Question: May i please get correct solutions step-by-step as soon as possible, thankyou!! Question 1 Marco Company is a manufacturing firm that uses job-order costing. At

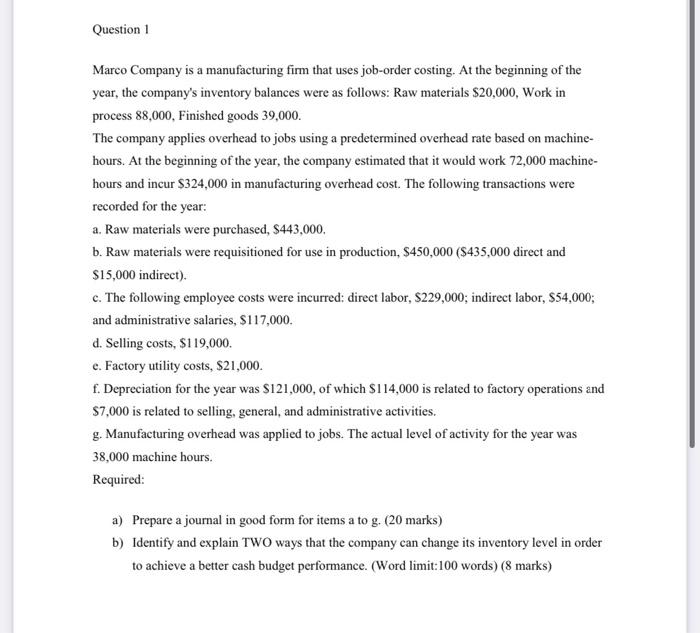

Question 1 Marco Company is a manufacturing firm that uses job-order costing. At the beginning of the year, the company's inventory balances were as follows: Raw materials $20,000, Work in process 88,000, Finished goods 39,000. The company applies overhead to jobs using a predetermined overhead rate based on machine- hours. At the beginning of the year, the company estimated that it would work 72,000 machine- hours and incur $324,000 in manufacturing overhead cost. The following transactions were recorded for the year: a. Raw materials were purchased, S443,000, b. Raw materials were requisitioned for use in production, $450,000 (5435,000 direct and $15,000 indirect). c. The following employee costs were incurred: direct labor, $229,000; indirect labor, $54,000; and administrative salaries, $117,000. d. Selling costs, $119,000 c. Factory utility costs, 821,000. f. Depreciation for the year was $121,000, of which $114,000 is related to factory operations and $7,000 is related to selling, general, and administrative activities. g. Manufacturing overhead was applied to jobs. The actual level of activity for the year was 38,000 machine hours. Required: a) Prepare a journal in good form for items a to g. (20 marks) b) Identify and explain TWO ways that the company can change its inventory level in order to achieve a better cash budget performance. (Word limit:100 words) (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts