Question: May I know how to attempt this question? Question 5 (30 marks) A firm that pays out 65% of its earnings of 20%. Its P/E

May I know how to attempt this question?

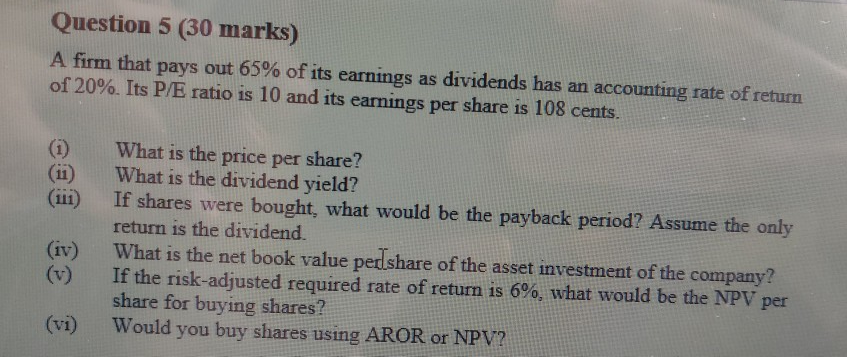

Question 5 (30 marks) A firm that pays out 65% of its earnings of 20%. Its P/E ratio is 10 and its earnings per share is 108 cents. dividends has an accounting rate of return as What is the price per share? What is the dividend yield? If shares were bought, what would be the payback period? Assume the only return is the dividend What is the net book value perlshare of the asset investment of the company? If the risk-adjusted required rate of returm is 6%, what would be the NPV per share for buying shares? Would you buy shares using AROR or NPV? (ii) (iii) (iv) (v) (vi)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts