Question: MAX RETURN WITH RISK CONSTRAINT AND LEVERAGE Using the provided data, solve for the max return possible while allowing for a max standard deviation of

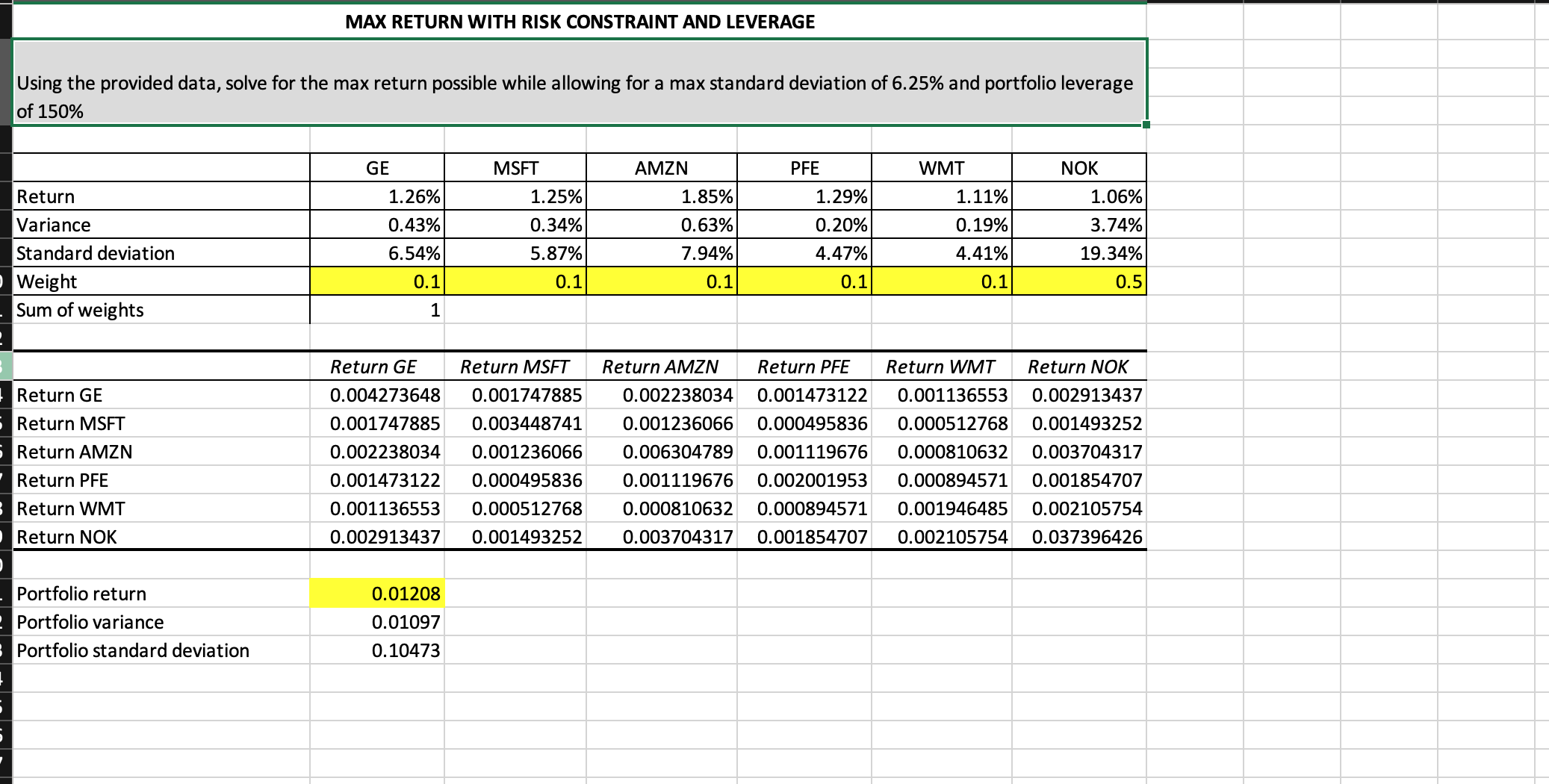

MAX RETURN WITH RISK CONSTRAINT AND LEVERAGE Using the provided data, solve for the max return possible while allowing for a max standard deviation of 6.25% and portfolio leverage of 150% GE AMZN PFE WMT NOK MSFT 1.25% Return 1.26% 1.29% 1.11% 0.34% 1.85% 0.63% 7.94% 0.20% 0.43% 6.54% 0.19% Variance Standard deviation Weight Sum of weights 1.06% 3.74% 19.34% 0.5 5.87% 0.1 4.47% 0.1 4.41% 0.1 0.1 0.1 1 Return GE Return PFE Return GE Return MSFT Return AMZN Return PFE Return WMT 0.004273648 0.001747885 0.002238034 0.001473122 0.001136553 Return MSFT 0.001747885 0.003448741 0.001236066 0.000495836 0.000512768 0.001493252 Return AMZN 0.002238034 0.001236066 0.006304789 0.001119676 0.001473122 0.000495836 0.001119676 0.002001953 0.000894571 0.001854707 Return WMT 0.001136553 0.000512768 0.000810632 0.000894571 0.001946485 0.002105754 Return NOK 0.002913437 0.001493252 0.003704317 0.001854707 0.002105754 0.037396426 0.000810632 0.003704317 Return NOK 0.002913437 0.01208 Portfolio return Portfolio variance Portfolio standard deviation 0.01097 0.10473 MAX RETURN WITH RISK CONSTRAINT AND LEVERAGE Using the provided data, solve for the max return possible while allowing for a max standard deviation of 6.25% and portfolio leverage of 150% GE AMZN PFE WMT NOK MSFT 1.25% Return 1.26% 1.29% 1.11% 0.34% 1.85% 0.63% 7.94% 0.20% 0.43% 6.54% 0.19% Variance Standard deviation Weight Sum of weights 1.06% 3.74% 19.34% 0.5 5.87% 0.1 4.47% 0.1 4.41% 0.1 0.1 0.1 1 Return GE Return PFE Return GE Return MSFT Return AMZN Return PFE Return WMT 0.004273648 0.001747885 0.002238034 0.001473122 0.001136553 Return MSFT 0.001747885 0.003448741 0.001236066 0.000495836 0.000512768 0.001493252 Return AMZN 0.002238034 0.001236066 0.006304789 0.001119676 0.001473122 0.000495836 0.001119676 0.002001953 0.000894571 0.001854707 Return WMT 0.001136553 0.000512768 0.000810632 0.000894571 0.001946485 0.002105754 Return NOK 0.002913437 0.001493252 0.003704317 0.001854707 0.002105754 0.037396426 0.000810632 0.003704317 Return NOK 0.002913437 0.01208 Portfolio return Portfolio variance Portfolio standard deviation 0.01097 0.10473

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts