Question: May I ask how to do this question Suppose the current stock price of the Walt Disney Company is $50 and you can enter a

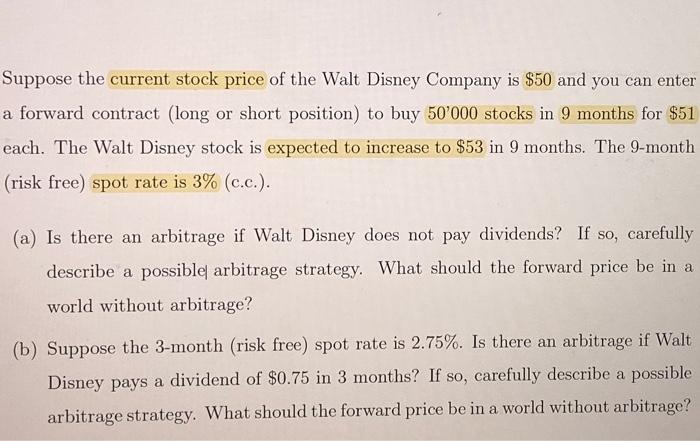

Suppose the current stock price of the Walt Disney Company is $50 and you can enter a forward contract (long or short position) to buy 50'000 stocks in 9 months for $51 each. The Walt Disney stock is expected to increase to $53 in 9 months. The 9-month (risk free) spot rate is 3% (c.c.). (a) Is there an arbitrage if Walt Disney does not pay dividends? If so, carefully describe a possible arbitrage strategy. What should the forward price be in a world without arbitrage? (b) Suppose the 3-month (risk free) spot rate is 2.75%. Is there an arbitrage if Walt Disney pays a dividend of $0.75 in 3 months? If so, carefully describe a possible arbitrage strategy. What should the forward price be in a world without arbitrage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts