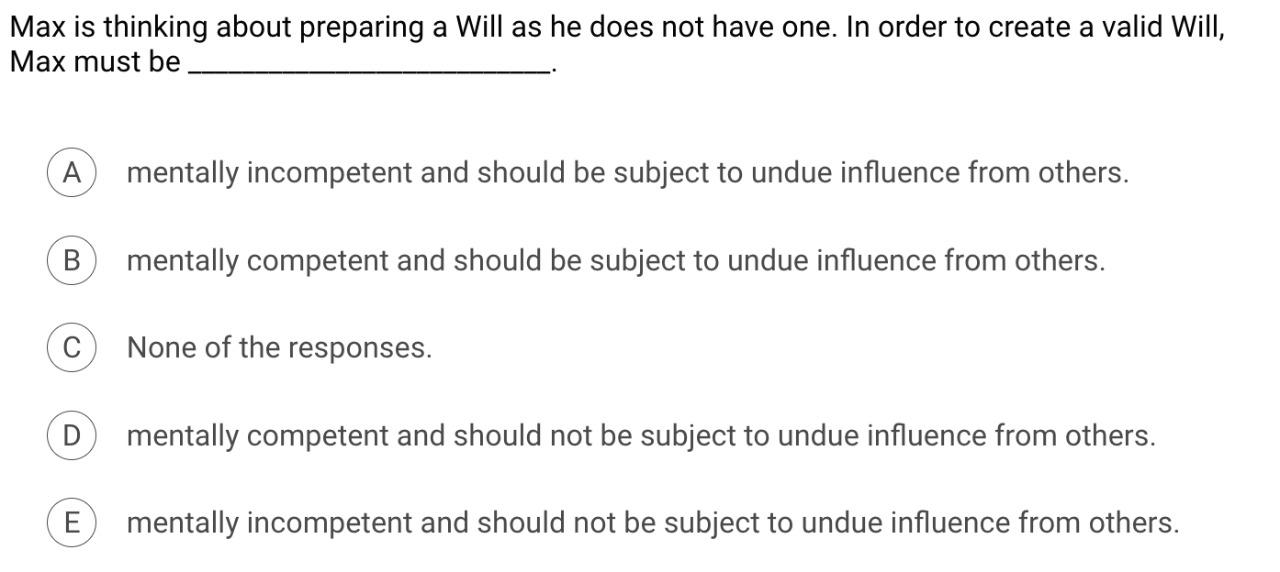

Question: Max is thinking about preparing a Will as he does not have one. In order to create a valid Will, Max must be A mentally

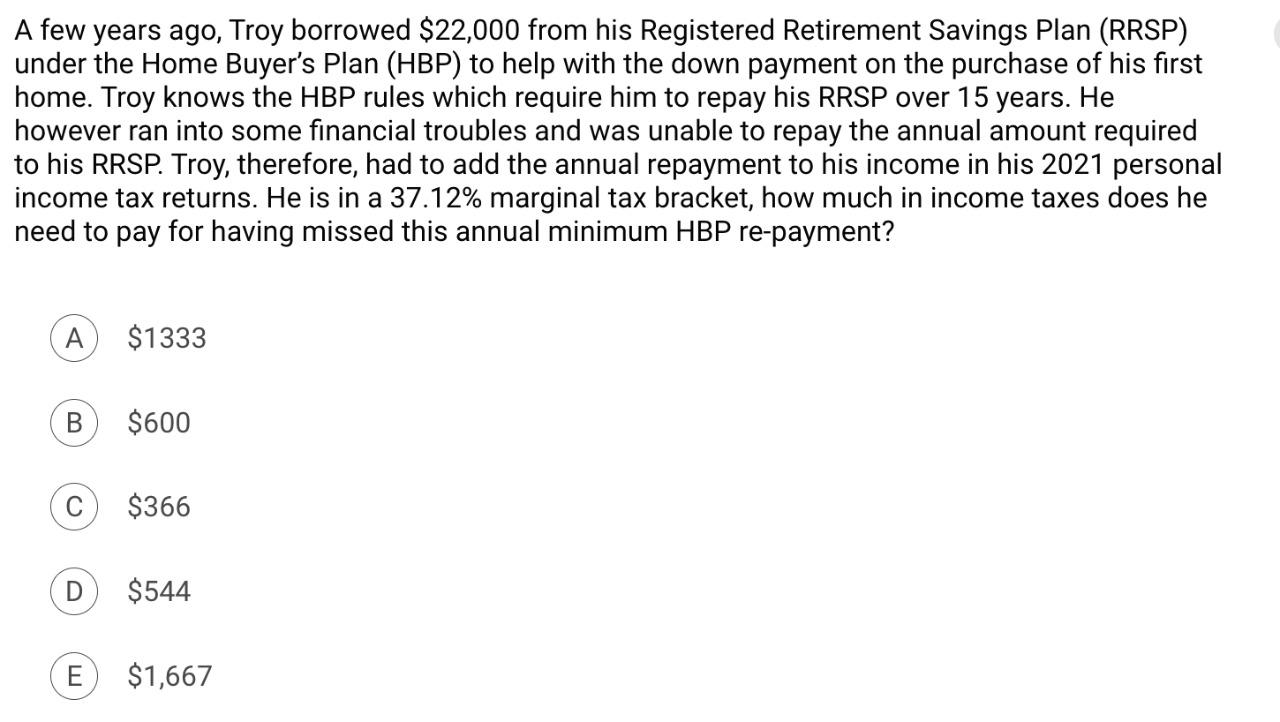

Max is thinking about preparing a Will as he does not have one. In order to create a valid Will, Max must be A mentally incompetent and should be subject to undue influence from others. B mentally competent and should be subject to undue influence from others. None of the responses. D mentally competent and should not be subject to undue influence from others. E mentally incompetent and should not be subject to undue influence from others. A few years ago, Troy borrowed $22,000 from his Registered Retirement Savings Plan (RRSP) under the Home Buyer's Plan (HBP) to help with the down payment on the purchase of his first home. Troy knows the HBP rules which require him to repay his RRSP over 15 years. He however ran into some financial troubles and was unable to repay the annual amount required to his RRSP. Troy, therefore, had to add the annual repayment to his income in his 2021 personal income tax returns. He is in a 37.12% marginal tax bracket, how much in income taxes does he need to pay for having missed this annual minimum HBP re-payment? A $1333 B $600 C $366 D $544 E $1,667 Max is thinking about preparing a Will as he does not have one. In order to create a valid Will, Max must be A mentally incompetent and should be subject to undue influence from others. B mentally competent and should be subject to undue influence from others. None of the responses. D mentally competent and should not be subject to undue influence from others. E mentally incompetent and should not be subject to undue influence from others. A few years ago, Troy borrowed $22,000 from his Registered Retirement Savings Plan (RRSP) under the Home Buyer's Plan (HBP) to help with the down payment on the purchase of his first home. Troy knows the HBP rules which require him to repay his RRSP over 15 years. He however ran into some financial troubles and was unable to repay the annual amount required to his RRSP. Troy, therefore, had to add the annual repayment to his income in his 2021 personal income tax returns. He is in a 37.12% marginal tax bracket, how much in income taxes does he need to pay for having missed this annual minimum HBP re-payment? A $1333 B $600 C $366 D $544 E $1,667

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts