Question: May I ask for comprehensive steps for part c,dc. What market weights should be given to various capital components in the weighted average cost of

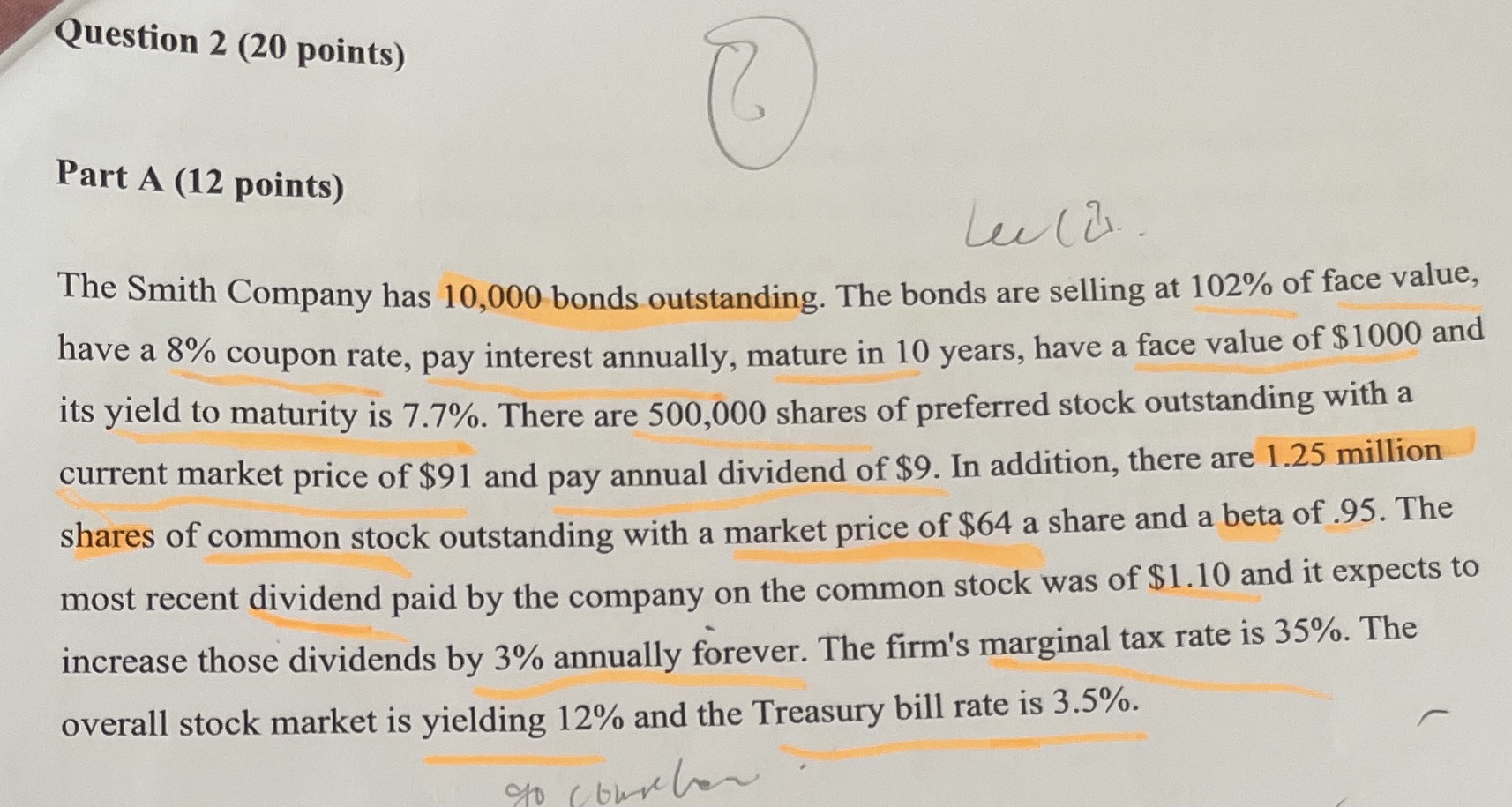

May I ask for comprehensive steps for part c,dc. What market weights should be given to various capital components in the weighted average cost of capital communication?d. What is the weighted average cost of capital using the cost equity calculated based on CAPM?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts