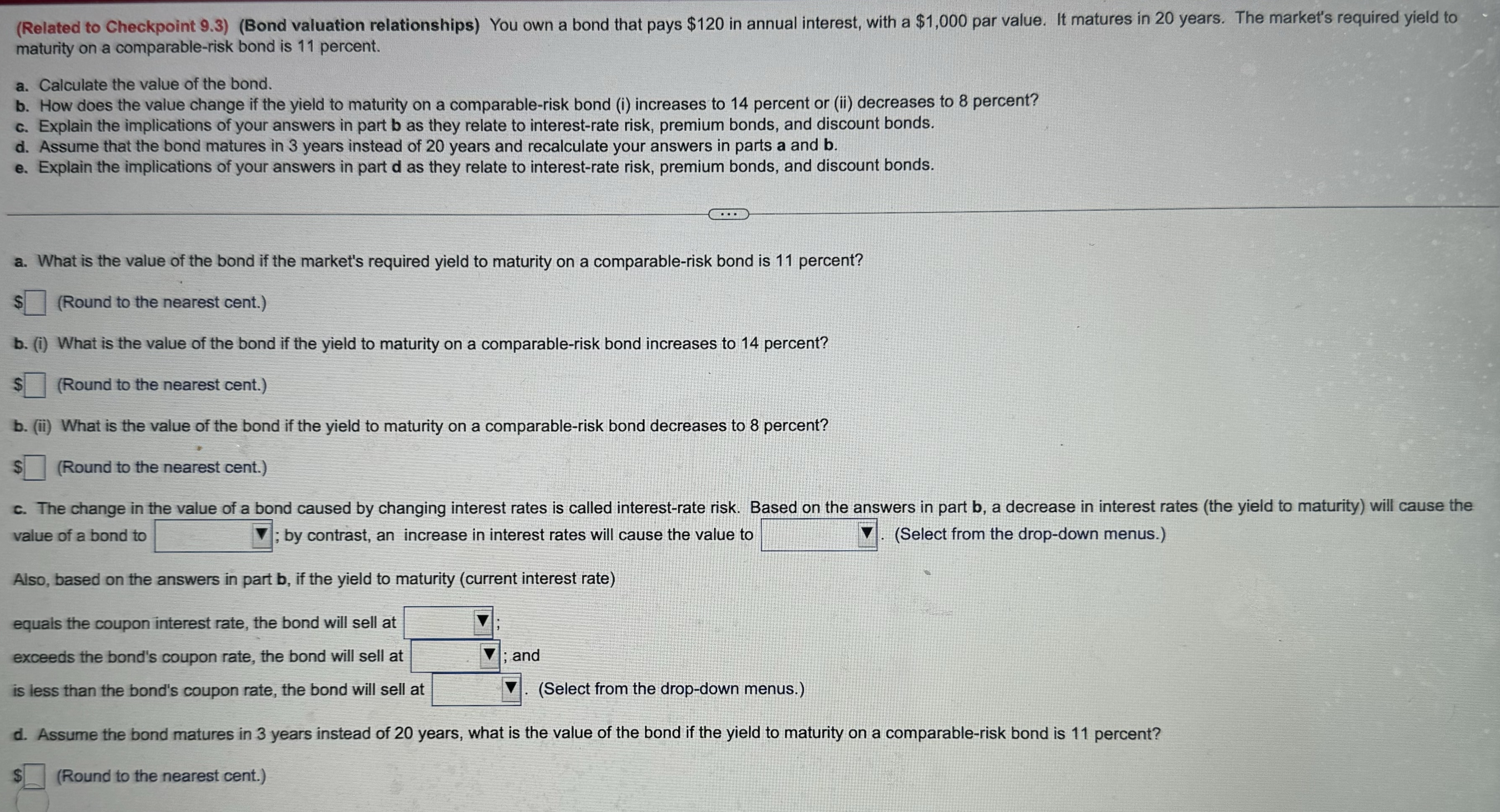

Question: maturity on a comparable - risk bond is 1 1 percent. a . Calculate the value of the bond. b . How does the value

maturity on a comparablerisk bond is percent.

a Calculate the value of the bond.

b How does the value change if the yield to maturity on a comparablerisk bond i increases to percent or ii decreases to percent?

c Explain the implications of your answers in part as they relate to interestrate risk, premium bonds, and discount bonds.

d Assume that the bond matures in years instead of years and recalculate your answers in parts a and

e Explain the implications of your answers in part as they relate to interestrate risk, premium bonds, and discount bonds.

a What is the value of the bond if the market's required yield to maturity on a comparablerisk bond is percent?

Round to the nearest cent.

bi What is the value of the bond if the yield to maturity on a comparablerisk bond increases to percent?

Round to the nearest cent.

bii What is the value of the bond if the yield to maturity on a comparablerisk bond decreases to percent?

Round to the nearest cent. value of a bond to by contrast, an increase in interest rates will cause the value tc Select from the dropdown menus.

Also, based on the answers in part b if the yield to maturity current interest rate

equals the coupon interest rate, the bond will sell at

exceeds the bond's coupon rate, the bond will sell at and is less than the bond's coupon rate, the bond will sell at Select from the dropdown menus.

d Assume the bond matures in years instead of years, what is the value of the bond if the yield to maturity on a comparablerisk bond is percent?

Round to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock