Question: Maximum length: 20 pages, 12 point font, 1.5 line spacing (excluding appendices Kindly note that markers will review only the first 20 pages. Referencing: Harvard

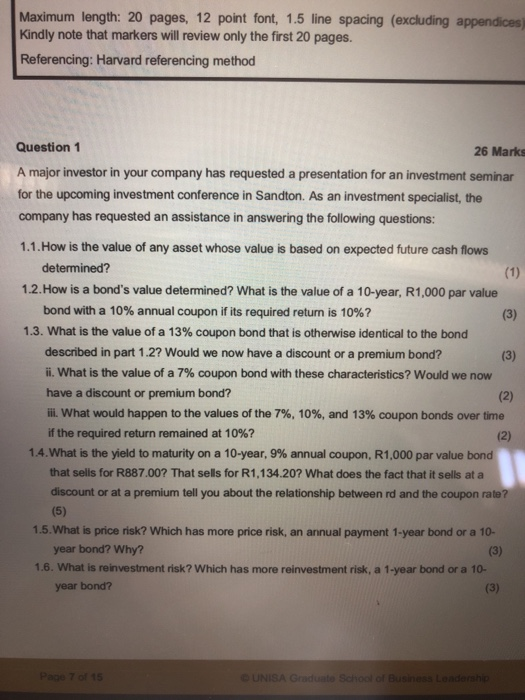

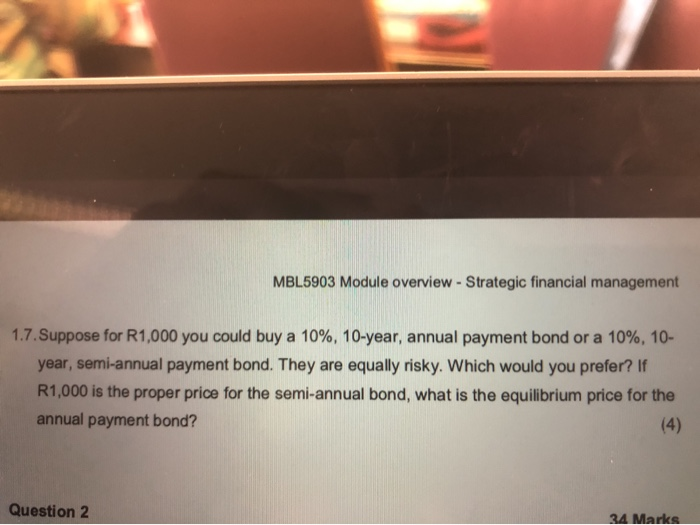

Maximum length: 20 pages, 12 point font, 1.5 line spacing (excluding appendices Kindly note that markers will review only the first 20 pages. Referencing: Harvard referencing method Question 1 26 Marks A major investor in your company has requested a presentation for an investment seminar for the upcoming investment conference in Sandton. As an investment specialist, the company has requested an assistance in answering the following questions: 1.1. How is the value of any asset whose value is based on expected future cash flows determined? 1.2. How is a bond's value determined? What is the value of a 10-year, R1,000 par value bond with a 10% annual coupon if its required return is 10%? (3) 1.3. What is the value of a 13% coupon bond that is otherwise identical to the bond described in part 1.27 Would we now have a discount or a premium bond? (3) ii. What is the value of a 7% coupon bond with these characteristics? Would we now ! have a discount or premium bond? (2) ill. What would happen to the values of the 7%, 10%, and 13% coupon bonds over time if the required return remained at 10%? (2) 14.What is the yield to maturity on a 10-year, 9% annual coupon, R1,000 par value bond that sells for R887.00? That sells for R1,134.20? What does the fact that it sells at a discount or at a premium tell you about the relationship between rd and the coupon rate? (5) 1.5. What is price risk? Which has more price risk, an annual payment 1-year bond or a 10- year bond? Why? 1.6. What is reinvestment risk? Which has more reinvestment risk, a 1-year bond or a 10 year bond? (3) UN SA Grade Scho MBL5903 Module overview - Strategic financial management 1.7. Suppose for R1,000 you could buy a 10%, 10-year, annual payment bond or a 10%, 10- year, semi-annual payment bond. They are equally risky. Which would you prefer? If R1,000 is the proper price for the semi-annual bond, what is the equilibrium price for the annual payment bond? (4) Question 2 34 Marks Maximum length: 20 pages, 12 point font, 1.5 line spacing (excluding appendices Kindly note that markers will review only the first 20 pages. Referencing: Harvard referencing method Question 1 26 Marks A major investor in your company has requested a presentation for an investment seminar for the upcoming investment conference in Sandton. As an investment specialist, the company has requested an assistance in answering the following questions: 1.1. How is the value of any asset whose value is based on expected future cash flows determined? 1.2. How is a bond's value determined? What is the value of a 10-year, R1,000 par value bond with a 10% annual coupon if its required return is 10%? (3) 1.3. What is the value of a 13% coupon bond that is otherwise identical to the bond described in part 1.27 Would we now have a discount or a premium bond? (3) ii. What is the value of a 7% coupon bond with these characteristics? Would we now ! have a discount or premium bond? (2) ill. What would happen to the values of the 7%, 10%, and 13% coupon bonds over time if the required return remained at 10%? (2) 14.What is the yield to maturity on a 10-year, 9% annual coupon, R1,000 par value bond that sells for R887.00? That sells for R1,134.20? What does the fact that it sells at a discount or at a premium tell you about the relationship between rd and the coupon rate? (5) 1.5. What is price risk? Which has more price risk, an annual payment 1-year bond or a 10- year bond? Why? 1.6. What is reinvestment risk? Which has more reinvestment risk, a 1-year bond or a 10 year bond? (3) UN SA Grade Scho MBL5903 Module overview - Strategic financial management 1.7. Suppose for R1,000 you could buy a 10%, 10-year, annual payment bond or a 10%, 10- year, semi-annual payment bond. They are equally risky. Which would you prefer? If R1,000 is the proper price for the semi-annual bond, what is the equilibrium price for the annual payment bond? (4) Question 2 34 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts