Question: may i please get help i. trial balance , adjusted entries and adjusted trial balance for the entries you just made. Post your journal entries

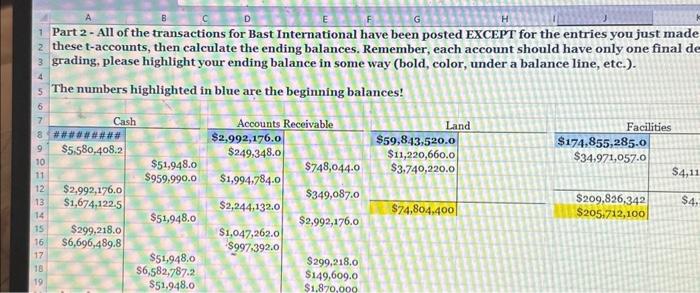

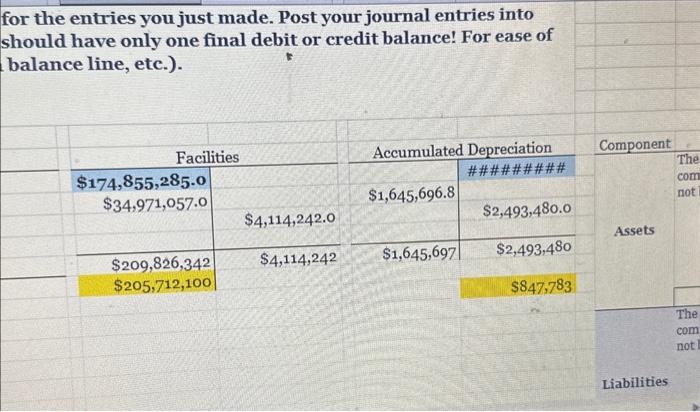

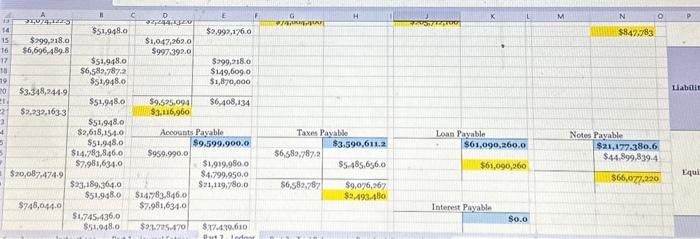

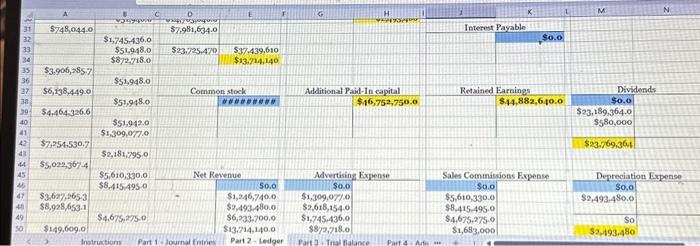

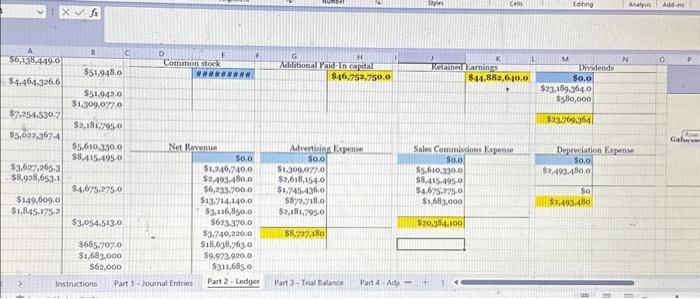

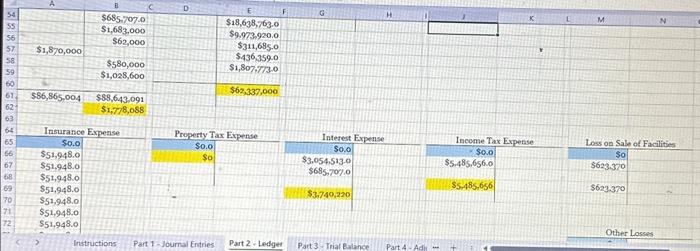

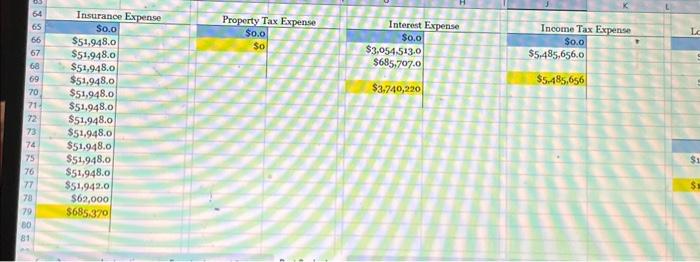

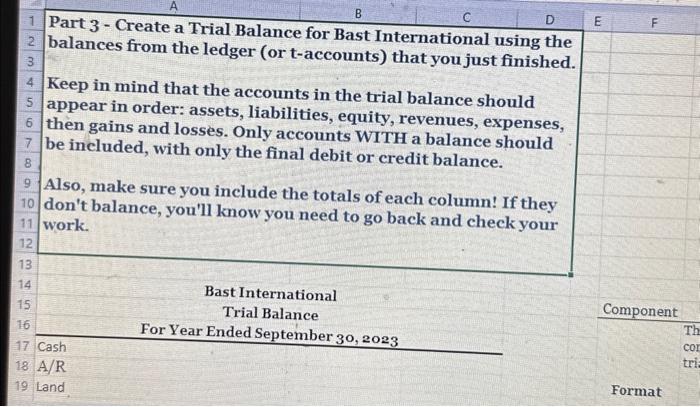

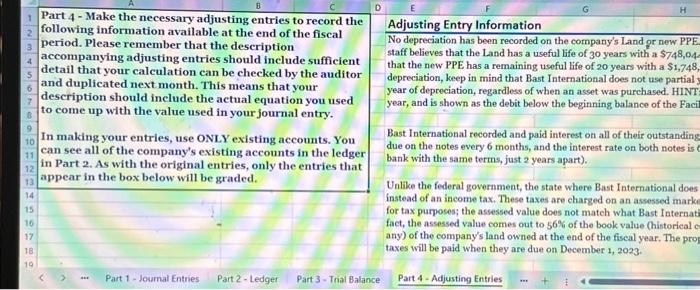

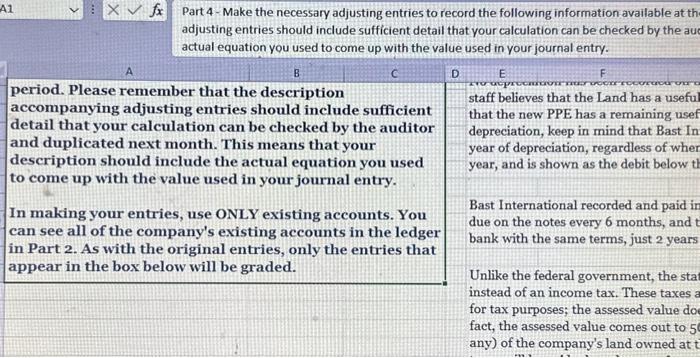

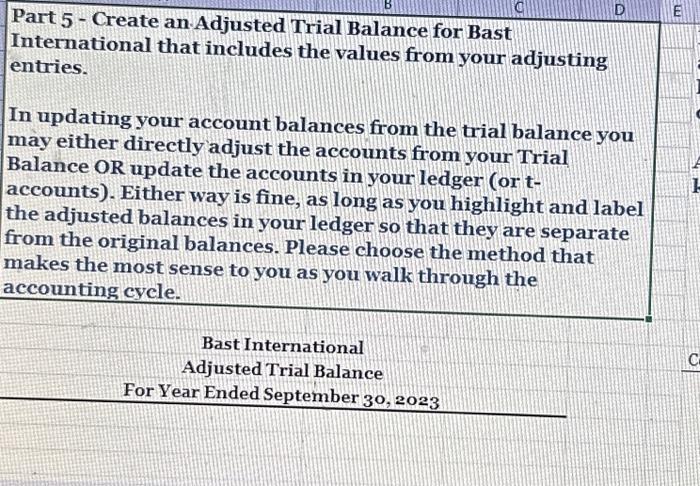

for the entries you just made. Post your journal entries into should have only one final debit or credit balance! For ease of balance line, etc.). Part 3-Create a Trial Balance for Bast International using the balances from the ledger (or t-accounts) that you just finished. Keep in mind that the accounts in the trial balance should appear in order: assets, liabilities, equity, revenues, expenses, then gains and losses. Only accounts WITH a balance should be included, with only the final debit or credit balance. Also, make sure you include the totals of each column! If they don't balance, you'll know you need to go back and check your work. Part 5 - Create an Adjusted Trial Balance for Bast International that includes the values from your adjusting entries. In updating your account balances from the trial balance you may either directly adjust the accounts from your Trial Balance OR update the accounts in your ledger (or t accounts). Either way is fine, as long as you highlight and label the adjusted balances in your ledger so that they are separate from the original balances. Please choose the method that makes the most sense to you as you walk through the accounting cycle. Part 4-Make the necessary adjusting entries to record the following information available at th adjusting entries should include sufficient detail that your calculation can be checked by the au actual equation you used to come up with the value used in your journal entry. Part 2 - All of the transactions for Bast International have been posted EXCEPT for the entries you just made these t-accounts, then calculate the ending balances. Remember, each account should have only one final de grading, please highlight your ending balance in some way (bold, color, under a balance line, etc.). The numbers highlighted in blue are the beginning balances! for the entries you just made. Post your journal entries into should have only one final debit or credit balance! For ease of balance line, etc.). Part 3-Create a Trial Balance for Bast International using the balances from the ledger (or t-accounts) that you just finished. Keep in mind that the accounts in the trial balance should appear in order: assets, liabilities, equity, revenues, expenses, then gains and losses. Only accounts WITH a balance should be included, with only the final debit or credit balance. Also, make sure you include the totals of each column! If they don't balance, you'll know you need to go back and check your work. Part 5 - Create an Adjusted Trial Balance for Bast International that includes the values from your adjusting entries. In updating your account balances from the trial balance you may either directly adjust the accounts from your Trial Balance OR update the accounts in your ledger (or t accounts). Either way is fine, as long as you highlight and label the adjusted balances in your ledger so that they are separate from the original balances. Please choose the method that makes the most sense to you as you walk through the accounting cycle. Part 4-Make the necessary adjusting entries to record the following information available at th adjusting entries should include sufficient detail that your calculation can be checked by the au actual equation you used to come up with the value used in your journal entry. Part 2 - All of the transactions for Bast International have been posted EXCEPT for the entries you just made these t-accounts, then calculate the ending balances. Remember, each account should have only one final de grading, please highlight your ending balance in some way (bold, color, under a balance line, etc.). The numbers highlighted in blue are the beginning balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts