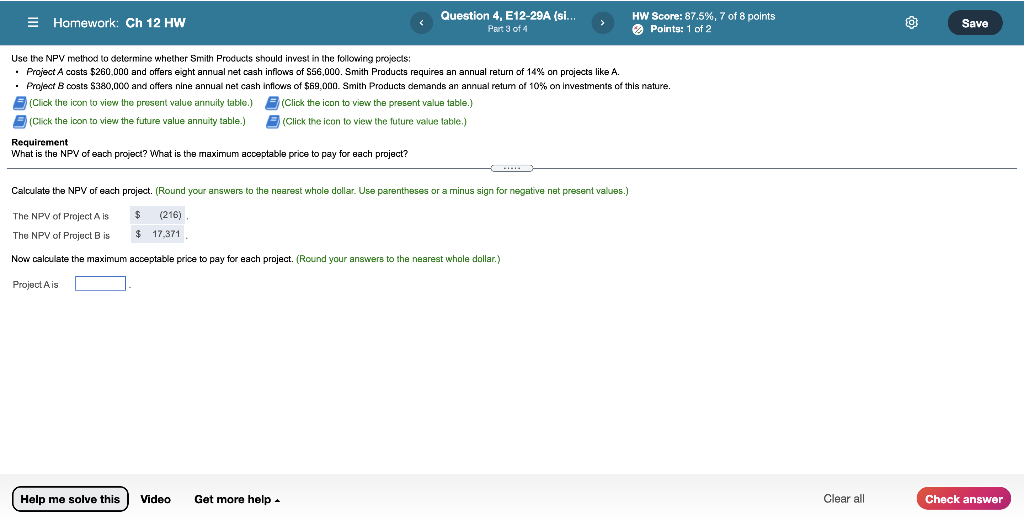

Question: Maximum acceptable price for Project A and B, please. Homework: Ch 12 HW Question 4, E12-29A (si... Part 3 of 4 HW Score: 87.5%, 7

Maximum acceptable price for Project A and B, please.

Homework: Ch 12 HW Question 4, E12-29A (si... Part 3 of 4 HW Score: 87.5%, 7 of 8 points Points: 1 of 2 @ Save Use the NPV method to determine whether Smith Products should invest in the following projects: Project A costs $260,000 and offers eight annual net cash inflows of S56,000. Smith Products requires an annual return of 14% on projects like A. Project costs $380,000 and offers nine annual net cash inflows of $69.000. Smith Products demands an annual retum of 10% on investments of this nature. (Click the icon to view the present value annuity table.) (Click the icon to view the present value table.) (Click the icon to view the future value annuity table.) (Click the icon to view the future value table.) Requirement What is the NPV of each project? What is the maximum acceptable price to pay for each project? Calculate the NPV of each project. (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) The NPV of Project Als $ (216) The NPV of Project B is $ 17,371 Now calculate the maximum acceptable price to pay for each project. (Round your answers to the nearest whole dollar.) Project Ais Help me solve this Video Get more help Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts