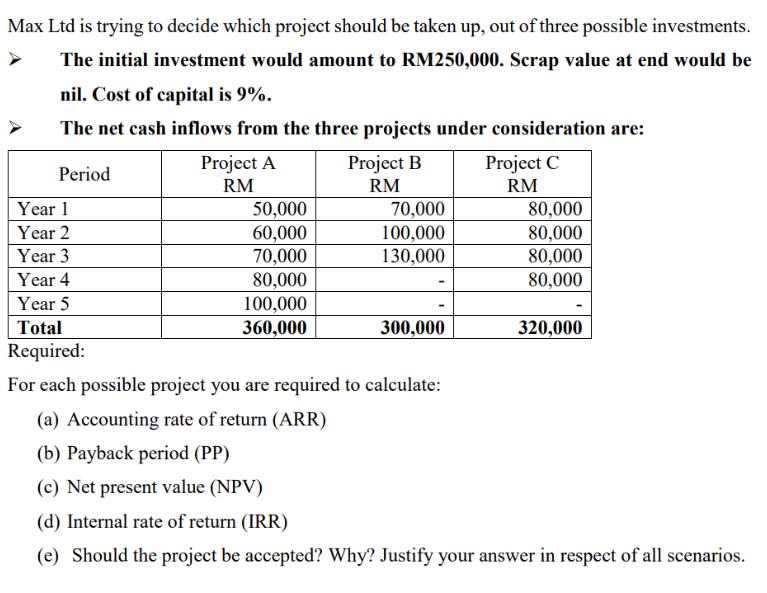

Question: Max Ltd is trying to decide which project should be taken up, out of three possible investments. The initial investment would amount to RM250,000.

Max Ltd is trying to decide which project should be taken up, out of three possible investments. The initial investment would amount to RM250,000. Scrap value at end would be nil. Cost of capital is 9%. The net cash inflows from the three projects under consideration are: Period Year 1 Year 2 Year 3 Year 4 Year 5 Total Required: Project A RM Project B RM Project C RM 50,000 70,000 80,000 60,000 100,000 80,000 70,000 130,000 80,000 80,000 - 80,000 100,000 360,000 300,000 320,000 For each possible project you are required to calculate: (a) Accounting rate of return (ARR) (b) Payback period (PP) (c) Net present value (NPV) (d) Internal rate of return (IRR) (e) Should the project be accepted? Why? Justify your answer in respect of all scenarios.

Step by Step Solution

There are 3 Steps involved in it

a Accounting Rate of Return ARR Accounting rate of return measures the average accounting income generated over time divided by the original investmen... View full answer

Get step-by-step solutions from verified subject matter experts