Question: may i have both the answer for sub Q d and e please!! can you please teach me subQ d and e please d)Consider the

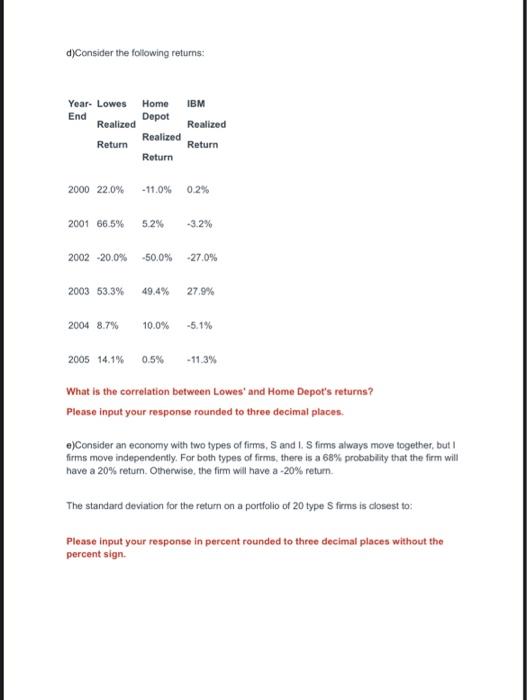

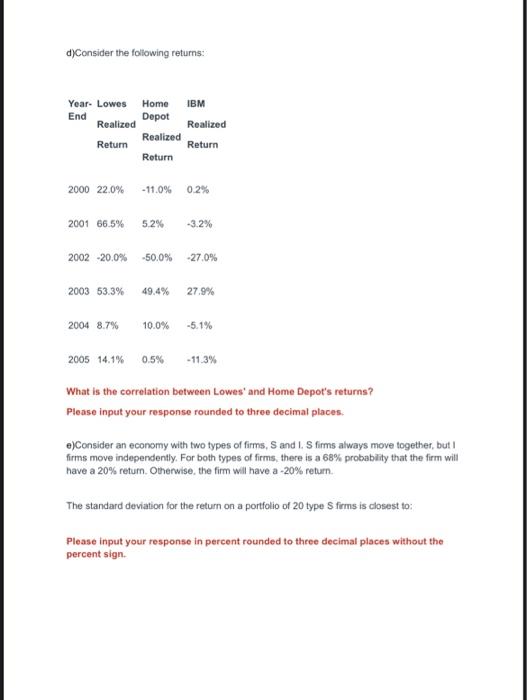

d)Consider the following returns: What is the correlation between Lowes' and Home Depot's returns? Please input your response rounded to three decimal places. e)Consider an economy with two types of firms, S and L. S firms always move together, but I firms move independently. For both types of firms, there is a 68% probabily that the firm will have a 20% return. Otherwise, the firm will have a 20% return. The standard deviation for the return on a portfolio of 20 type S frms is closest to: Please input your response in percent rounded to three decimal places without the percent sign. d)Consider the following returns: What is the correlation between Lowes' and Home Depot's returns? Please input your response rounded to three decimal places. e)Consider an economy with two types of firms, S and L. S firms always move together, but I firms move independently. For both types of firms, there is a 68% probabily that the firm will have a 20% return. Otherwise, the firm will have a 20% return. The standard deviation for the return on a portfolio of 20 type S frms is closest to: Please input your response in percent rounded to three decimal places without the percent sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts