Question: May 30 Taysom honors the note when it is presented for payment. Prepare journal entries to record these selected transactions for Vitalo Company. Nov. 1

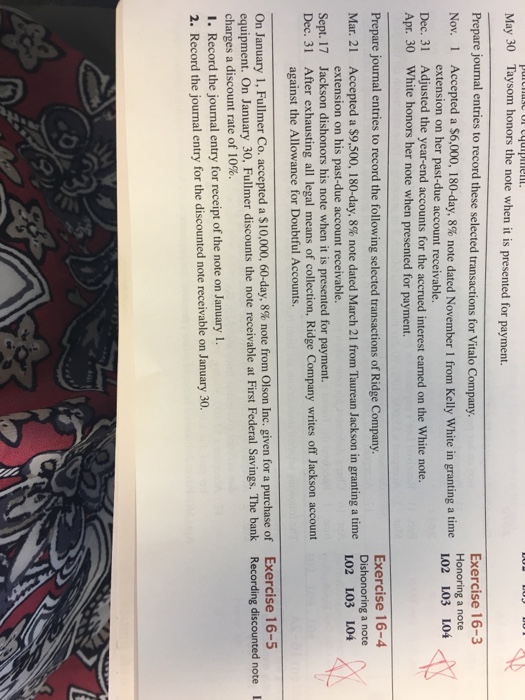

May 30 Taysom honors the note when it is presented for payment. Prepare journal entries to record these selected transactions for Vitalo Company. Nov. 1 Accepted a $6,000, 180-day, 8% note dated November 1 from Kelly white in granting a time extension on her past-due account receivable. Dec. 31 Adjusted the year-end accounts for the accrued interest earned on the White note. Apr. 30 White honors her note when presented for payment. Exercise 16-3 Honoring a note: 02: 03 L04 Prepare journal entries to record the following selected transactions of Ridge Company. Mar. 21 Accepted a $9, 500, 180-day, 8% note dated March 21 from Taurean Jackson in granting a time extension on his past-due account receivable. Sept. 17 Jackson dishonors his note when it is presented for payment. Dec. 31 After exhausting all legal means of collection, Ridge Company writes off Jackson account against the Allowance for Doubtful Accounts. Exercise 16-5 Recording discounted note L02 L03 L04 On January 1, Fullmer Co. accepted a $10,000. 60-day, 8% note from Olson Inc. given for a purchase of equipment. On January 30, Fullmer discounts the note receivable at First Federal Savings. The bank charges a discount rate of 10%. 1. Record the journal entry for receipt of the note on January 1. 2. Record the journal entry for the discounted note receivable on January 30. Exercise 16-5 Recording discounted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts