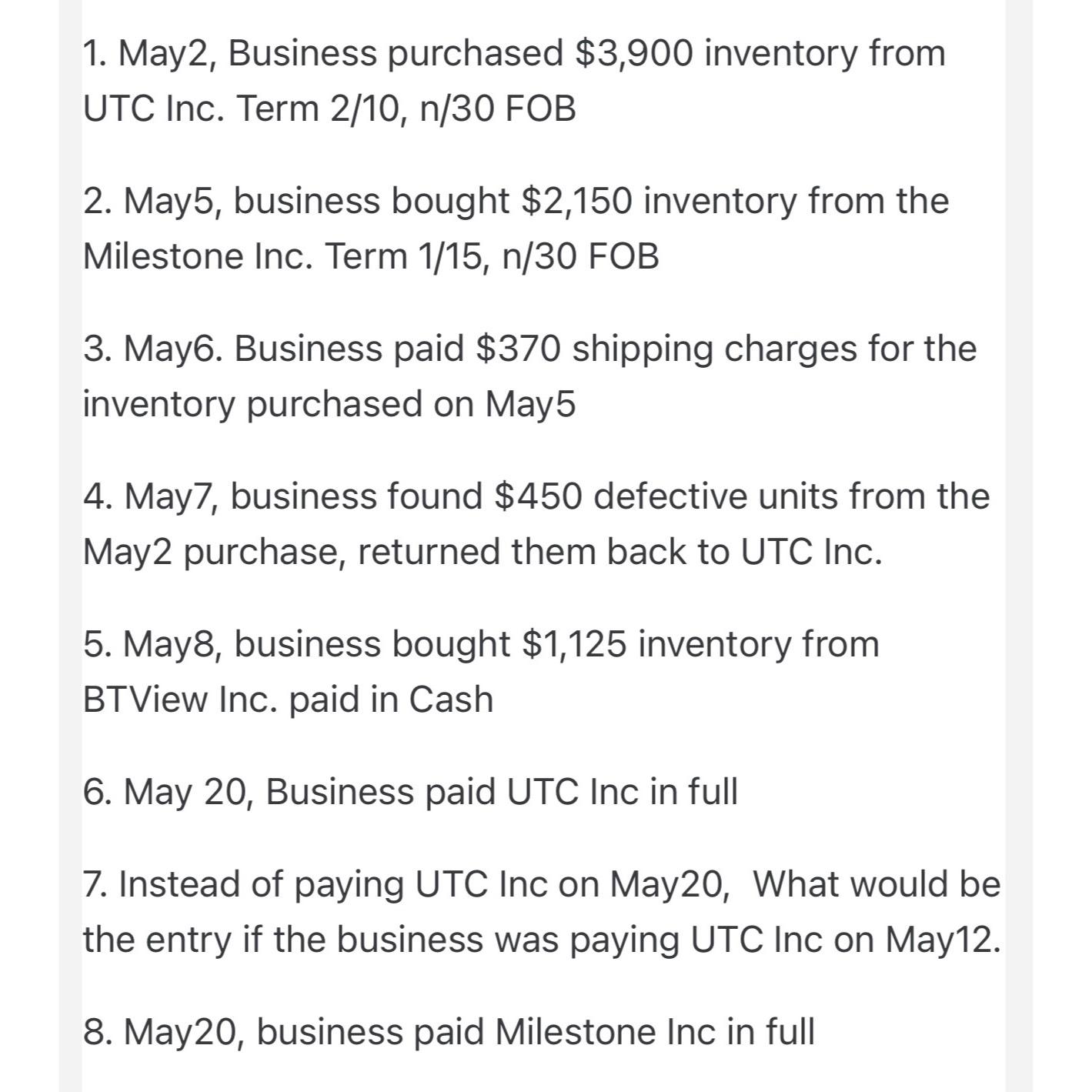

Question: May 2 , Business purchased $ 3 , 9 0 0 inventory from UTC Inc. Term 2 / 1 0 , n / 3 0

May Business purchased $ inventory from UTC Inc. Term n FOB

May business bought $ inventory from the Milestone Inc. Term n FOB

May Business paid $ shipping charges for the inventory purchased on May

May business found $ defective units from the May purchase, returned them back to UTC Inc.

May business bought $ inventory from BTView Inc. paid in Cash

May Business paid UTC Inc in full

Instead of paying UTC Inc on May What would be the entry if the business was paying UTC Inc on May

May business paid Milestone Inc in full

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock