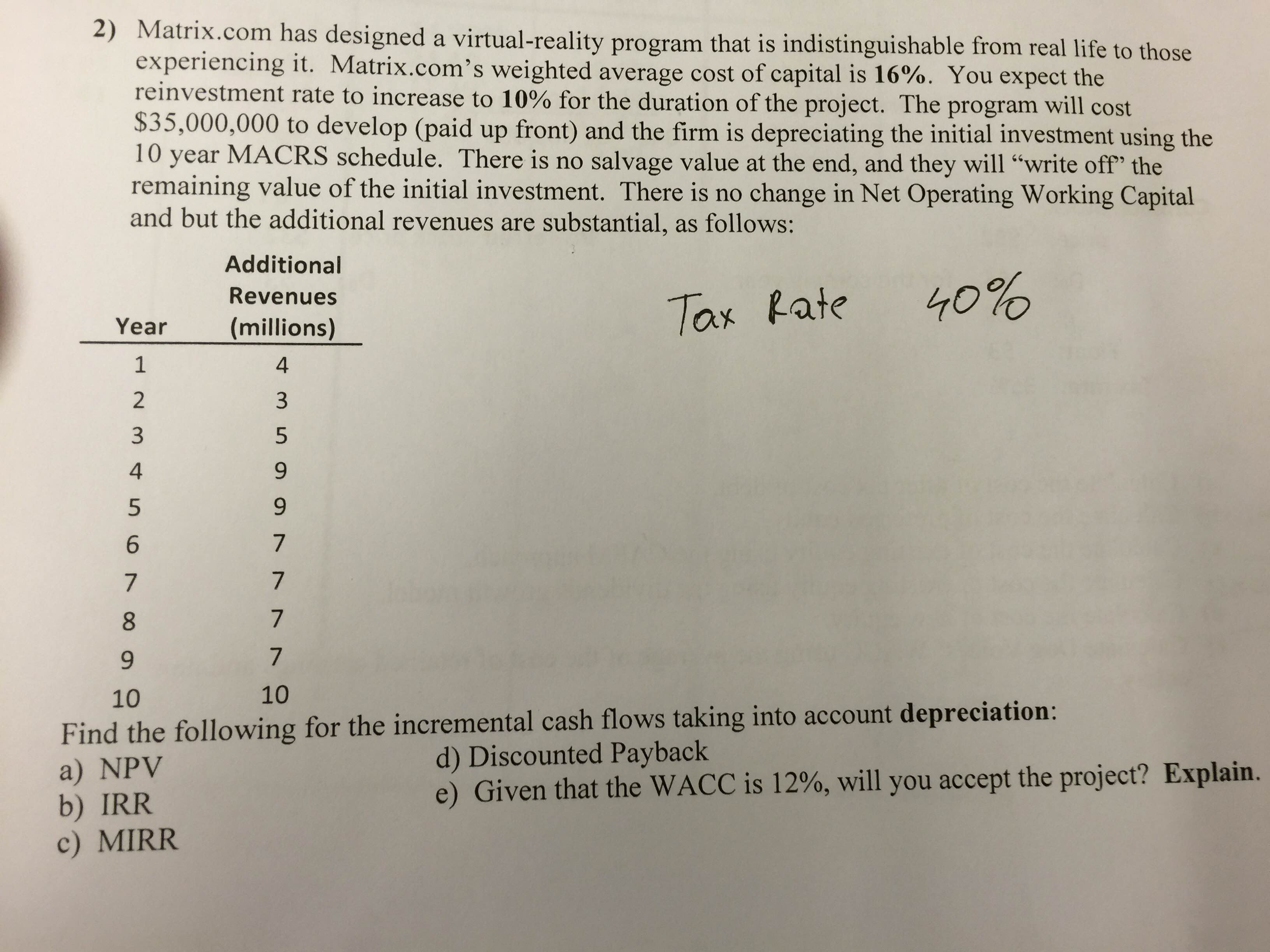

Matrix.com has designed a virtual -reality program that is indistinguishable from real life to those experiencing it. Matrix .com's weighted average cost of capital is 16%. You expect the reinvestment rate to increase to 10% for the duration of the project. The program will cost $35,000,000 to develop (paid up front) and the firm is depreciating the initial investment using the 10 year MACRS schedule. There is no salvage value at the end, and they will "write off' the remaining value of the initial investment. There is no change in Net Operating Working Capital and but the additional revenues are substantial, as follows: Additional Revenues Find the following for the incremental eash flows taking into account depreciation: NPV IRR MIRR Matrix.com has designed a virtual -reality program that is indistinguishable from real life to those experiencing it. Matrix .com's weighted average cost of capital is 16%. You expect the reinvestment rate to increase to 10% for the duration of the project. The program will cost $35,000,000 to develop (paid up front) and the firm is depreciating the initial investment using the 10 year MACRS schedule. There is no salvage value at the end, and they will "write off' the remaining value of the initial investment. There is no change in Net Operating Working Capital and but the additional revenues are substantial, as follows: Additional Revenues Find the following for the incremental eash flows taking into account depreciation: NPV IRR MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts