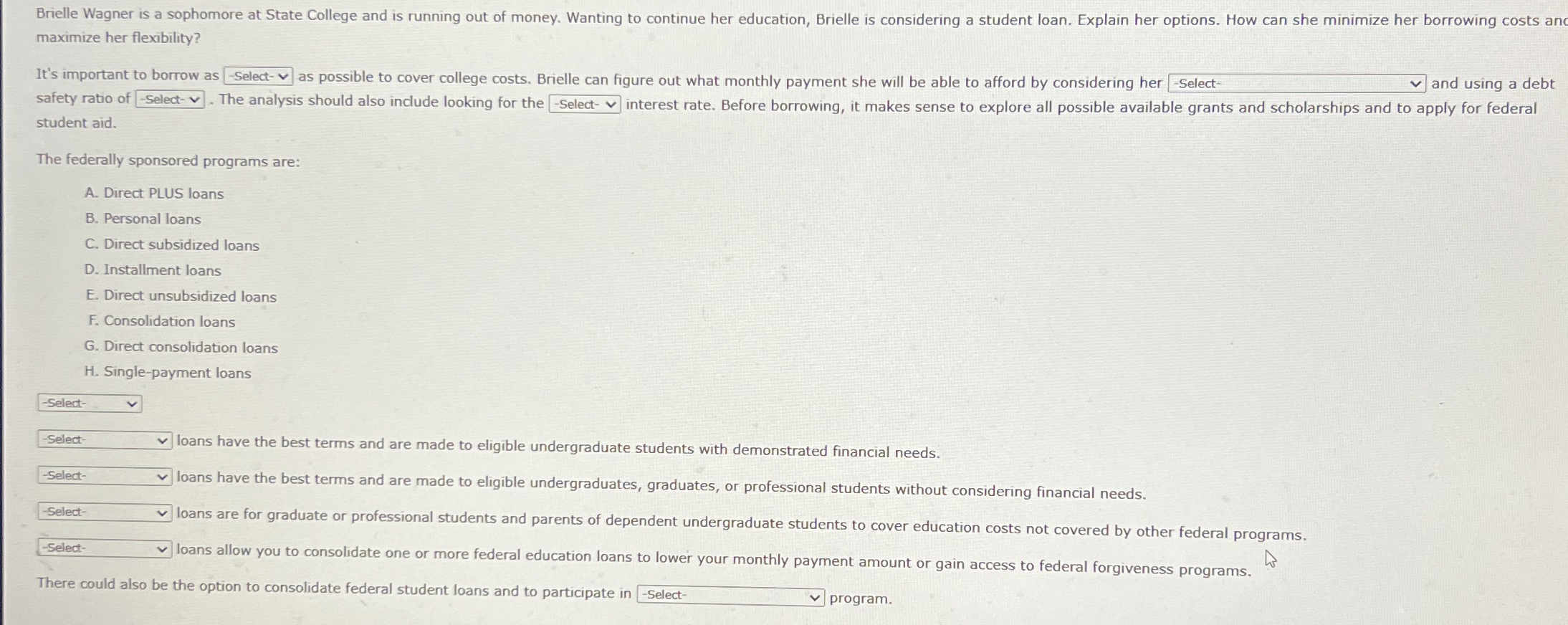

Question: maximize her flexibility? It's important to borrow as as possible to cover college costs. Brielle can figure out what monthly payment she will be able

maximize her flexibility?

It's important to borrow as as possible to cover college costs. Brielle can figure out what monthly payment she will be able to afford by considering her and using a debt safety ratio of The analysis should also include looking for the interest rate. Before borrowing, it makes sense to explore all possible available grants and scholarships and to apply for federal student aid.

The federally sponsored programs are:

A Direct PLUS loans

B Personal loans Direct subsidized loans

D Installment loans

E Direct unsubsidized loans

Consolidation loans

G Direct consolidation loans

H Singlepayment loans

loans have the best terms and are made to eligible undergraduate students with demonstrated financial needs.

loans have the best terms and are made to eligible undergraduates, graduates, or professional students without considering financial needs.

Sele loans are for graduate or professional students and parents of dependent undergraduate students to cover education costs not covered by other federal programs.

elect loans allow you to consolidate one or more federal education loans to lower your monthly payment amount or gain access to federal forgiveness programs.

There could also be the option to consolidate federal student loans and to participate in Selec program.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock