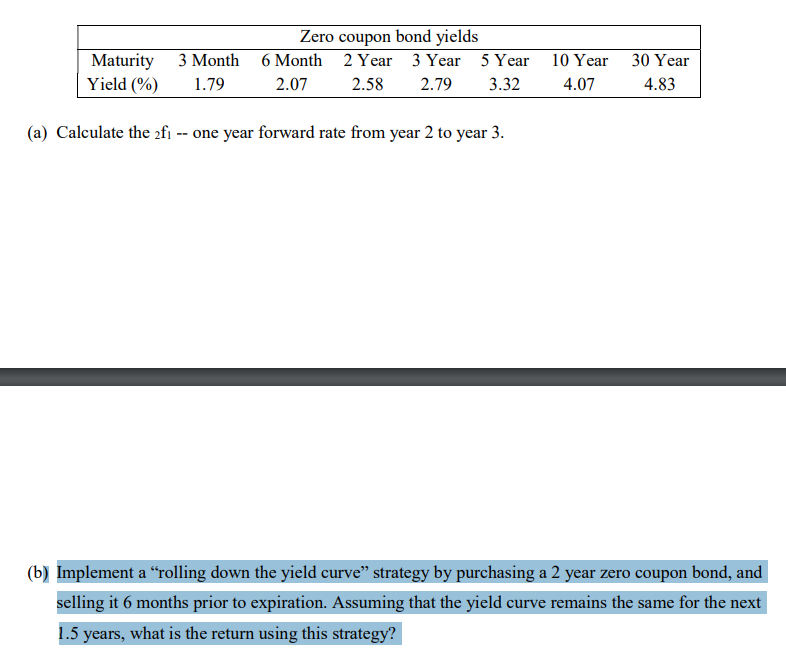

Question: Maturity Yield (%) 3 Month 1.79 Zero coupon bond yields 6 Month 2 Year 3 Year 5 Year 2 .07 2.58 2.79 3.32 10 Year

Maturity Yield (%) 3 Month 1.79 Zero coupon bond yields 6 Month 2 Year 3 Year 5 Year 2 .07 2.58 2.79 3.32 10 Year 4.07 30 Year 4.83 (a) Calculate the efi -- one year forward rate from year 2 to year 3. (b) Implement a rolling down the yield curve strategy by purchasing a 2 year zero coupon bond, and selling it 6 months prior to expiration. Assuming that the yield curve remains the same for the next 1.5 years, what is the return using this strategy? Maturity Yield (%) 3 Month 1.79 Zero coupon bond yields 6 Month 2 Year 3 Year 5 Year 2 .07 2.58 2.79 3.32 10 Year 4.07 30 Year 4.83 (a) Calculate the efi -- one year forward rate from year 2 to year 3. (b) Implement a rolling down the yield curve strategy by purchasing a 2 year zero coupon bond, and selling it 6 months prior to expiration. Assuming that the yield curve remains the same for the next 1.5 years, what is the return using this strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts