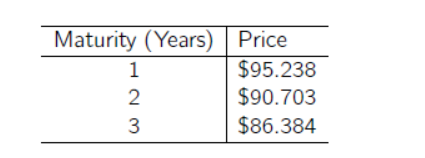

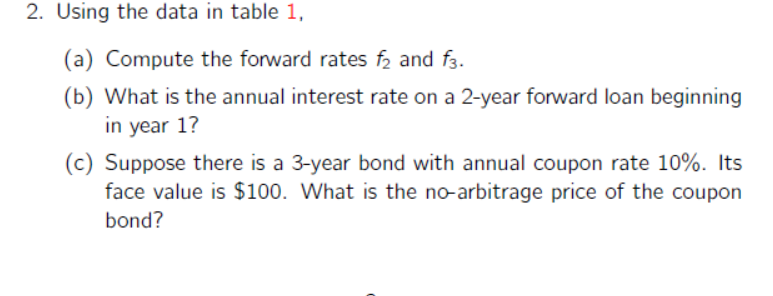

Question: Maturity (Years) Price $95.238 $90.703 $86.384 2. Using the data in table 1, (a) Compute the forward rates f2 and f3. (b) What is the

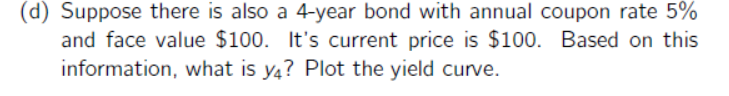

Maturity (Years) Price $95.238 $90.703 $86.384 2. Using the data in table 1, (a) Compute the forward rates f2 and f3. (b) What is the annual interest rate on a 2-year forward loan beginning in year 1? (C) Suppose there is a 3-year bond with annual coupon rate 10%. Its face value is $100. What is the no-arbitrage price of the coupon bond? d) Suppose there is also a 4-year bond with annual coupon rate 5% and face value $100. It's current price is $100. Based on this information, what is y4? Plot the yield curve

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock